CP ETFs launched an ‘ETF of ETFs’ for fixed income on Wednesday: the CP High Yield Trend ETF (HYTR) that tracks a Solactive Index comprised of U.S. high yield corporate bond ETFs and U.S. 3-7 year Treasury ETFs. The fund seeks to provide investment results corresponding before fees and expenses, generally to the performance of the CP High Yield Trend Index.

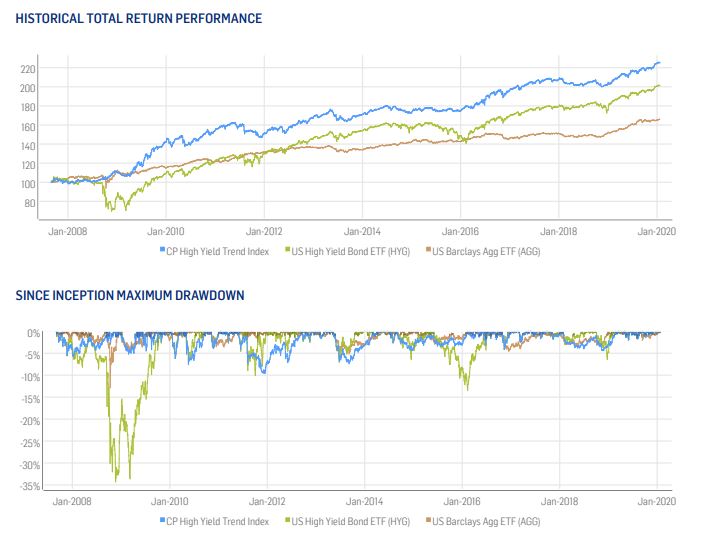

The CP High Yield Trend Index is a rules-based quantitative index comprised of a blend of allocations to U.S. High Yield Corporate Bond ETFs and U.S. 3-7 year treasuries. The index seeks to provide improved exposure to the U.S. high yield corporate markets while reducing risk in times of market turbulence. It uses a blend of trend-following and time-series momentum methodologies with a wide range of parameters, providing a robust method of allocating to U.S. High Yield Corporate ETFs while attempting to reduce significant portfolio turnover.

The HYTR Plan

HYTR seeks to achieve its investment objective by investing at least 80% of its net assets, including borrowings for investment purposes but exclusive of collateral held from securities lending, in securities included in the index. The rules-based index is comprised of a blend of allocations to U.S. high yield corporate bond ETFs and U.S. 3-7 year Treasuries. The Index seeks to provide improved risk-adjusted exposure to the U.S. high yield corporate bond market while reducing risk in times of market turbulence. It uses a blend of trend-following and historic momentum methodologies with a wide range of parameters to reduce model risk. This process seeks to provide a robust method of allocating to U.S. high yield corporate ETFs while attempting to reduce unnecessary portfolio turnover.

The fund may also invest up to 20% of its net assets, including borrowings for investment purposes but exclusive of collateral held from securities lending, in index futures, options, options on index futures, swap contracts or other derivatives, cash equivalents, other investment companies, as well as in securities and other instruments not included in the Index but which the Adviser believes will help the Fund track the Index.

The Board of Trustees may change HYTR’s investment objective upon 60 days’ written notice to shareholders. Depending on market turbulence, the fund could be reweighted daily with 20% increments for high yield bond ETFs, leaving the remainder to be filled with treasury ETFs. HYTR will charge 0.6%.

Learn more about HYTR at Counterpoint’s website. For more market trends, visit ETF Trends.