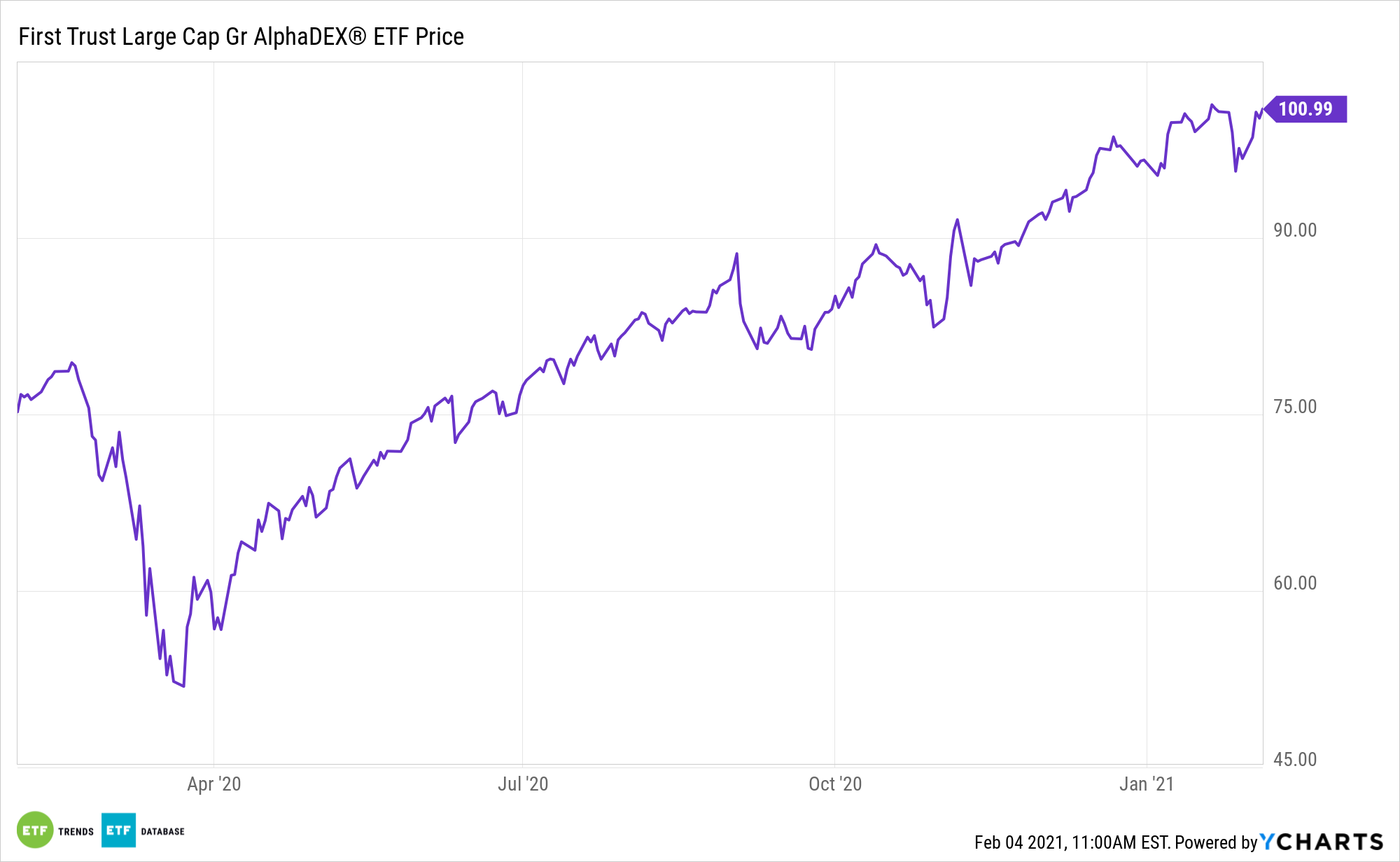

Cyclical and value stocks are generating some buzz, but the growth factor is still in fashion. With that in mind, the First Trust Large Cap Growth AlphaDEX Fund (NASDAQ: FTC) is a strong exchange traded fund to consider.

The $1.08 billion FTC, which turns 14 years old in May, tracks the NASDAQ AlphaDEX Large Cap Growth Index, a unique avenue to growth equities.

The index is built “by ranking the eligible stocks from the NASDAQ US 500 Large Cap Growth Index on growth factors including 3-, 6- and 12- month price appreciation, sales to price and one year sales growth, and separately on value factors including book value to price, cash flow to price and return on assets. All stocks are ranked on the sum of ranks for the growth factors and, separately, all stocks are ranked on the sum of ranks for the value factors. A stock must have data for all growth and/or value factors to receive a rank for that style,” according to First Trust.

Picking Apart the Fantastic FTC ETF

Growth stocks are often associated with high-quality, prosperous companies whose earnings are expected to continue increasing at an above-average rate relative to the market. Growth stocks generally have high price-to-earnings (P/E) ratios and high price-to-book ratios. Still, data suggest the growth/value premium isn’t overly elevated relative to historical norms.

Adding to FTC’s allure are sector-level changes hastened by the coronavirus pandemic.

“Some growth businesses may be permanently accelerated by COVID, but for others, the 2020 bump was a temporary pull-forward of demand,” according to BlackRock research. “Meanwhile, cyclical value stocks, those with ties to economic growth and low valuations, have been most depressed and should enjoy a larger bounce with market and economic recoveries. A look back also shows that value historically has outperformed in the early stages of a recovery.”

Growth stocks may be seen as exorbitant and overvalued, causing some investors to favor value stocks, which are considered undervalued by the market. Value stocks tend to trade at a lower price relative to their fundamentals (including dividends, earnings, and sales). While they generally have solid fundamentals, value stocks may have lost popularity in the market and are considered bargain priced compared with their competitors.

“Notwithstanding our outlook for a value resurgence, we see good reason to stick with stocks with dominant and emerging business models that can continue to deliver for shareholders. Sectors like technology and healthcare contain many high-quality businesses with the ability to compound growth across time,” concludes BlackRock.

Technology and healthcare are FTC’s two largest sector allocations, combining for about 61.5% of the fund’s weight.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.