“In this month, it (RAAX) increased its position from zero to 20 percent into REITs,” said Rakszawski. “So the model indicated some bullish indicators or signals for the REIT segment.”

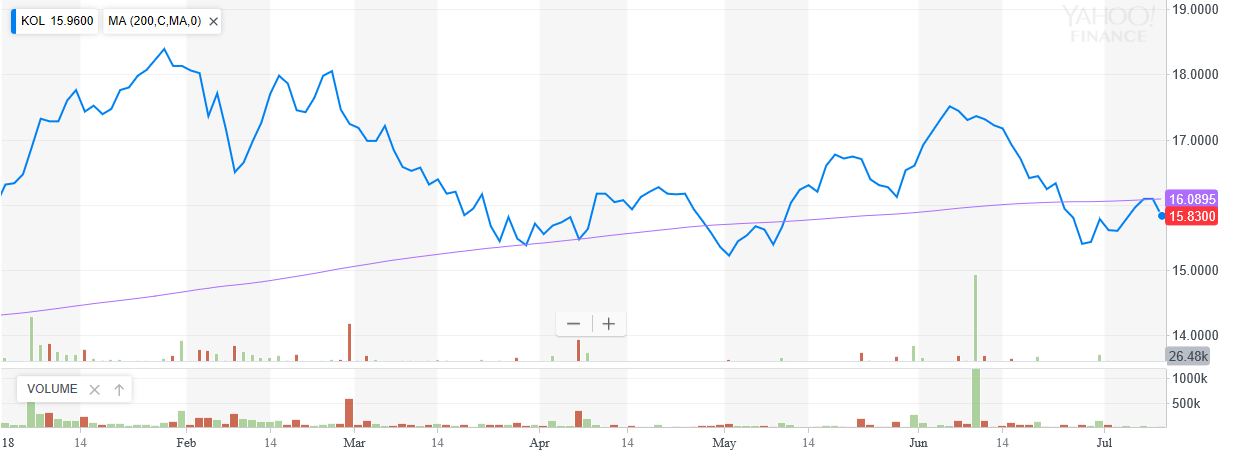

Likewise, the RAAX model propelling its holdings also signaled a bullish sentiment in coal through the VanEck Vectors Coal ETF (NYSEArca: KOL). KOL did cross below its 200-day moving average towards the end of June, possibly presenting a buying opportunity that RAAX picked up on–KOL has risen as high as 2.2 percent within the last five days and is up 23.83 percent the past year.

![]()

This in-and-out of real assets strategy has yielded RAAX a 1.4 percent return year-to-date and with changing market conditions as of late due to trade disputes, it may continue to thrive through the rest of 2018.

This in-and-out of real assets strategy has yielded RAAX a 1.4 percent return year-to-date and with changing market conditions as of late due to trade disputes, it may continue to thrive through the rest of 2018.

“We’re really pleased with the interest we’ve seen in not only just real assets in general, but the strategy behind this particular ETF,” said Rakszawski.

For more market trends, visit ETFTrends.com.