With casinos, malls, stores and other real estate-intensive businesses grappling with temporary closures due the COVID-19 pandemic, real estate investment trusts (REITs) and the related exchange traded funds are facing challenges of their own this year, but the rough environment could also be giving investors clues about sources of leadership when a rebound arrives.

Enter the ALPS REIT Dividend Dogs ETF (NYSEArca: RDOG), which is one of the newest entrants to the REIT ETF fray.

RDOG screening is isolated at the REIT segment level, providing high dividend exposure by selecting the five highest-yielding REITs in nine REIT segments, according to the ALPS fund page for RDOG, that states the ETF includes a Technology REIT segment to help capture the strong growth in wireless towers and data centers, which can also act as a defensive attribute to the fund and excludes the Mortgage REIT (mREIT) segment to avoid REITs most sensitive to interest rates and credit spreads.

Translation: what RDOG features (exposure to technology REITs) and what it excludes (mREITs) are both meaningful traits in the current environment.

Addition by Exclusion and Inclusion

Excluding mREITs limits RDOG’s credit and interest rate risk, but the ETF’s exclusion of that asset class was important in the first quarter when mREITs were forced to sell assets to meet margin calls on loans used to finance positions.

Conversely, the fund’s exposure to technology REITs, including data center and infrastructure fare, is proving efficacious at a time of increased demand attributable to the 5G rollout and increased cloud spending, among other factors.

Cell towers and data processing centers store the information and handle the orders that start the e-commerce process, making the fund a diverse play on some of the most important emerging technological themes. Adding to the long-term case of RDOG is that its technology REIT exposure is overweight that of traditional real estate funds and that companies in this spectrum have a documented history of outperforming broader REIT benchmarks.

Another point in favor of RDOG is a methodology that sources sustainable payouts and distribution growth, which is pivotal at a time when many REITs are likely to pay their upcoming dividends in the form of shares, not cash.

RDOG also implements a quality screen where constituents must have Funds From Operations (FFO) per share greater than Dividend per share (DPS), which has helped buffer the fund’s returns YTD relative to competitors.

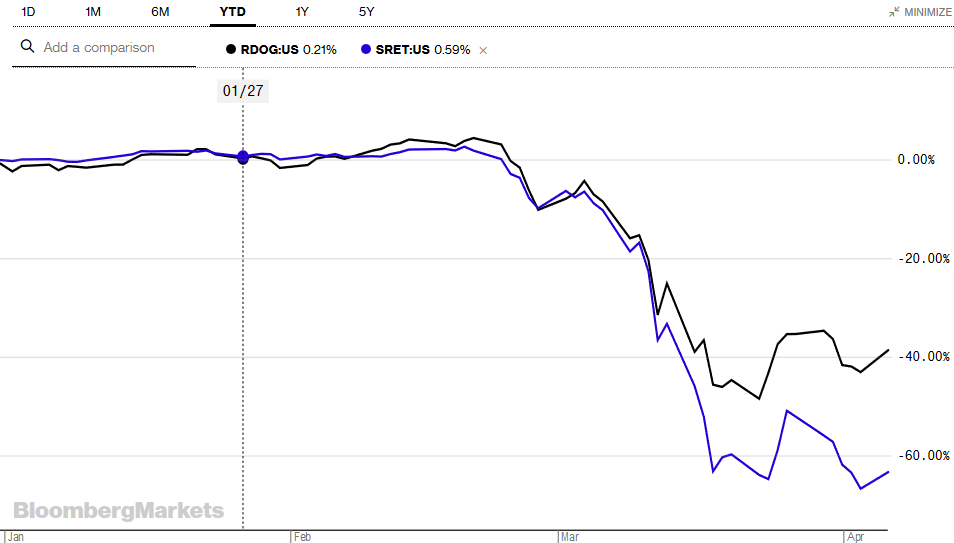

That quality is enabling RDOG to outpace higher-yielding rivals this year, as highlighted by the chart below.

For more investing ideas, visit ETF Trends.