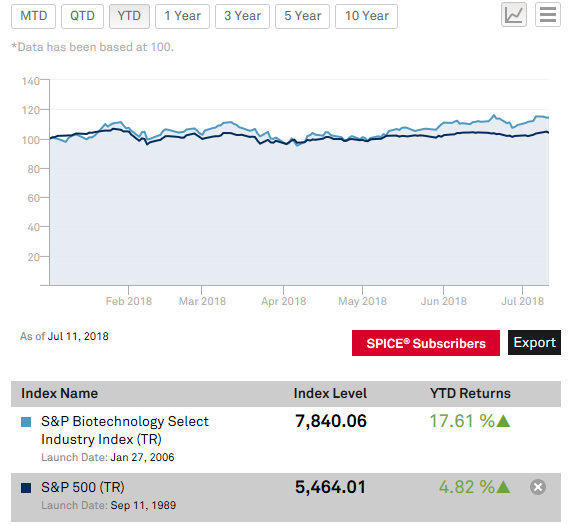

Year-to-date performance figures show that the index is outperforming the S&P 500 by almost 13%. LABU has been a beneficiary of that, producing gains of 21.97% year-to-date and 50.88% the past year per performance figures on Yahoo! Finance.

![]()

Related: Biotech ETFs Climb on Biogen’s Promising Clinical Trial

Tax Breaks and IPOs Fueling Industry

Per a blog post from Direxion Investments, one of the main drivers for the strong performance in the biotech and pharmaceutical industry is a lower corporate tax rate. As mentioned, these corporate tax breaks are helping to fuel the number of mergers and acquisitions taking place within the sector.

According to Direxion Investments, “the primary catalyst behind this spending spree is the windfall many of these companies gained from the new U.S. tax structure that lowered corporate tax rate from 35 to 21 percent while also permitting companies to repatriate revenue stockpiled offshore at the lower rate. This is enormously beneficial to pharmaceutical companies, who tend to hoard offshore profits. The last time companies experienced such a tax holiday in 2004, Pfizer Inc. repatriated $37 billion for dividend and stock buyback programs.”

In addition, there have been 32 initial public offerings (IPOs) in the sector, which is already 12 IPOs shy of matching the number of IPOs in 2017 with the second half of 2018 still left. Per Direxion’s blog post, “These companies seemingly can’t appear fast enough, as investors have pounced on the new listings, driving their share price up by as much as 60 percent in the case of recent IPO AvroBio.”

For more trends in ETF investing, click here.