Several key economic indicators come out every week to help provide insight into the overall health of the U.S. economy. Policymakers and advisors closely monitor these indicators to understand the direction of interest rates, as the data can significantly impact business decisions and financial markets.

In this article, we take a deeper look at three of the most important economic releases from the past week: personal consumption expenditures (PCE), gross domestic product (GDP), and new orders for durable goods. By examining these data points, we gain valuable insights into the spending behaviors of consumers and businesses and how these patterns impact overall economic growth.

In the week ending on May 25, the SPDR S&P 500 ETF Trust (SPY) fell 1.09%, while the Invesco S&P 500® Equal Weight ETF (RSP) was down 2.32%.

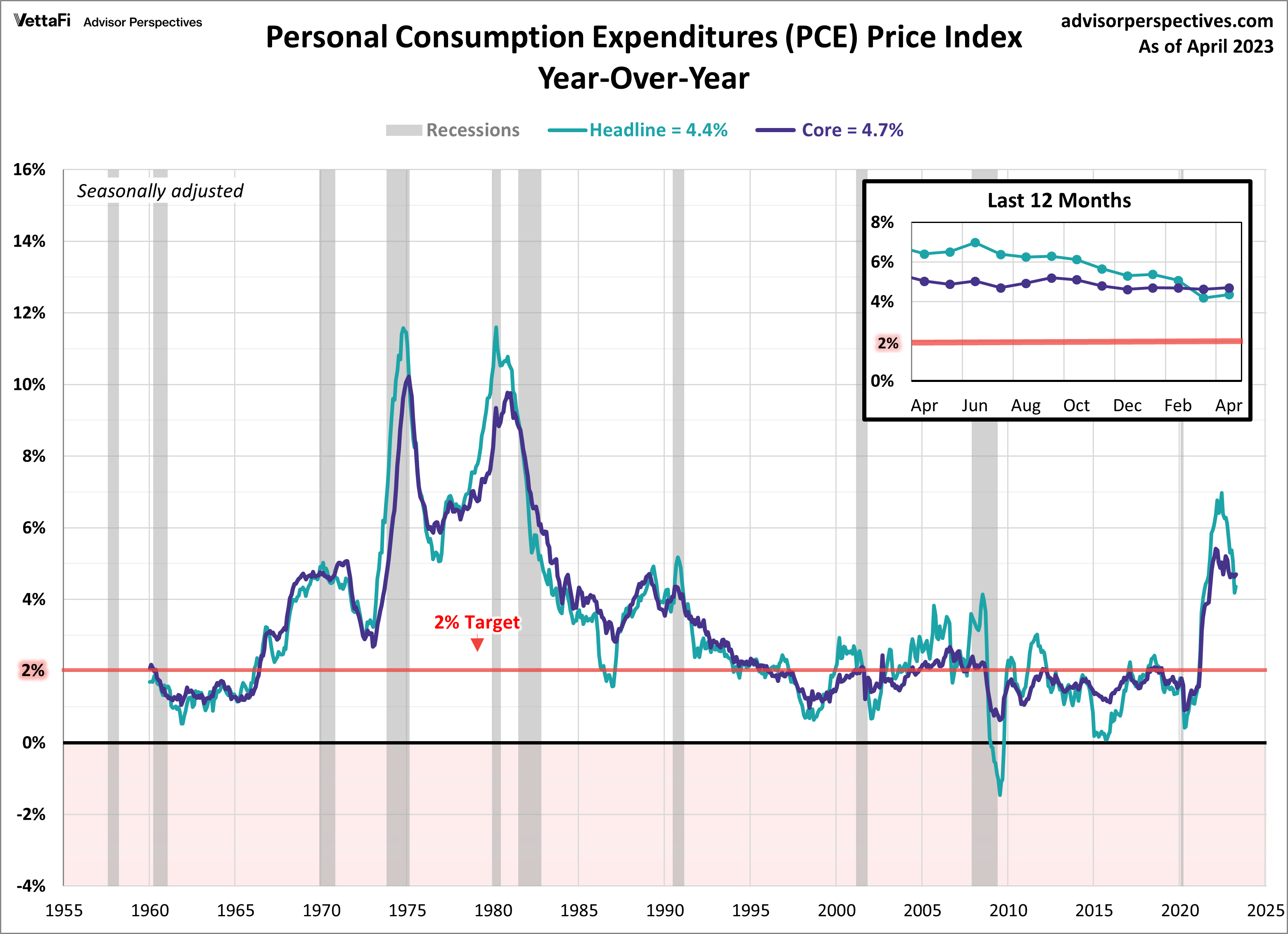

Personal Consumption Expenditures (PCE)

The PCE price index revealed that inflation is sticking around. On an annual basis, consumer spending rose 4.4% in April compared to a year ago, up from 4.2% last month. This month’s reading went against expectations that inflation would continue to drop, marking the first increase since January.

Core PCE, better known as the Fed’s preferred measure of inflation, also came in higher than expected in April. The latest data showed an annual increase of 4.7%, which was just above the 4.6% forecast. Like the headline data, this marked the first uptick since January. On a monthly basis, both the headline and core PCE price index increased 0.4% from March.

While the headline number was in line with expectations, the core number was higher than anticipated. The PCE price index remains well above the Fed’s 2% target rate and this month’s unexpected increase could deter past hopes of rate hikes ending soon.

