The technology sector is traditionally a low-yield space, but it’s the biggest dividend-paying sector in the S&P 500 in dollar terms, plus it’s home to ample payout growth.

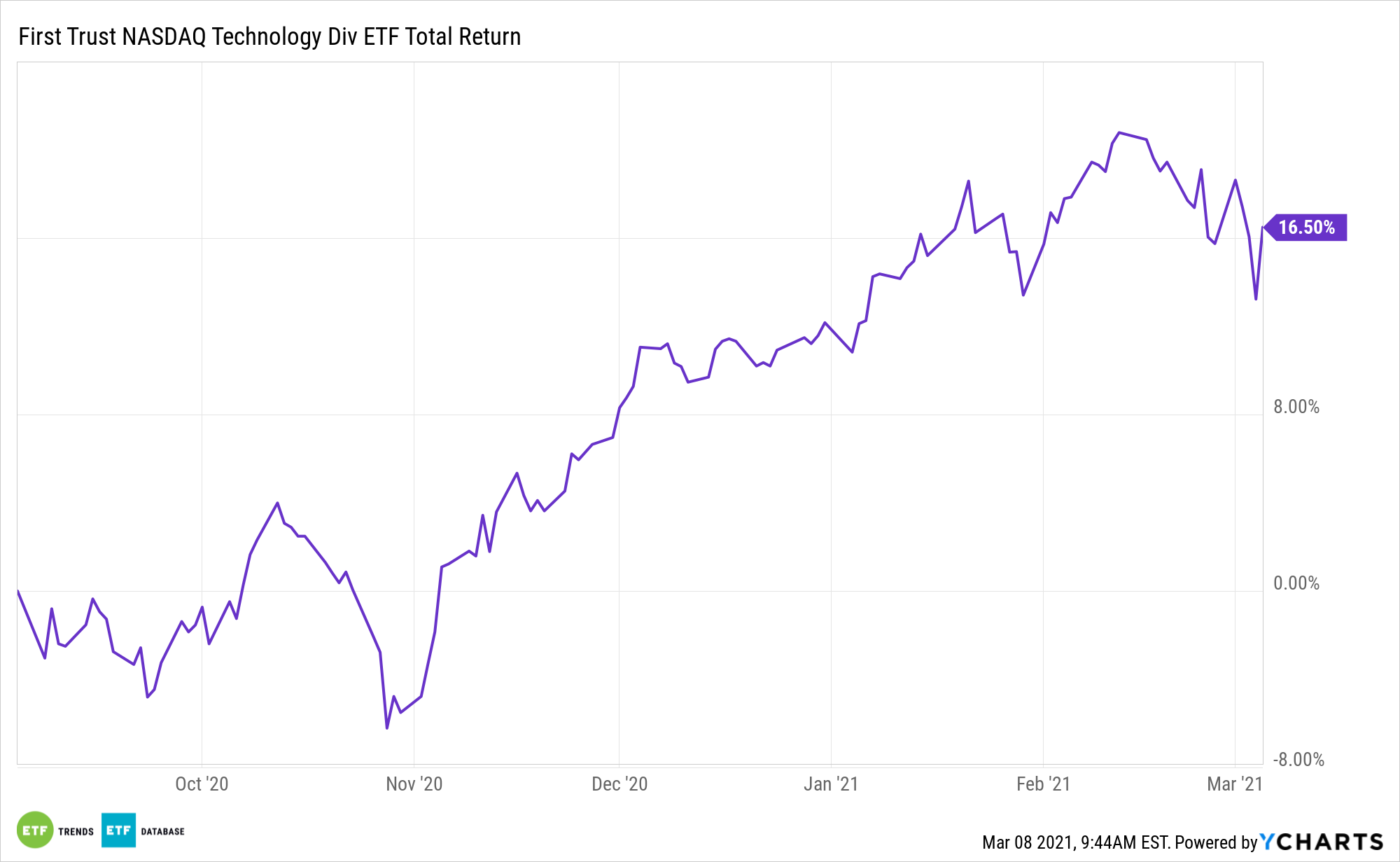

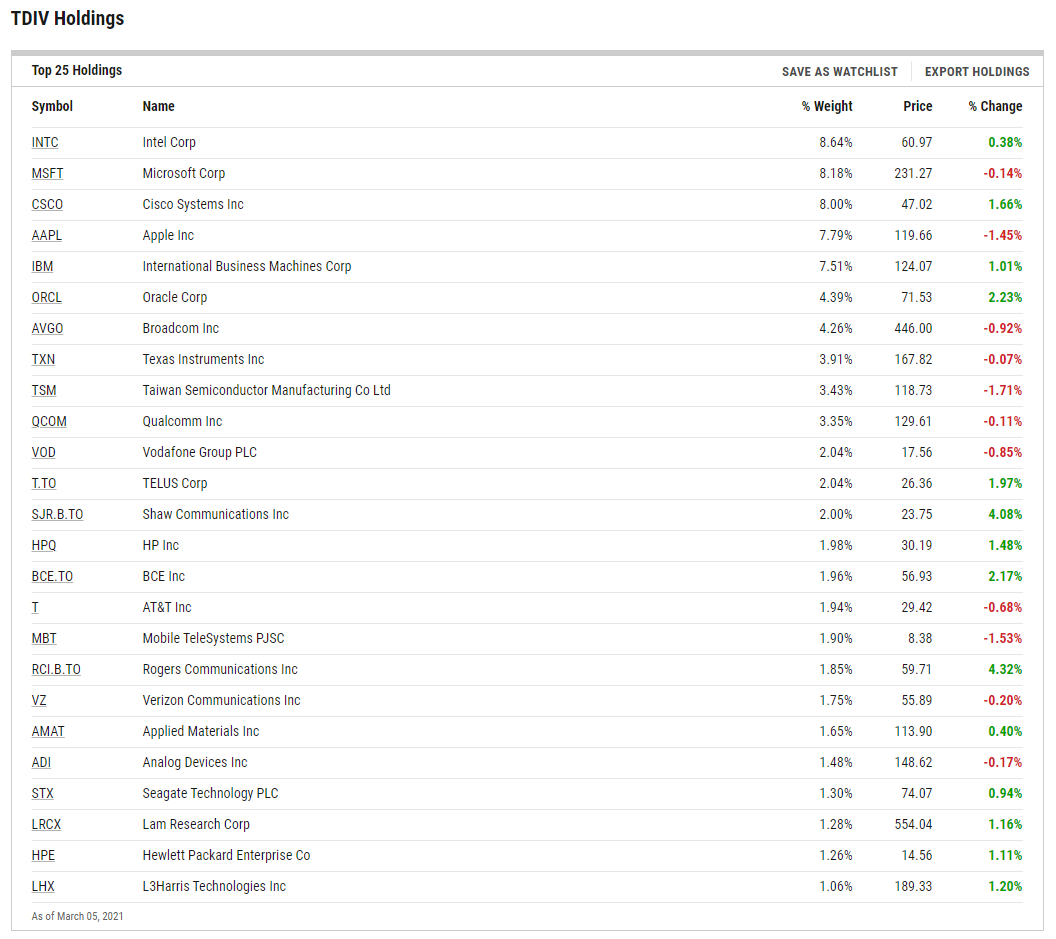

Those positive traits highlight the case for the First Trust NASDAQ Technology Dividend Index Fund (NasdaqGS: TDIV). TDIV tracks the NASDAQ Technology Dividend Index.

Recent data confirm that the technology sector is an increasingly prominent part of the dividend growth landscape.

“Technology stocks have steadily increased their contribution to the overall dividends paid out by S&P 500 companies, reflecting their impressive growth and increasingly crucial position as a linchpin of the global economy,” reports Lawrence Strauss for Barron’s. “At the end of March 2018, the tech sector accounted for about 15% of the dividends paid by the companies in that index, according to S&P 500 Dow Jones Indices. Two and half years later, at the end of last year’s third quarter, it had risen to 18.4%.”

Is TDIV the Right Income Idea for Quality Growth?

For years, technology was the not first sector investors thought of when they thought of dividends. The largest sector weight in the S&P 500 is changing that and that change has been a boon for an array of exchange traded funds. In fact, in dollar terms, technology is now the largest dividend-paying sector in the United States.

While yields are low across many sectors, including tech, TDIV is relevant for income investors because it’s home to a group of companies with large cash stockpiles that can sustain and grow payouts.

“As the Tech industry matures, more companies are consistently paying out dividends,” said S&P Dow Jones. “Adjusting the dividend policy to accommodate newer Tech names enables the index to gain more income from these companies.”

The defensive sector tends to include consumer staples, healthcare, real estate and utilities. Technology sector ETFs such as TDIV are widely viewed as economically sensitive plays, not defensive ones.

“Looked at another way, S&P 500 tech dividends are punching below their weight. They accounted for 18% of the total paid out in last year’s third quarter, more than any other sector. However, the tech sector accounts for about 27% of the S&P 500’s market capitalization, according to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices,” reports Barron’s.

TDIV screens for technology names that have paid a regular or common dividend within the past 12 months, have a yield of at least 0.5%, and have not had a decrease in common dividends per share paid within the past 12 months.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.