The power of the night effect was seen in large caps on Thursday for the second time this week.

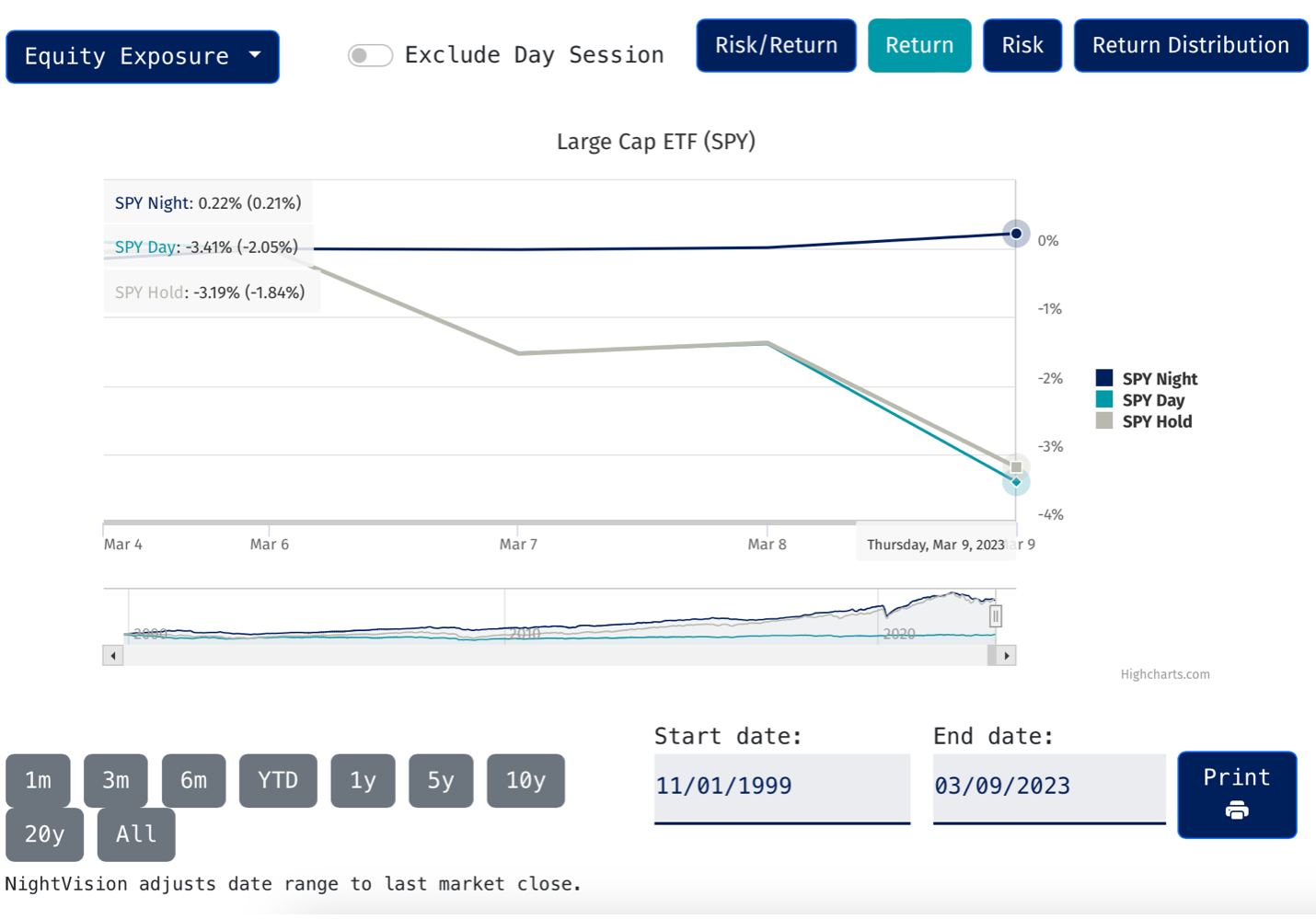

As the S&P 500 is on track to shed over 3% this week, all losses have come from the day session, with the overnight session modestly in the green. By market close Thursday, the SPDR S&P 500 ETF Trust (SPY) has declined 3.19% since the beginning of the week, with the night session climbing 0.21%, partially offsetting the day session’s 3.41% fall.

The night effect is a persistent phenomenon whereby overnight markets have historically outperformed the daytime trading session on a risk-adjusted basis. The historically lower volatility of the overnight session may lead to better up/down capture ratios, allowing investors to more comfortably maintain their target equity exposure through periods of market volatility.

At market close on Thursday, there was a 225 basis point spread between the prior night and day performance of the SPY. SPY gained 0.21% during the night session but fell 2.04% during the day trading session yesterday, according to the NightWatch Mobile App.

On Tuesday, there was a 150 basis point spread SPY’s overnight and day performance. SPY declined 0.01% during the prior night session, followed by a 1.51% drop during the day session on Tuesday, according to NightWatch.

NightShares launched two ETFs last year providing exposure to the night session of large-cap stocks. The NightShares 500 ETF (NSPY) offers focused exposure to the night performance of 500 large-cap U.S. companies.

For investors looking to maintain day exposure but overweight the night, the NightShares 500 1x/1.5x ETF (NSPL) tilts toward the night, providing investment results, before fees and expenses, that correspond to 100% of the performance of a portfolio of 500 large-cap U.S. companies during the day and 150% of the portfolio performance at night.

The night effect was also observed in small caps this week. The spread between the night and day performance of the iShares Russell 2000 ETF (IWM) was 291 basis points on Thursday. IWM gained 0.07% during the night session and plummeted 2.84% during the day.

The day/night performance spread was 108 basis points on Tuesday as IWM declined 0.03% overnight, then fell 1.11% during the day trading session. On Monday, IWM’s night session was up 0.03% and the day session fell 1.49, according to NightWatch.

The NightShares 2000 ETF (NIWM) provides exposure to the night performance of 2000 small-cap U.S. companies.

For more news, information, and analysis, visit the Night Effect Channel.