Managing Director, Global Research & Design, APAC, Indexology Blog

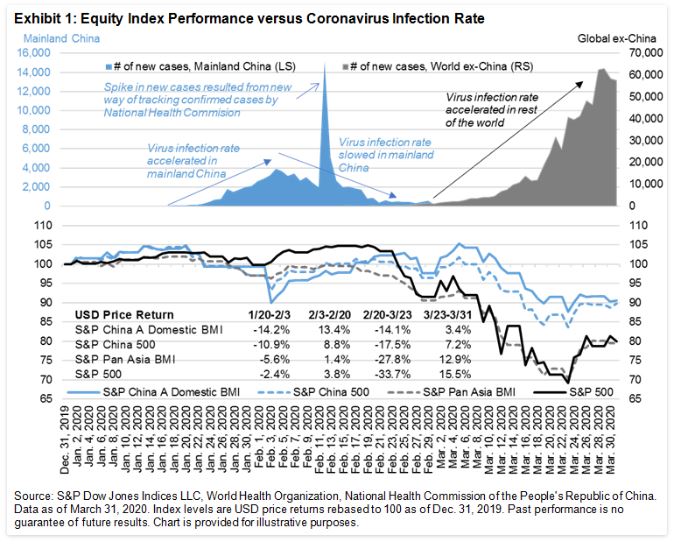

As the coronavirus has spread across continents, countries around the world are experiencing a slowdown in economic activity and volatility in the financial markets. The S&P Pan Asia BMI and S&P 500® lost 20.5% and 20.0%, respectively, [1] in the first quarter of 2020. During the same period, the S&P China A Domestic BMI and S&P China 500 (which seeks to track the top 500 domestic and offshore listed Chinese companies) dropped 9.5% and 10.3%, respectively, [2] which was only half of the loss suffered by the U.S. and Pan Asian markets.

In response to the domestic coronavirus outbreak, the China A-shares market experienced a significant drawdown of 14.2% between Jan. 20 and Feb. 3, 2020, when the number of new cases of coronavirus infections in China was on the rise. However, the market has recovered most of its losses since Feb. 3, 2020, as a result of government stimulus packages and improved investor sentiment due to a slowing domestic infection rate.[3] Business activities began to pick up in China subsequently, and the National Bureau of Statistics announced the China Manufacturing Purchasing Managers’ Index rebounded to 52.0 in March from 35.7 in February. Nevertheless, global equity market sentiment turned to panic as investors expected a global recession due to the worsening coronavirus outbreak in the rest of the world. The S&P 500 and S&P Pan Asia BMI declined by 33.7% and 27.8%, respectively, between Feb. 20 and March 23, 2020, while the S&P China A Domestic BMI and S&P China 500 suffered smaller losses of 14.1% and 17.5%, respectively.

