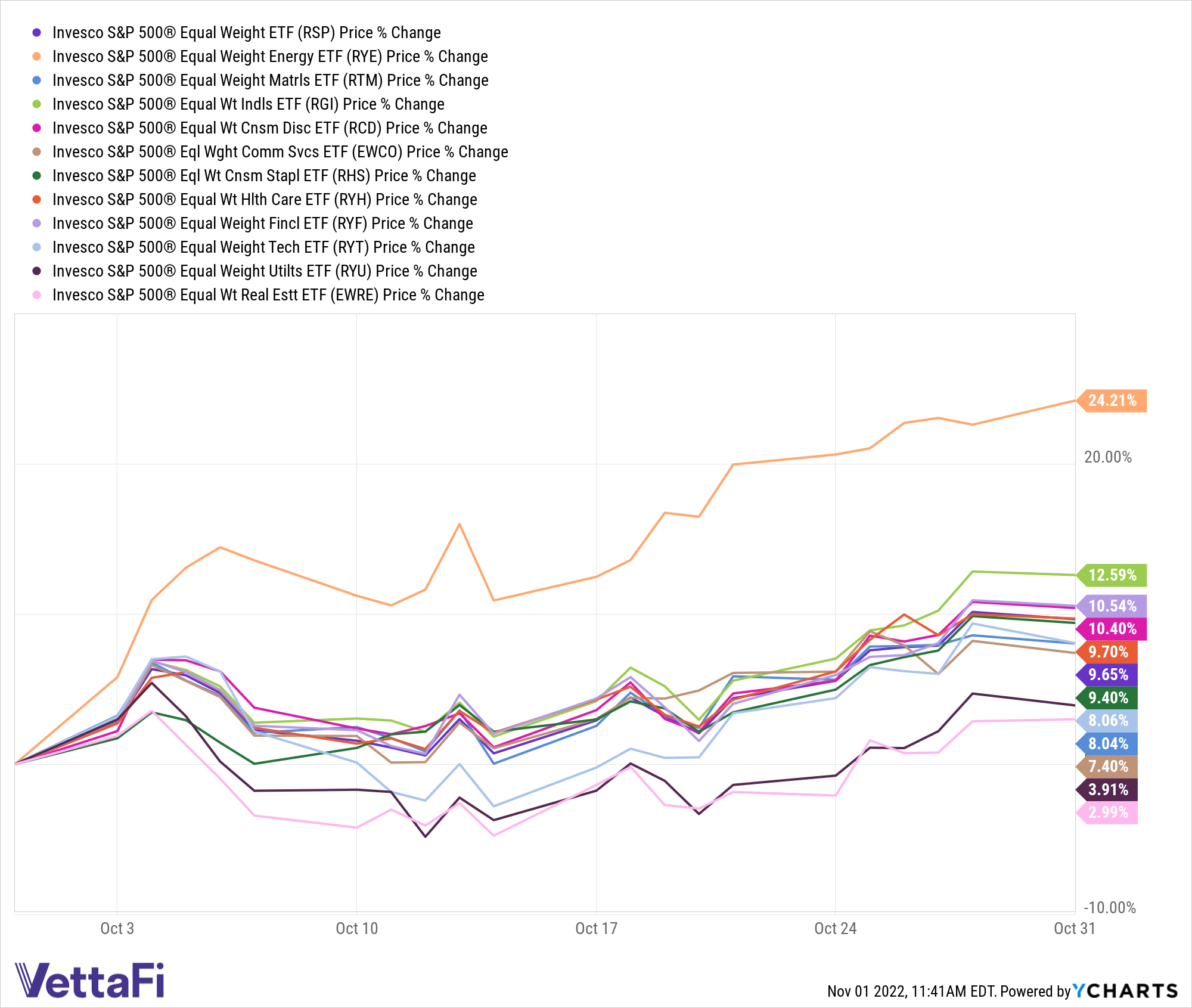

While all of Invesco’s equal-weight sector ETFs recorded gains during October, there were five sectors that performed exceptionally well, pulling the S&P 500 Equal Weight Index higher.

The S&P 500 Index gained 8.10% on a total return basis during the month of October, notching its best month since the broad market’s July rally. During the same period, the equal-weight index, tracked by the Invesco S&P 500® Equal Weight ETF (RSP), increased 9.80%.

This is a favorable reversal from the prior month’s performance, in which the indexes posted their worst monthly returns since March 2020, both declining 9.2%, with equal weight slightly outperforming.

The energy sector regained its strength in October. The Invesco S&P 500 Equal Weight Energy ETF (RYE) was the top performing sector, increasing 24.21% during the month.

Trailing RYE’s standout performance is the Invesco S&P 500 Equal Weight Industrials ETF (RGI), which gained 12.59% in October.

The Invesco S&P 500 Equal Weight Financials ETF (RYF) and the Invesco S&P 500 Equal Weight Consumer Discretionary ETF (RCD) returned 10.54% and 10.40%, respectively.

Rounding out the winners, the Invesco S&P 500® Equal Weight Health Care ETF (RYH) increased 9.70%.

The equal-weight sectors that posted positive gains but served as counterweights, pulling RSP lower, include consumer staples, information technology, materials, communication services, utilities, and real estate.

The equal-weight sector ETFs offering exposure are the Invesco S&P 500 Equal Weight Consumer Staples ETF (RHS), the Invesco S&P 500 Equal Weight Technology ETF (RYT), the Invesco S&P 500 Equal Weight Materials ETF (RTM), the Invesco S&P 500 Equal Weight Communication Services ETF (EWCO), the Invesco S&P 500 Equal Weight Utilities ETF (RYU), and the Invesco S&P 500 Equal Weight Real Estate ETF (EWRE).

For more news, information, and strategy, visit the Portfolio Strategies Channel.