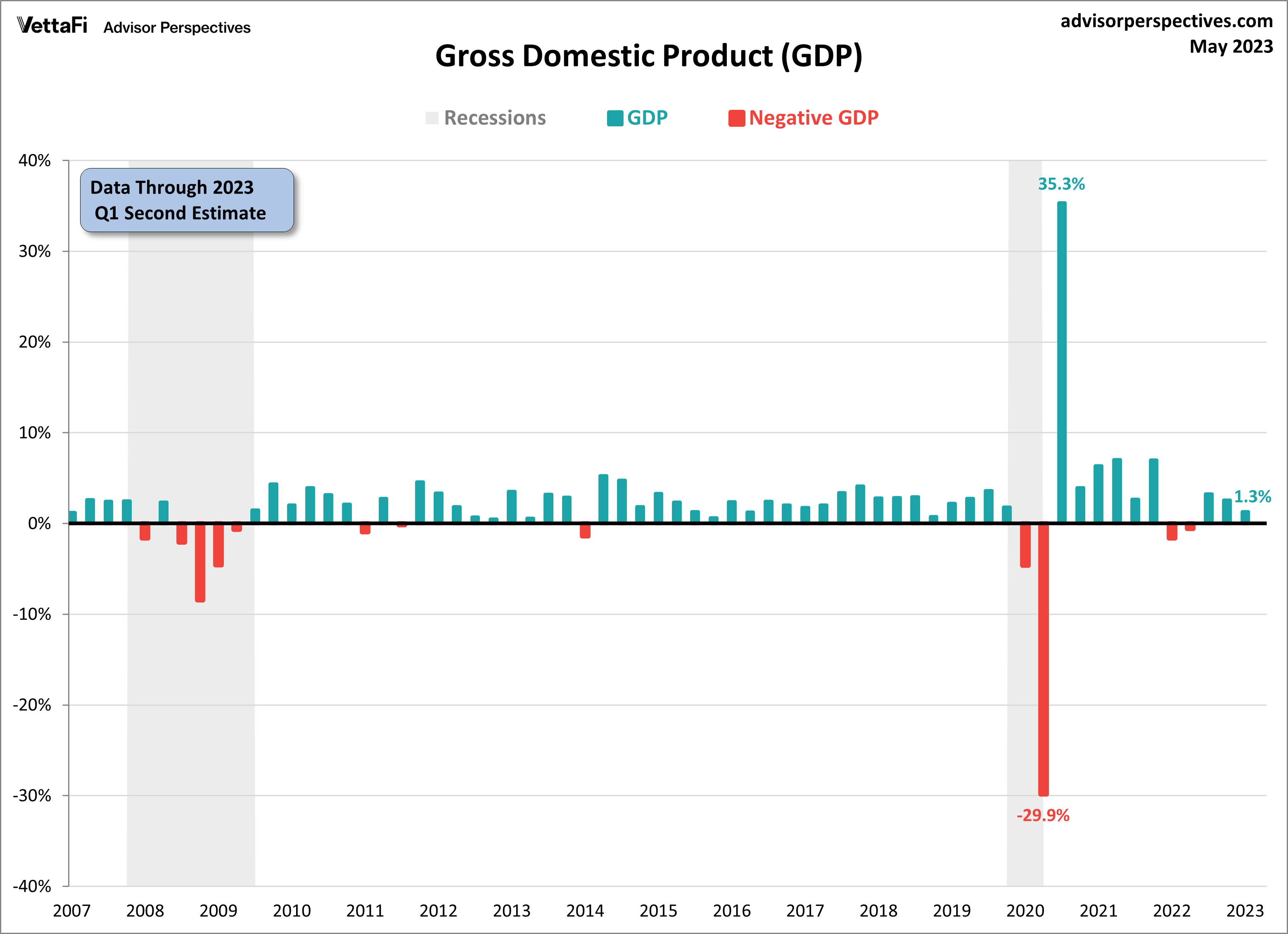

Gross Domestic Product (GDP)

The latest figures on real gross domestic product (GDP) show that the U.S. economy grew at a quicker pace than initially estimated at the beginning of this year. The second estimate for Q1 2023 GDP showed the economy grew 1.3%, slightly higher than the 1.1% growth shown in the advance estimate last month.

Despite the growth, the economy has been losing momentum over the past several months. GDP has decelerated over the past two quarters, decreasing from 3.2% in Q3 of last year to 2.6% in Q4 and further down to 1.3% now.

Consumer spending started the year off strong, making the largest contribution to real GDP growth out of the four subcomponents. However, since January, consumers have been scaling back their spending each month due to the challenges posed by high inflation and rising interest rates.

Conversely, of the four components, gross private domestic investment experienced the largest decline in Q1. With that said, business spending was revised slightly higher from the advance estimate, which contributed to the upward revision of overall GDP growth.

