Since its launch 20 years ago, the Invesco S&P 500® Equal Weight ETF (RSP) has generated 10,500 basis points in excess returns for investors compared to the S&P 500.

When RSP launched in April 2003, it reinvented the ways that investors were able to access the S&P 500. RSP continues to add value to portfolios, helping mitigate concentration risk with an equal-weight strategy, and has provided the potential for higher returns in a cost-effective and tax-efficient way.

RSP gives every security in the S&P 500 an equal weight at each quarterly rebalance. Equal weight’s methodology of selling relative winners and buying relative losers adds the small size and value factor tilts to a portfolio.

“When individuals think about investing in the S&P 500, they probably think about their exposure being more equal weight-like than cap weight. They probably don’t think about the fact that when they allocate, they’re allocating more of their money to a smaller proportion of the index due to cap weighting as opposed to more of a broad exposure,” Nick Kalivas, head of factor and core equity product strategy for Invesco, told VettaFi.

“One of the problems that RSP solved was it provided a broader exposure to the S&P 500 – a more diversified exposure to the S&P 500 – without being so concentrated in some of those big names,” Kalivas said. “I think as history has shown, as you go across time, the top names kind of come in and out. There’s new leadership, new top names over time, and so being more dispersed in your allocation like equal weight really avoids the potential shortcomings in cap weighting.”

With over $33 billion in assets under management, RSP is the world’s largest equal-weight ETF. The fund’s launch was pivotal for the ETF industry as it was the first smart beta ETF, an area that Invesco expects to hit a milestone of $1 trillion in assets under management by the end of 2023.

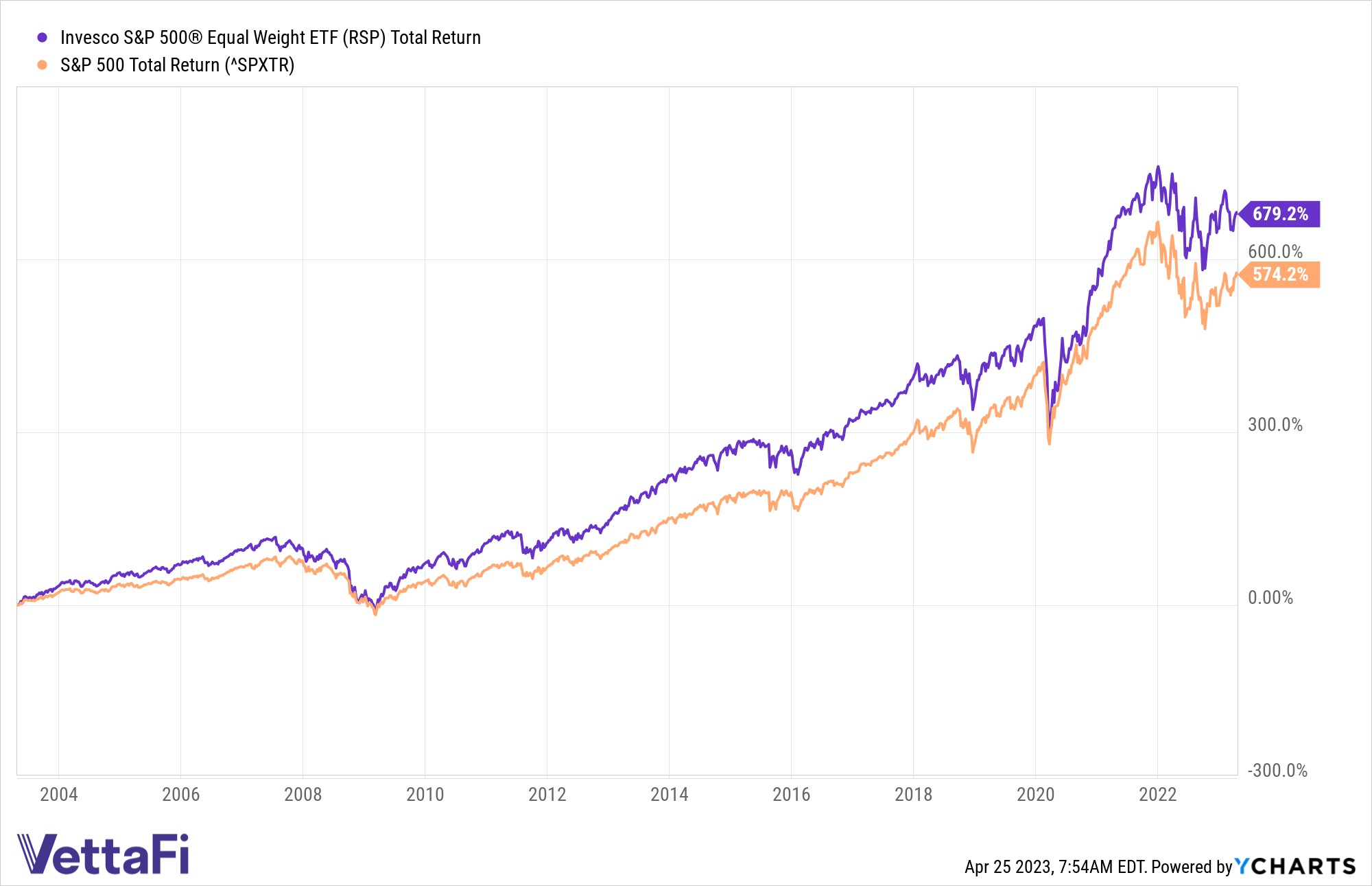

The fund has outperformed the S&P 500 over various market conditions, most recently in 2022, when RSP declined 11.6% compared to the S&P 500’s 18.1% plunge.

RSP has significantly outperformed for buy-and-hold investors since its inception. In the 20 years following the fund’s launch on April 24, 2003, RSP has gained 679.2% while the S&P 500 has climbed 574.2%.

For more news, information, and analysis, visit the Portfolio Strategies Channel.