The day and overnight trading sessions had vastly different responses to the latest inflation print.

The SPDR S&P 500 ETF Trust (SPY) and the iShares Russell 2000 ETF (IWM) both saw notable gains during the overnight trading session yesterday, before declining sharply during the day session. The Consumer Price Index rose 4.9% in April from a year earlier, marking the 10th consecutive month that inflation has slowed. Economists surveyed by Bloomberg had expected an annual increase of 5%.

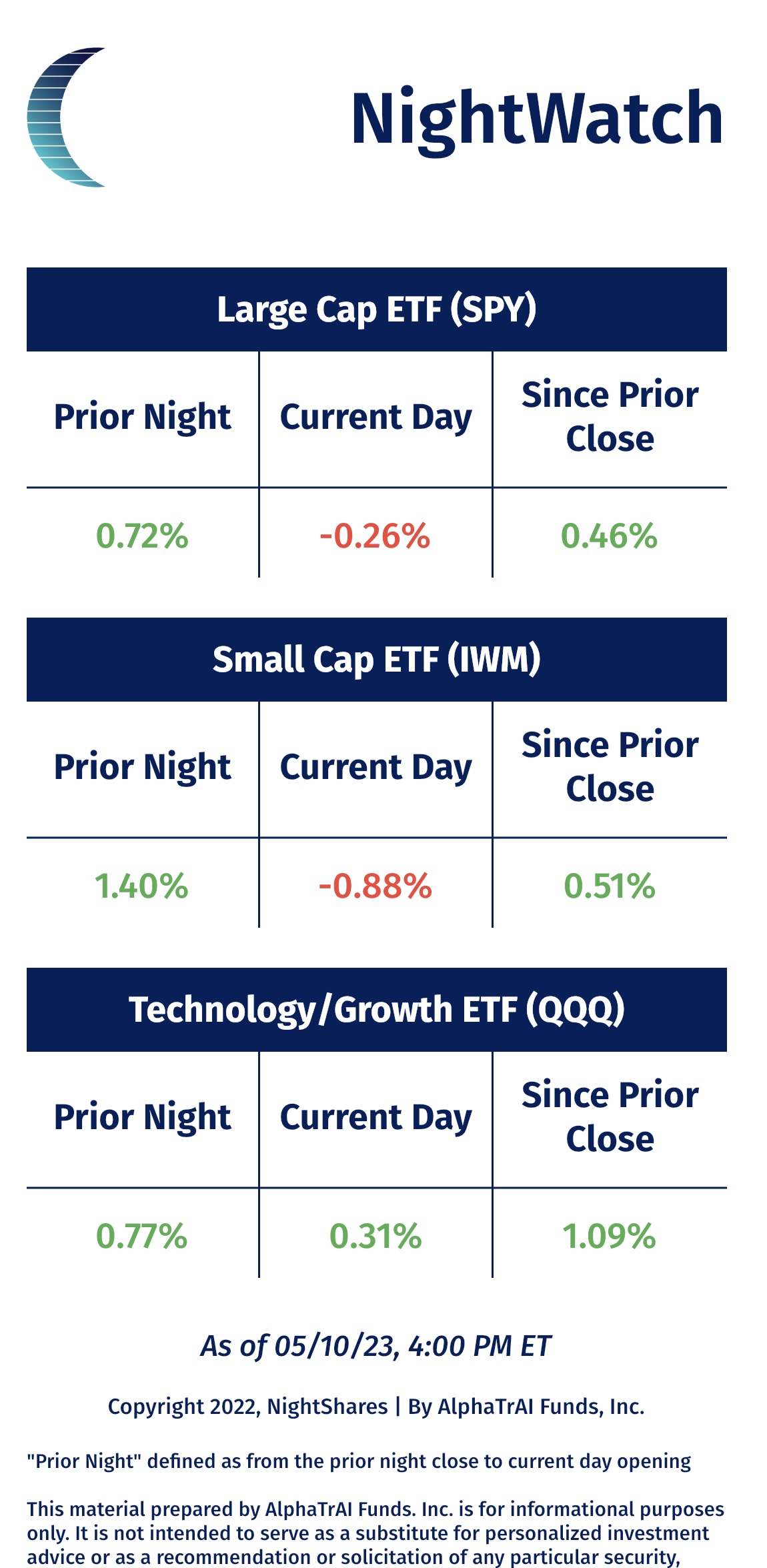

SPY and IWM’s returns were 0.7% and 1.4%, respectively, during the overnight trading session yesterday. The day clawed back some of the gains as the market responded differently to the latest CPI print, with SPY and IWM shedding 0.3% and 0.9% during the day session, according to the NightWatch Mobile App.

The Night Effect

The night effect is a market anomaly in which equities have historically performed better during the overnight session (when local markets are closed) than during the day when markets are open. Over the past 20 years, the night session has outperformed the day session from a risk and/or return perspective.

According to NightShares, the frequently stated rationale as to why the night effect works focuses on the timing of information flow/availability, risk management practices, and liquidity premiums arising from differences in the trading volumes between the day and night sessions.

Investors can gain access to the overnight trading session with NightShares ETFs. The NightShares 500 ETF (NSPY) offers exposure to the night performance of 500 large-cap U.S. companies (comparable to the S&P 500). Meanwhile, the NightShares 2000 ETF (NIWM) provides exposure to the night performance of 2000 small-cap U.S. companies (comparable to the Russell 2000).

The NightShares 500 1x/1.5x ETF (NSPL) tilts toward the night while maintaining daytime exposure. The fund provides investment results that correspond to 100% of the performance of a portfolio of 500 large-cap U.S. companies during the day and 150% of the portfolio performance at night.

For more news, information, and analysis, visit the Night Effect Channel.