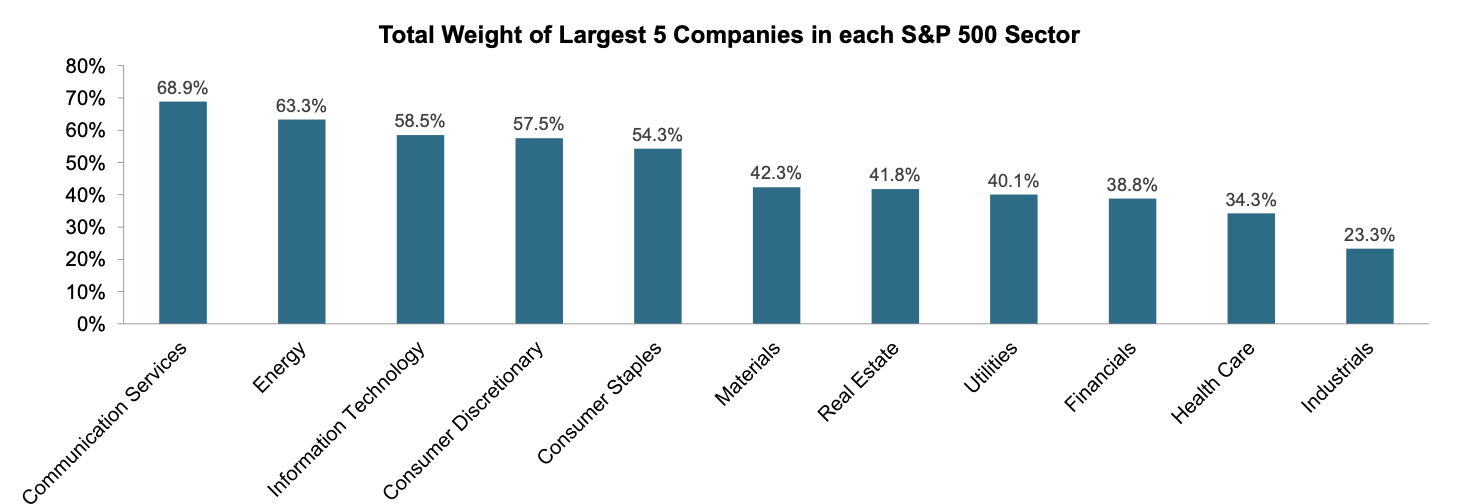

An equal-weight ETF is particularly impactful in the sectors with the highest concentration risk.

An equal-weight strategy can reduce concentration risk by weighting each constituent company equally so that a small group of companies does not have an outsized impact on the index.

The three sectors with the greatest total weight of the largest five companies include communication services, energy, and information technology. The sectors with the lowest concentration in the largest five names are industrials, healthcare, and financials, according to S&P Dow Jones Indices.

Concentration risk is a growing concern among advisors. In a 2022 survey, 69.7% of advisors said they were concerned or very concerned about the concentration of the top five names in the S&P 500. 22.5% of advisors were “just a little” concerned, and only 7.7% of advisors said they were not concerned, according to “When Markets Wobble, Cash Remains King: Free Cash Flow Investing.” (Date: August 30, 2022. Sample size: 293 respondents, 37.9% RIAs.)

Investors looking for more balanced exposure to the communication services, energy, and information technology sectors can look to the Invesco S&P 500 Equal Weight Communications Services ETF (EWCO), the Invesco S&P 500 Equal Weight Energy ETF (RYE), and the Invesco S&P 500 Equal Weight Technology ETF (RYT).

See more: How Does RSPE Compare to RSP?

For an equal-weighted strategy, the simple arithmetic of rebalancing connects equally weighted indexes to momentum effects. If the price of a constituent increases by more than the average of its peers, then its weight in the portfolio will increase, and the position will necessarily be trimmed at the next rebalance as the portfolio returns to equal weights.

On the other hand, if a stock falls by more than the average of its peers, its weighting will fall too, and more must be purchased at the next rebalance to return to equal weight. Thus, equal-weight indexes sell relative winners and purchase relative losers at each rebalance, adding a value tilt to portfolios.

For more news, information, and analysis, visit the Portfolio Strategies Channel.