According to Direxion Investments’ most recent Relative Weight Spotlight, “bullish feelings” in October elicited a risk-on vibe that fed into strength for growth and cyclical equities for that month.

“Economic data continues to point toward bifurcation that sees the U.S. consumer chugging along, but manufacturing around the globe remaining sluggish,” the post said. “However, anyone looking for markets to react negatively to the continued weak global manufacturing data was left hurting in October as markets ripped to new all-time new highs. Investors caught bullish feelings thanks to progress on the U.S.-China trade deal, the avoidance of a hard Brexit, continued accommodating monetary policy, and another decent earnings season. In our opinion, investors may be showing some signs of complacency of a reflation trade considering that earnings are far from inspiring as beats are below average. Recent price action simply may highlight how investors seem to have priced in much of the bad economic news and believe that central banks have their back should the picture deteriorate markedly from here.”

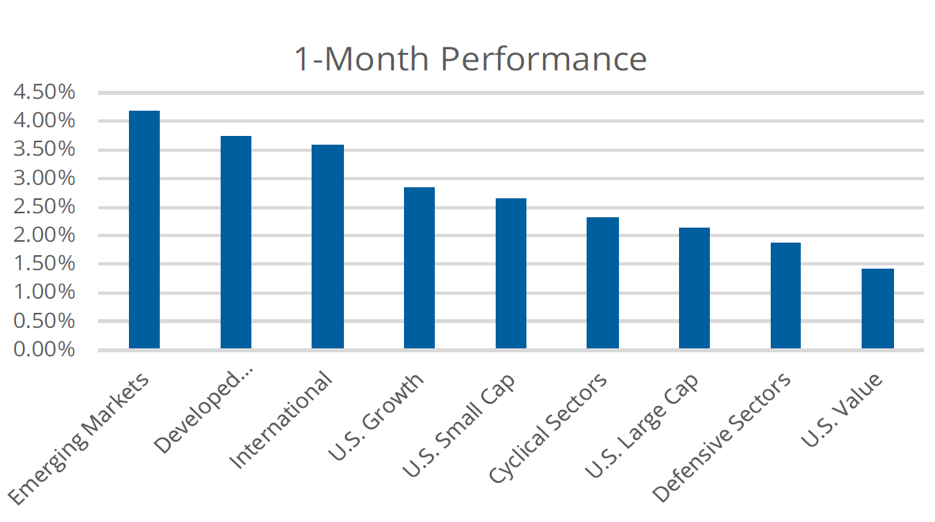

“In the U.S., September’s rotation to value stocks proved to be short-lived as growth outperformed by 1.42% last month,” the blog post noted. “Cyclical sectors bested defensive sectors by 0.44% thanks to the continued risk-on tone. However, small caps beat large caps for the second straight month. Over the last twelve months, cyclical sectors and value stocks are neck and neck in the performance, leading with each up over 17%.”

Bloomberg Finance, L.P., as of October 31, 2019. Past performance is not indicative of future results. One cannot invest directly in an index. The data is representative of the 1-month returns of the indexes found in the Definitions list below.

ETFs to play include the Direxion Russell 1000 Growth Over Value ETF (NYSEArca: RWGV), which offers investors the ability to benefit not only from growth opportunities potentially performing well, but from their outperformance compared to value. RWGV measures the performance of a portfolio that has 150% long exposure to the Russell 1000® Value Index and 50% short exposure to the Russell 1000® Growth Index. On a monthly basis, the Index will rebalance such that the weight of the Long Component is equal to 150% and the weight of the Short Component is equal to 50% of the Index value.

For investors looking for continued upside in U.S. cyclical sectors over defensive sectors, the Direxion MSCI Cyclicals Over Defensives ETF (NYSEArca: RWCD) offers them the ability to benefit not only from cyclical sectors potentially performing well but from their outperformance compared to defensive sectors. RWCD seeks investment results that track the MSCI USA Cyclical Sectors – USA Defensive Sectors 150/50 Return Spread Index, which measures the performance of a portfolio that has 150% long exposure to the MSCI USA Cyclical Sectors Index and 50% short exposure to the MSCI USA Defensive Sectors Index.

For more relative market trends, visit our Relative Value Channel.