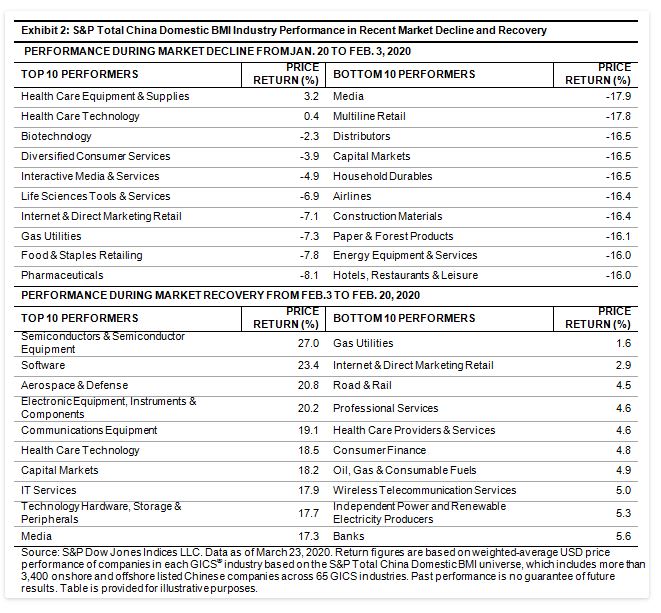

Before coronavirus infection accelerated in the rest of the world, the rate of domestic outbreak in mainland China was the determinant driver of the Chinese equity market performance. During the market decline between Jan. 20 and Feb. 3, 2020, the vast majority of industries suffered losses; however there was a significant spread in industry returns, from 3.2% to -17.9%. Health care equipment, health care technology, and biotech were top-performing industries due to the threat of the outbreak. As cities in China were locked down and travel was restricted to control the outbreak, airlines, retailers, restaurants, and hotels took a hard hit, while companies in interactive media, internet retail, and food and staples retailing were least affected. Semis, software, electronic equipment, and tech hardware companies were also less hammered by the domestic virus outbreak and they were among the top performers during the market rally between Feb. 3 and Feb. 20, 2020, when coronavirus infection rates slowed in mainland China.

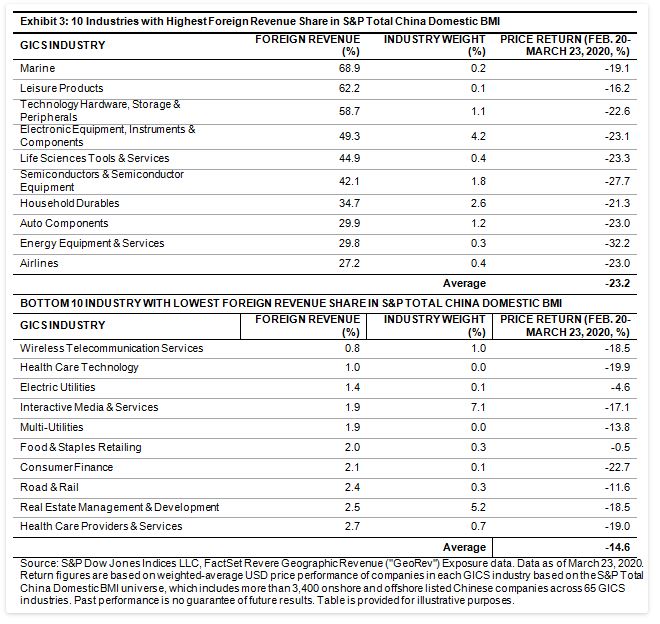

The acceleration of coronavirus infection in the rest of the world, especially in the U.S. and Europe, heightened investor concern around a global recession, which was expected to also slow economic activity recovery in China. Based on companies in the S&P Total China Domestic BMI, electronic equipment, household durables, semiconductors, auto components, and tech hardware are the larger industries with high foreign revenue exposure, ranging from 29.9% to 58.7%. Revenues of these industries are more vulnerable to global economic slowdown compared to other industry peers. In contrast, interactive media, real estate management, and wireless telecom services have low exposure to foreign revenue, ranging from only 0.8% to 2.5%, and their revenues are dominated by domestic demand. In the recent global stock market crash (Feb. 20-March 23, 2020), the 10 industries with the highest foreign revenue share dropped 23.2%, while the 10 industries with lowest foreign revenue share only dropped 14.6%. Overall, only 14.4% of total revenue across all companies in the S&P Total China Domestic BMI are sourced outside of China, which implies that the revenues of these companies would largely follow the pace of domestic demand rather than international market demand. This was reflected in the smaller losses seen in the Chinese equity indices during the recent global market crash.

[1] USD price returns between Dec. 31, 2019, and March 31, 2020.

[2] USD price returns between Dec. 31, 2019, and March 31, 2020.

[3] The spike in new infection cases on Feb. 12-13, 2020, was due to Chinese authorities changing the manner in which infection cases were tracked, aiming to include more cases for more timely treatment and allow faster quarantining of patients.