If there’s anything we’ve learned from 2020, it’s that market risk can strike quickly and dramatically. An effective risk-managed strategy can help a diversified investment portfolio better adapt to quick turns in the market. But how can you stay invested while mitigating risk of the unknowns?

In the upcoming webcast, Reduce Market Downside Risk with a New Approach to Hedge Equity Portfolios, Marc Odo, Client Portfolio Manager, Swan Global Investments; and Jamie Atkinson, Managing Director, Head of Global Sales, Swan Global Investments, will outline how incorporating hedged equity into a portfolio may help your clients mitigate tail risk while seeking upside market participation.

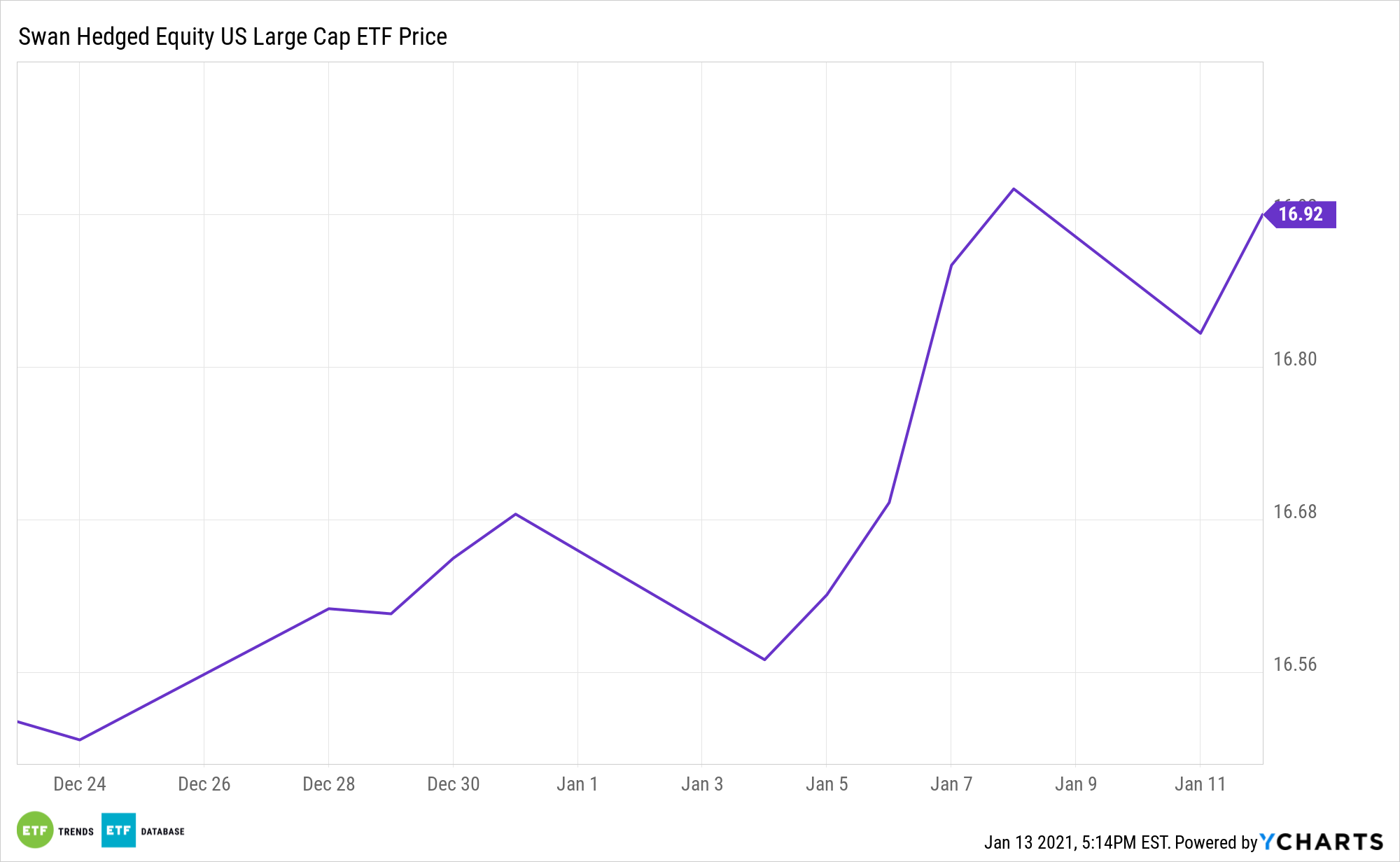

Specifically, the recently launched Swan Hedged Equity U.S. Large-Cap ETF (HEGD) aims to address long term investors’ need for capital appreciation while hedging against the risks and volatility associated with today’s often unsteady markets. This differentiated solution combines the benefits of the low-cost ETF investment structure with an actively managed hedging strategy.

The fund is anchored by Swan’s proprietary Defined Risk Strategy (DRS), a time-tested, disciplined approach that utilizes hedged equity and options-based strategies seeking to help investors grow their capital while mitigating downside risk. HEGD pairs the benefits of ETFs with actively managed options strategies, potentially resulting in a less volatile investment experience and more consistent returns.

The Swan Hedged Equity U.S. Large-Cap ETF provides a distinct blend of passive investing and active risk management. The ETF is always seeking to participate in S&P 500 returns via S&P 500 equity ETFs. Additionally, it is always hedged against market risk via long-term put options purchased at or near-the-money. Investors can gain exposure to the innovative approach from a leader in hedged equity since 1997.

Financial advisors who are interested in learning more about risk management strategies can register for the Thursday, January 14 webcast here.