Amid a period of market turbulence, the Invesco S&P 500® Equal Weight ETF (RSP) has taken in nearly $1 billion in net new assets during the first two weeks of the year as investors plow into equal-weighted strategies.

During the first nine trading days of the year to date, RSP has seen days in which investors have plowed in hundreds of millions in assets looking to buy the dip, ranking in $949 million in net new assets.

8.8% of all flows into ETFs this year have gone into equal weight funds, trailing only vanilla and value ETF categories, according to FactSet data.

RSP is an equal-weighted ETF with nearly two decades of past performance data and $33 billion in assets, as of January 13. The fund carries an expense ratio of 20 basis points, notably lower than the FactSet segment average expense ratio of 57 basis points, according to ETF Database.

RSP tracks the S&P 500 Equal Weight Index, in which component companies receive equal allocations, as opposed to being weighted by market capitalization. The weighting structure results in exposure that is considerably more balanced than other alternatives and has a heavier focus on value.

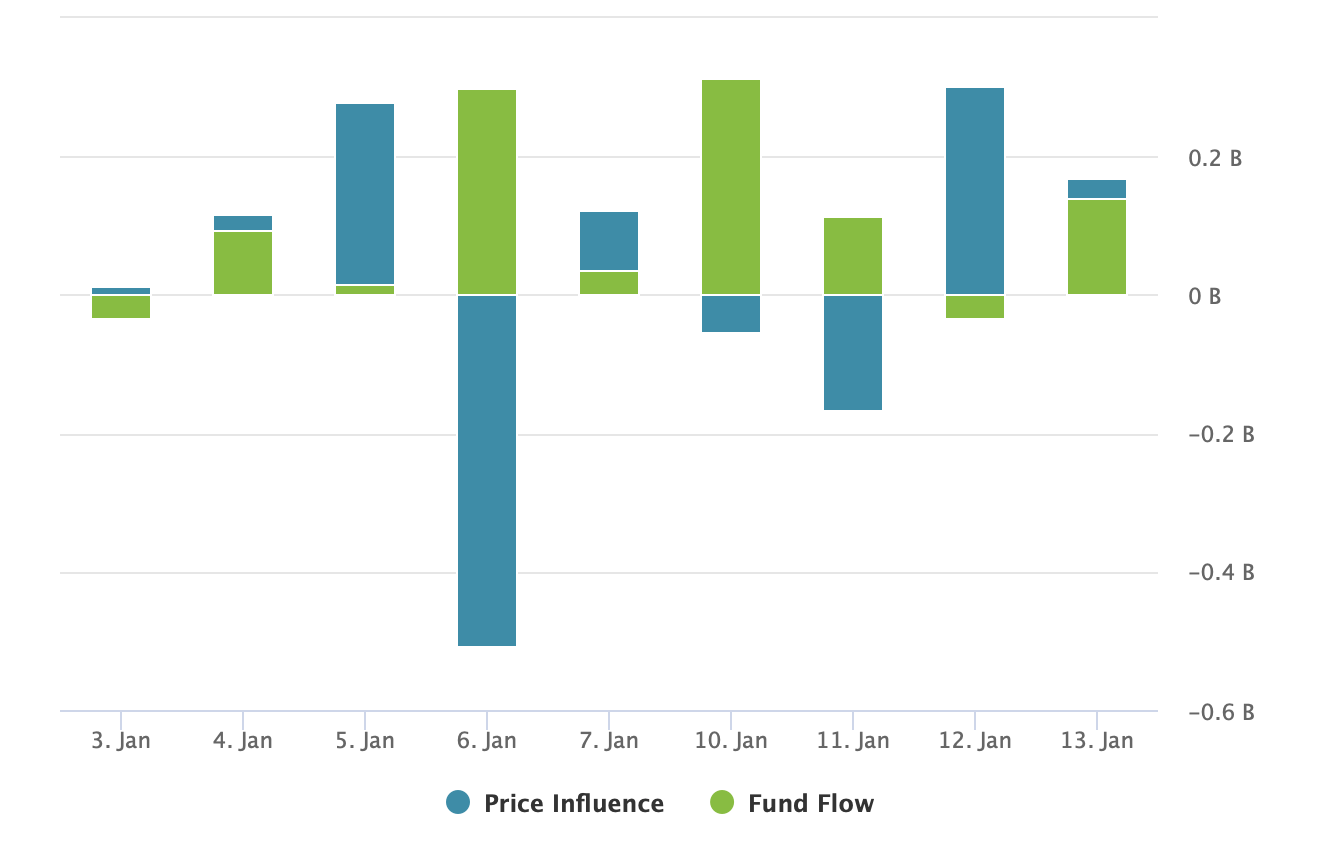

The fund saw the greatest inflows on January 6 and January 10, when it took in $299 million and $312 million, respectively, in new assets.

The flows followed the volatility in the market, when RSP’s price influence dipped by $506 million on January 6 and by $165 million on January 10, highlighting investors’ appetite and optimism for the equal-weighted strategy.

For more information, visit Invesco.com.

For more news, information, and strategy, visit our Portfolio Strategies Channel.