While the night effect can be clearly seen in both small- and large-cap stocks, it has historically been far more pronounced in small-cap returns.

Over the past 20 years (2003 through 2022), 100% of the returns generated by the iShares Russell 2000 ETF (IWM) have come at night. This phenomenon is referred to as the night effect, whereby equities have historically performed better during the overnight session (when local markets are closed) than during the day when markets are open.

The night session has contributed 12.62% of positive performance while the day session has declined 2.90% over the 20-year period ending December 31, 2022. Over three years ending December 31, 2022, small caps have returned 74.51% during the night session but the day session has clawed back some of the returns, as the day session has declined 37.36% during that period.

See more: “Everything Advisors Need to Know About the Night Effect“

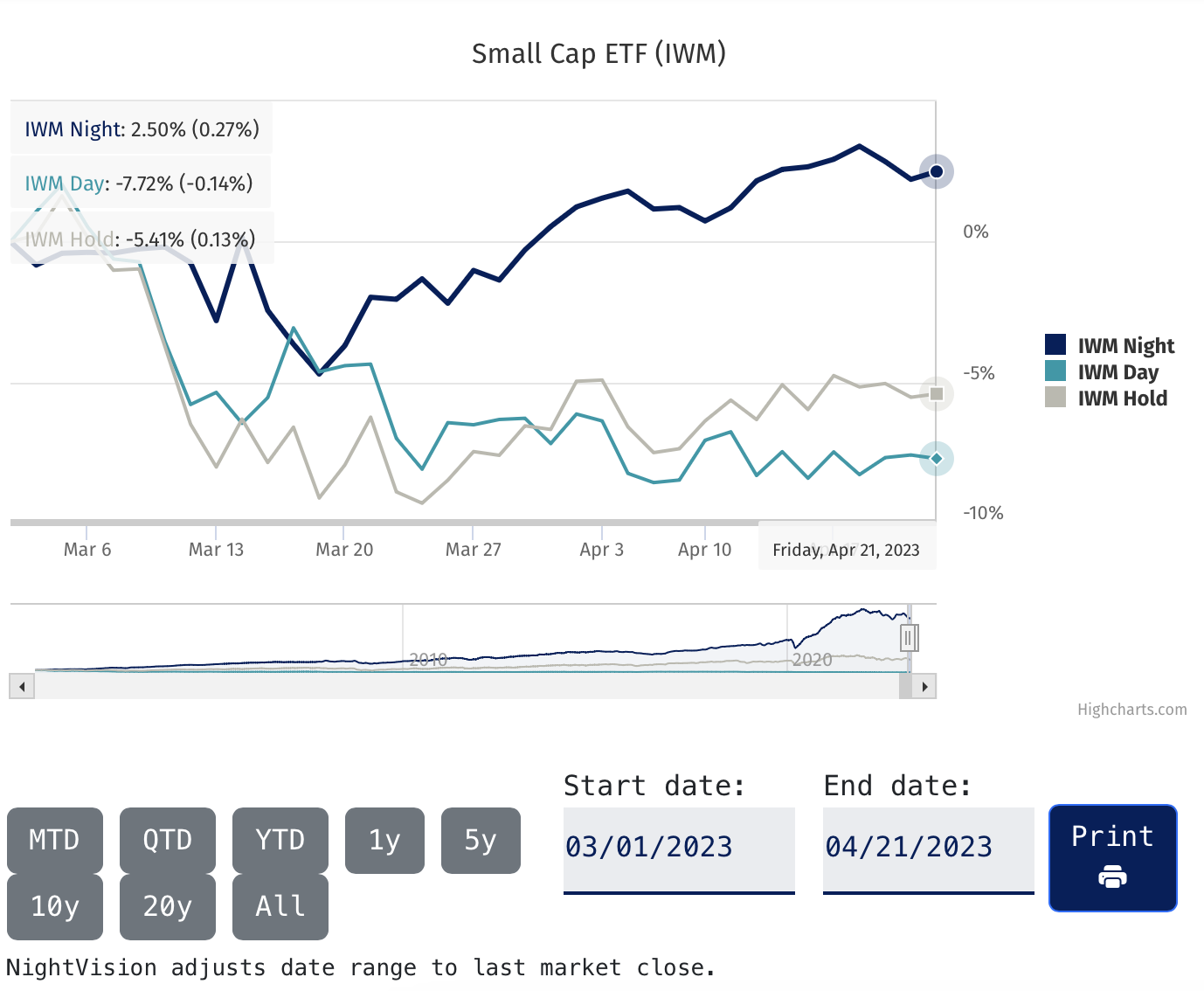

The night effect has been observed in small caps in recent history. From March 1 through April 21, the night session of IWM has climbed 2.50% while the day has declined 7.72%, bringing the buy-and-hold return to -5.41% during that period, according to NightVision.

Investors can get exposure to the night session with the NightShares 2000 ETF (NIWM), which offers exposure to the night performance of 2000 small-cap U.S. companies. Investors can use NIWM as a substitute for small-cap exposure, or to complement and enhance existing small-cap exposure by effectively tilting toward the night.

Notably, investors do not have to accept more risk, as measured by volatility, to access the historically positive overnight returns captured by the night effect. In fact, the annualized daily volatility for U.S. small-cap stocks has been lower in the night session than the day sessions across a range of periods, according to NightShares.

For more news, information, and analysis, visit the Night Effect Channel.