U.S. stocks fell on Thursday as investors woke to the news that Russia had invaded Ukraine, arousing concern while simultaneously creating an potential buying opportunity

As of Thursday afternoon, the Dow Jones Industrial Average fell over 660 points while the S&P 500 followed its lead, declining over 1%.

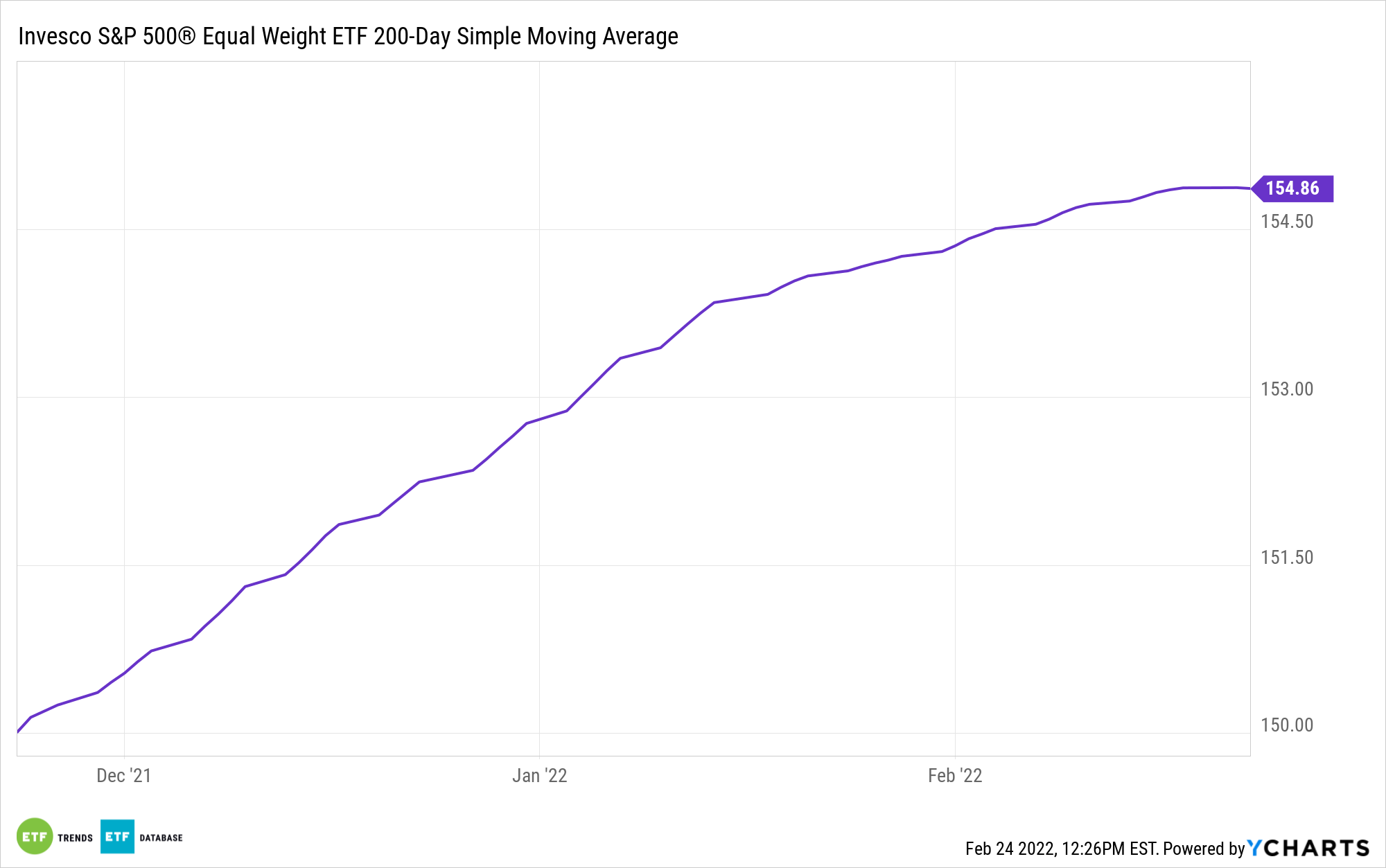

Looking at the moving average indicator can help identify trends and key price points for a security. While the S&P 500 has crossed below its 200-day moving average, the 50-day moving average is still above, not yet signaling a possible “death cross” — when a short-term moving average falls below the long-term moving average.

As market turbulence continues, pressured by geopolitical tensions, inflation, and rising rates, investors can capitalize on the turmoil by buying into high-value funds when their prices are lower.

A strong offering to consider in the current economic climate is the Invesco S&P 500 Equal Weight ETF (RSP).

Equal-weighted ETFs such as RSP, which is the largest fund in its category, minimize single stock risk. That’s a potential selling point for investors at a time when growth and technology stocks have been weighing on the broader market.

As the S&P 500 has grown ever more top-heavy, many investors in products tied to the index in a market cap-weighted fund have found themselves facing historic levels of concentration risk, according to Invesco.

Market capitalization-weighted ETFs can often result in just a few companies having an outsized influence on index performance. When looking at the S&P 500, investors have up to 35 times the exposure to the top holdings in a market cap strategy than they would in an equal-weighted approach.

Opting for an equal-weight index, as opposed to a market cap-weighted approach, can provide diversification benefits and reduce concentration risk by weighting each constituent company equally, so that a small group of companies does not have an outsized impact on the index.

With quarterly rebalances to maintain equal weightings, RSP’s methodology imposes a strict “buy low/sell high” discipline, trimming allocations to companies that have grown and increasing allocations to companies that have underperformed, according to Invesco.

Another equal-weighted ETF to consider is the Invesco ESG S&P 500 Equal Weight ETF (RSPE), which integrates ESG considerations into the investment strategy.

For more news, information, and strategy, visit the Portfolio Strategies Channel.