Source: Toroso Research

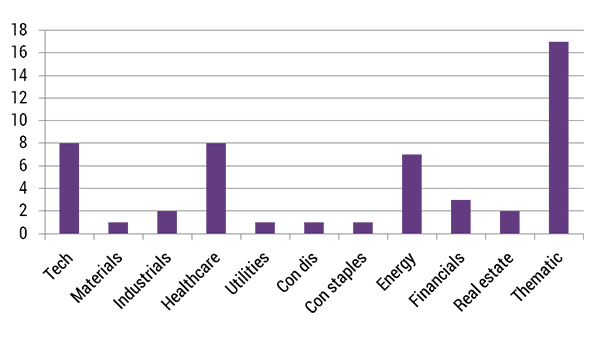

NUMBER OF EW ETFs BY SECTOR/THEME

Since many of these global growth themes are very new, market cap weighting would ignore many of the key small-cap pure plays. Therefore, EW makes a lot of sense for capturing better thematic exposure.

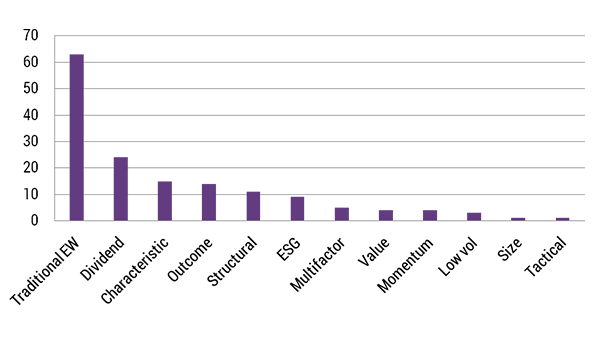

EW CHARACTERISTIC FOCUSED ETFs

Finally, there are the ETFs that focus on business characteristics, which we have written about in previous research.

We believe ETFs that target a business characteristic, which have traditionally only been accessed by active managers, will continue to be a spectacular growth driver for the future.

Here is a list of the EW Characteristic focused ETFs:

- VanEck Vectors Morningstar Wide Moat ETF MOAT

- Knowledge Leaders Developed World ETF KLDW

- VanEck Vectors Morningstar International Moat ETF MOTI

- Goldman Sachs Hedge Industry VIP ETF GVIP

- Guggenheim Insider Sentiment ETF NFO

- Global X Guru Index ETF GURU

- Cambria Foreing Shareholder Yield ETF FYLD

- Elements Morningstar Wide Moat Focus Total Return Index ETN WMW

- Cambria Emerging Shareholder Yield ETF EYLD

- SPDR S&P 500 Buibackk ETF SPYB

- VanEck Vectors Spin-Off ETF SPUN

- Global X Founder-Run Companies ETF BOSS

- Brand Value ETF BVAL

- USCF SummerHaven SHPEN Index Fund BUYN

- USCF SummerHaven SHPEI Index Fund BUY

JUST WEIGHT

It seems that EW is underappreciated because the ideal weighting just can’t be that simple, right? Well for many focused, characteristic, and thematic ETFs, equal weighting is the primary methodology. For traditional exposures, EW can provide different factor exposure and returns. For example, since 2003 when RSP opened, it has returned almost 400% while the S&P 500 is up just over 300%. Which leads us to conclude with a quote by Leonardo Da Vinci: “Simplicity is the ultimate sophistication.”

This article was written by Toroso Asset Management, a participant in the ETF Strategist Channel.

Click here to see disclosures.