PGIM Investments continues to build out its actively managed fixed income ETF lineup with the launch of the PGIM Floating Rate Income ETF (NYSE Arca: PFRL). The new ETF, which seeks to maximize current income by investing primarily in senior floating rate loans, is managed by PGIM Fixed Income, a leveraged finance manager with $38 billion in floating rate loan assets under management as of March 31.

PGIM is the $1.4 trillion global investment management business of Prudential Financial.

The PGIM Floating Rate Income ETF’s investment strategy mirrors the $4.6 billion PGIM Floating Rate Income Fund, which ranks in Morningstar’s top decile for total returns over the three‑, five-, and 10-year periods ending March 31. Both funds are managed by Brian Juliano, Parag Pandya, Robert Cignarella, Ian Johnston, and Robert Meyer.

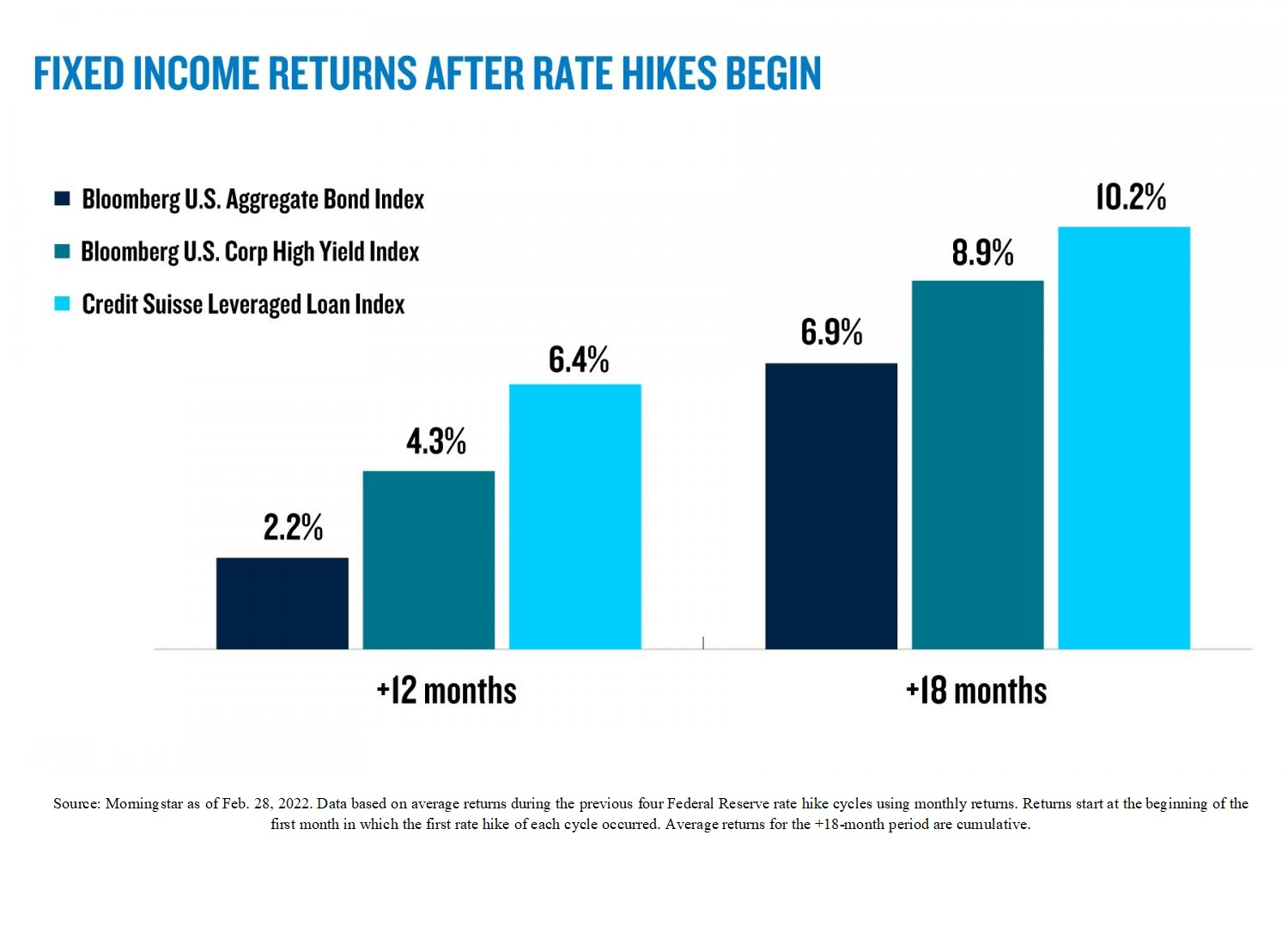

Floating rate loans may benefit from rising interest rates, as the coupon they pay resets based on short-term interest rate movements. PGIM Investments’ recent analysis indicates that floating rate loans have historically outperformed the broader U.S. bond market 12 to 18 months after previous Fed rate hike cycles began (see chart above).

“We’ve seen increased demand for floating rate strategies as investors look to protect against rising rates. In our view, actively managed credit selection will be a differentiating factor between managers in volatile markets, and we are thrilled to offer PGIM Fixed Income’s time-tested strategy as an ETF,” said Stuart Parker, president and CEO of PGIM Investments, in a news release.

“Despite strong fundamentals, uncertainty around developments in Ukraine, inflation and central bank hawkishness underscore the importance of both credit selection and risk management,” added Brian Juliano, managing director and head of the U.S. leveraged loan team at PGIM Fixed Income. “Mechanically, the coupons that bank loans pay reset on short-term interest rate movements, which may help to mitigate the impact of rising interest rates. This structure, when paired with active management and a well-researched credit selection process, seeks to provide investors with an opportunity to be rewarded as market volatility continues.”

For more news, information, and strategy, visit VettaFi.