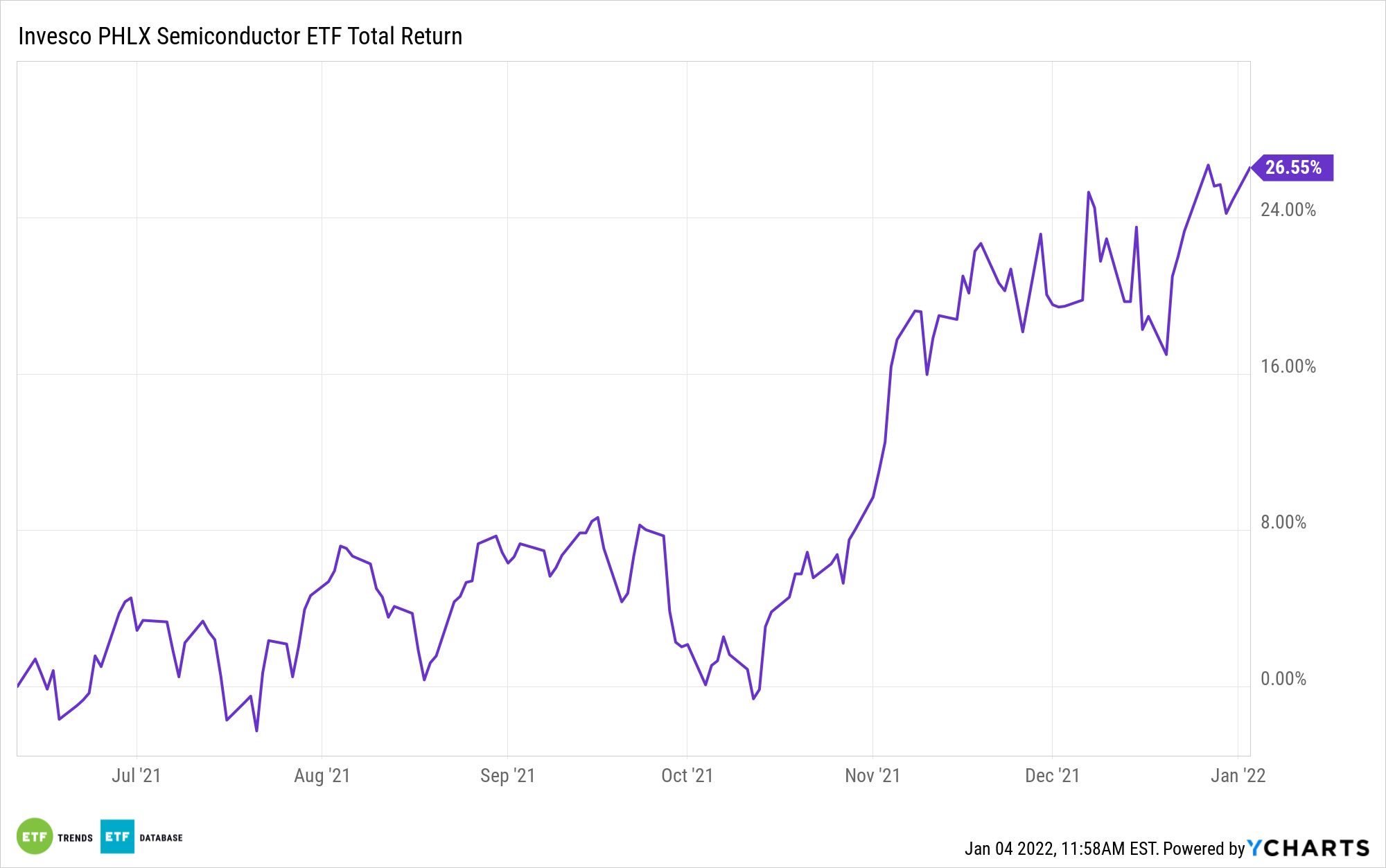

The semiconductor industry sizzled in terms of equity performance in 2021, and while some market observers are betting last year’s returns won’t be replicated, that doesn’t mean there isn’t upside there for the taking.

Actually, the outlook for global chip sales this year, even when accounting for the potential easing of supply chain woes, is attractive. That’s good news for exchange traded funds, including the Invesco PHLX Semiconductor ETF (SOXQ).

SOXQ, which follows the PHLX SOX Semiconductor Sector Index, debuted last June. Despite its late start, the Invesco ETF returned about 21.5% in less than six months of work, underscoring widespread strength among chip equities last year.

Analysts at Euler Hermes are forecasting 9% growth in global semiconductor sales this year, taking the industry above the $600 billion mark for the first time. That’s on top of 26% growth last year.

“A months-long semiconductor shortage during the pandemic impacted a wide-range of industries — from automobiles to gaming consoles — as chipmakers struggled to keep up with unprecedented demand as global economic activity bounced back from the Covid crisis,” reports Eustance Huang for CNBC.

Reaching another year of record revenue is an objective that will be helped by easing supply chain issues. Taiwan Semiconductor (NYSE:TSM), operator of the world’s largest chip foundry, plays a key role in that equation. The company, which accounts for nearly 4% of the SOXQ roster, is expanding capacity to meet surging demand.

Multiple factors, including soaring demand for consumer electronics chips, highlight Taiwan Semiconductor’s motivation to boost capacity.

Other factors include “An increase in prices due to tight supply and demand dynamics” and “further improvement in product mix for semiconductors as a result of higher priced and new generation chips being introduced,” according to CNBC.

Key to the SOXQ outlook for 2022 is to what extent Advanced Micro Devices (NASDAQ:AMD) and Nvidia (NASDAQ:NVDA) build on 2021 showings. Those companies are at the heart of data center, gaming, and crypto chip demand and combine for 14% of SOXQ’s weight.

Another SOXQ member firm to keep an eye on is Marvell Technology Inc. (NASDAQ:MRVL), which heads into 2022 as one of Wall Street’s preferred chip ideas.

“With about 80% of revenue rooted in cloud, enterprise, and communications infrastructure, we expect the stock’s valuation premium to hold and for the company to grow revenues and expand profits at a healthy clip into its multiple,” said Goldman Sachs’ Toshiya Hari about Marvell in a recent note to clients.

For more news, information, and strategy, visit the Nasdaq Investment Intelligence Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.