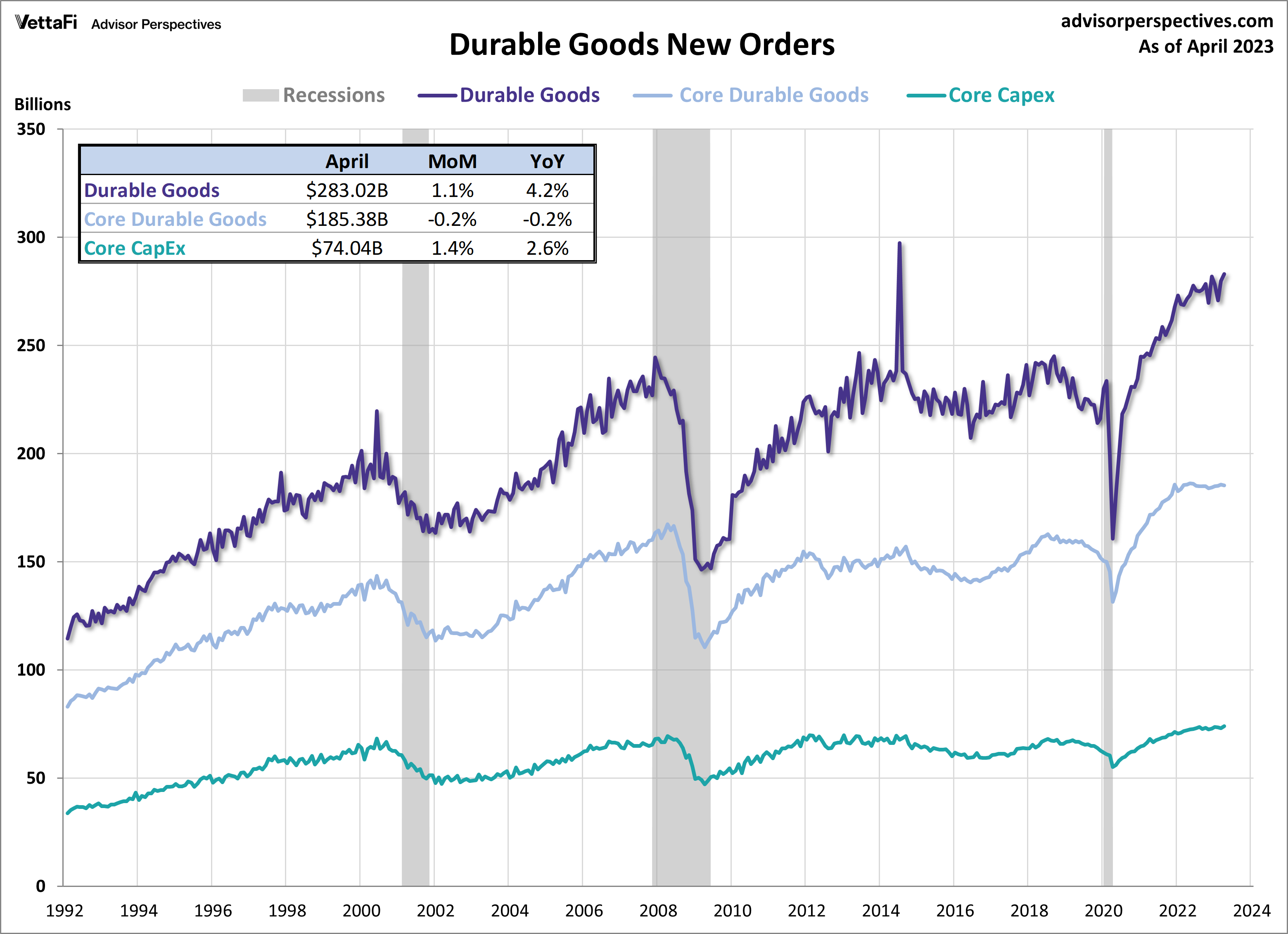

Durable Goods

New orders for durable goods, which measure the demand for longer-lasting products by both consumers and businesses, unexpectedly rose for the second consecutive month. The unexpected boost this month is in large part due to increased spending in the transportation and defense sector. In April, new orders increased by 1.1% to $283.02 billion, surpassing the estimate of a 1.0% monthly decline. However, after stripping out transportation, “core” durable goods orders fell for the first time in five months by 0.2%.

Taking it a step further to an even narrower “core”, when transportation and defense are stripped out, new orders dropped by 3.0% from last month. Core capital goods (capex) orders, which focus specifically on business investments, signaled growth in the industrial side of the economy as orders increased 1.4% from last month following two months of pullbacks.

The focus for this week shifts to employment as the market awaits the release of several key job reports. The April JOLTS data and May employment reports will provide insights into the health of the labor market and by extension, the overall economy. On Wednesday, we will learn if job openings continued to fall in April after reaching a near 2-year low in March. The current forecast expects job openings to rise for the first time in 4 months to 9.775 million from March’s 9.590 million.

Then on Thursday, the ADP employment report will publish, which will set the stage for the more comprehensive BLS employment report released on Friday. Expectations are that the economy added 180,000 nonfarm jobs in May, down from 253,000 in April, and that the unemployment rate rose from 3.4% to 3.5%.

For more news, information, and strategy, visit our Portfolio Strategies Channel.