When investors priced in a U.S.-China trade deal into equities, the markets headed south like a flock of birds before winter. Now, global investment firms like Goldman Sachs and UBS are warning investors not to make the same mistake twice by pricing in a rate cut.

U.S. equities have been ripping and roaring again thanks to hopes that an interest rate cut by the Federal Reserve will resuscitate the extended bull run.

“I think the market has overpriced the amount of rate cuts that the Fed is likely to do,” said Axel Weber, chairman of Swiss bank UBS during a panel discussion at an Institute of International Finance meeting in Tokyo.

“If you listen to some of the key decision makers like Charlie Evans, if you listen to Jay Powell, there is no imminent rate cut,” added Weber. “There is likelihood if further weakness in the data evolves over the second half of the year that they might consider corrective action.”

Weber’s sentiment paired perfectly with that of John Waldron, president and chief operating officer at Goldman Sachs.

“The market is pricing in a fairly substantial set of moves by the Fed,” said Waldron, who was also attending the meeting. “I worry a little bit that the market is too optimistic about how much and how soon the Fed will move.”

With investors overestimating a rate cut, can this translate to strength for international equities over U.S. equities? The Direxion FTSE International Over US ETF (NYSEArca: RWIU) gives investors the opportunity to capitalize on this hunch.

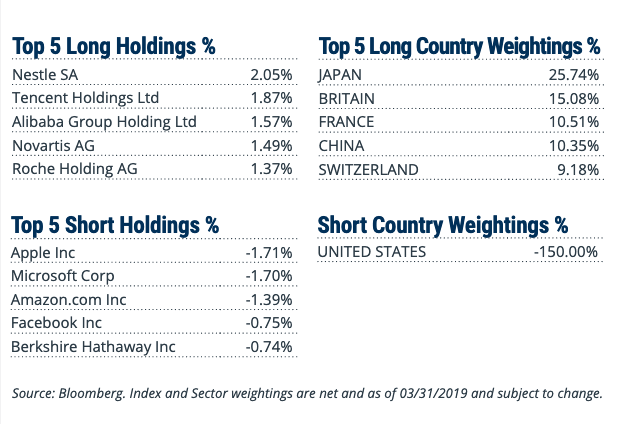

RWIU seeks investment results, before fees and expenses, that track the FTSE All-World ex US/Russell 1000 150/50 Net Spread Index. The FTSE All-World ex US/Russell 1000® 150/50 Net Spread Index (R1AWXUNC) measures the performance of a portfolio that has 150 percent long exposure to the FTSE All-World ex US Index and 50 percent short exposure to the Russell 1000® Index.

On a monthly basis, the Index will rebalance such that the weight of the Long Component is equal to 150 percent and the weight of the Short Component is equal to 50 percent of the Index value. In tracking the Index, the Fund seeks to provide a vehicle for investors looking to efficiently express an international over domestic investment view by overweighting exposure to the Long Component and shorting exposure to the Short Component.

On the flip side, for investors sensing continued upside in U.S. equities over international equities, the Direxion FTSE Russell US Over International ETF (NYSEArca: RWUI) offers them the ability to benefit not only from domestic U.S. markets potentially performing well, but from their outperformance compared to international markets.

For more relative market trends, visit our Relative Value Channel.