Sarah Bloom Raskin, former Federal Reserve governor turned senior fellow at Duke University, is sensing that a rate cut is near. After all, who knows the central bank better than a former member of its very own.

What did the Fed do recently to give off signals of a much-needed rate cut? It’s certainly a cut for a stock market that is looking for a trigger event now that the U.S.-China trade deal went asunder.

Raskin cited Fed Chair Jerome Powell’s recent comment that the central bank “will act as appropriate to sustain the expansion.”

“I think Chairman Powell has given a message to markets that’s indicating that a rate cut is coming. This is, in essence, a very strong signal that the FOMC is actually ready to talk about cutting rates,” said Raskin.

Can this suspected rate cut boost U.S. equities over international equities?

An ETF to Consider if U.S. Equities Continue Strength

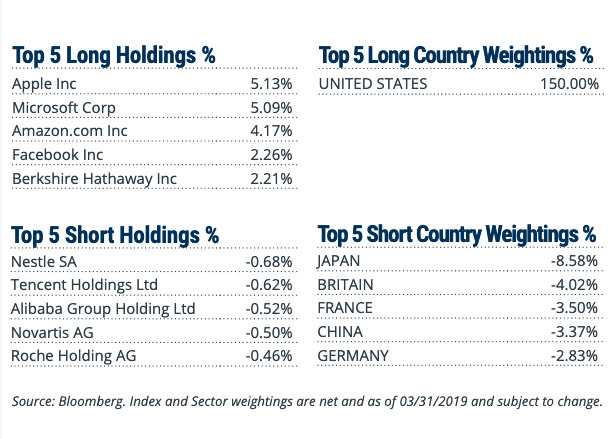

For investors looking for continued upside in U.S. equities over international equities, the Direxion FTSE Russell US Over International ETF (NYSEArca: RWUI) offers them the ability to benefit not only from domestic U.S. markets potentially performing well, but from their outperformance compared to international markets.

Short country positions include Japan, which saw a surprise drop in factory data the same time U.S. equities were doing better than expected in first-quarter earnings.

“Key risks to the outlook are U.S. protectionism and political instability in Europe. The former would hurt Japan’s exports that feed into global supply chains, as well as autos,” said Bloomberg economist Yuki Masujima.

Global Challenges Ahead?

The higher U.S. GDP comes global economic growth remains a primary concern. Earlier this year, the IMF cut its global growth forecast to the lowest level since the financial crisis, citing the impact of tariffs and a weak outlook for most developed markets.

According to the IMF, the world economy will grow at a 3.3 percent pace, which is 0.2 percent lower versus the initial forecast in January. Nonetheless, strength in leading markets like the U.S. with its healthy labor market are keeping global growth afloat.

Will the U.S. continue its upward trajectory in the third quarter and through the rest of 2019?

The U.S. capital markets literally stumbled into 2019 after a slipping and sliding through a fourth quarter to forget–the Dow Jones Industrial Average fell 5.6 percent, while the S&P 500 was down 6.2 percent and the Nasdaq Composite declined 4 percent. Overall, 2018 marked the worst year for stocks since 2008 and only the second year the Dow and S&P 500 fell in the past decade.

Despite a number of roadblocks heading into 2019 after a rough fourth-quarter market showing to end 2018, the U.S. economy rebounded in the first quarter this year, beating analysts’ expectations of 2.5 percent growth with a 3.2 percent growth number.

For more market trends, visit ETF Trends.