Halfway through the year, the penchant for investors to pour into U.S. equities over international markets is continuing thus far in June, according to the latest Relative Weight Spotlight from Direxion Investments.

Despite a number of roadblocks heading into 2019 after a rough fourth-quarter market showing to end 2018, the U.S. economy rebounded in the first quarter this year, beating analysts’ expectations of 2.5 percent growth with a 3.2 percent growth number. As such, investors have been quick to lean on the U.S. even if a trade deal with China went sideways in May.

For investors looking for continued upside in U.S. equities over international equities, the Direxion FTSE Russell US Over International ETF (NYSEArca: RWUI) offers them the ability to benefit not only from domestic U.S. markets potentially performing well, but from their outperformance compared to international markets.

“Relative flows between U.S. and International ETFs have moved in the same direction as relative performance in 8 of the last 12 months, with February, March, April and May 2019 all seeing ETF flows align with monthly performance,” the Relative Weight Spotlight post noted. “May saw the largest relative strength in flows in favor of International stocks since March of 2018, with U.S. ETFs seeing almost $16.0B in net redemption activity while International ETFs saw over $2.2B in net creations.”

“June has seen this trend continue with U.S. stocks outperforming International shares, and ETF investors are sharply moving back to the U.S. after redeeming throughout the month of May,” the post added. “Over the first 7 trading days of June, ETFs specifically targeting exposure to the U.S. have taken in $4.64B more relative to International ETFs, indicating that relative strength in flows has quickly returned in favor of domestic exposure.”

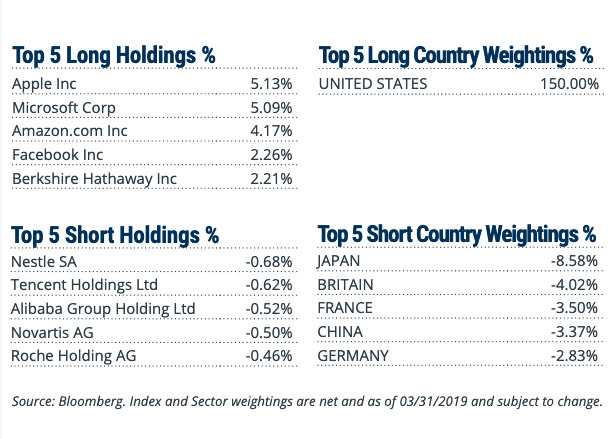

The fund’s long positions include holdings that helped the S&P 500 and Nasdaq Composite reach highs like Apple and Microsoft, which just hit $1 trillion in market capitalization.

Short country positions include Japan, which saw a surprise drop in factory data the same time U.S. equities were doing better than expected in first-quarter earnings.

China Putting Up a Fight

According to the IMF, the world economy will grow at a 3.3 percent pace, which is 0.2 percent lower versus the initial forecast in January. Nonetheless, strength in leading markets like the U.S. with its healthy labor market are keeping global growth afloat.

Will the U.S. continue its upward trajectory in the second quarter and through the rest of 2019? Helping to boost the case for international equities is stiff competition from China.

The trade impasse with the United States didn’t seem to affect China in May as the country’s overall trade surplus was about $42 billion–double the $20.5 billion expected by economists polled by Reuters. The data comes just as the International Monetary Fund (IMF) lowered the growth expectations for China through the rest of the year.

However, the IMF projected a growth forecast of 6.3 percent, lowering their initial expected growth rate of 6.2 percent. They’re expecting that to slow further in 2020 to 6 percent and even lower to 5.5 percent by the year 2024.

For more market trends, visit ETF Trends.