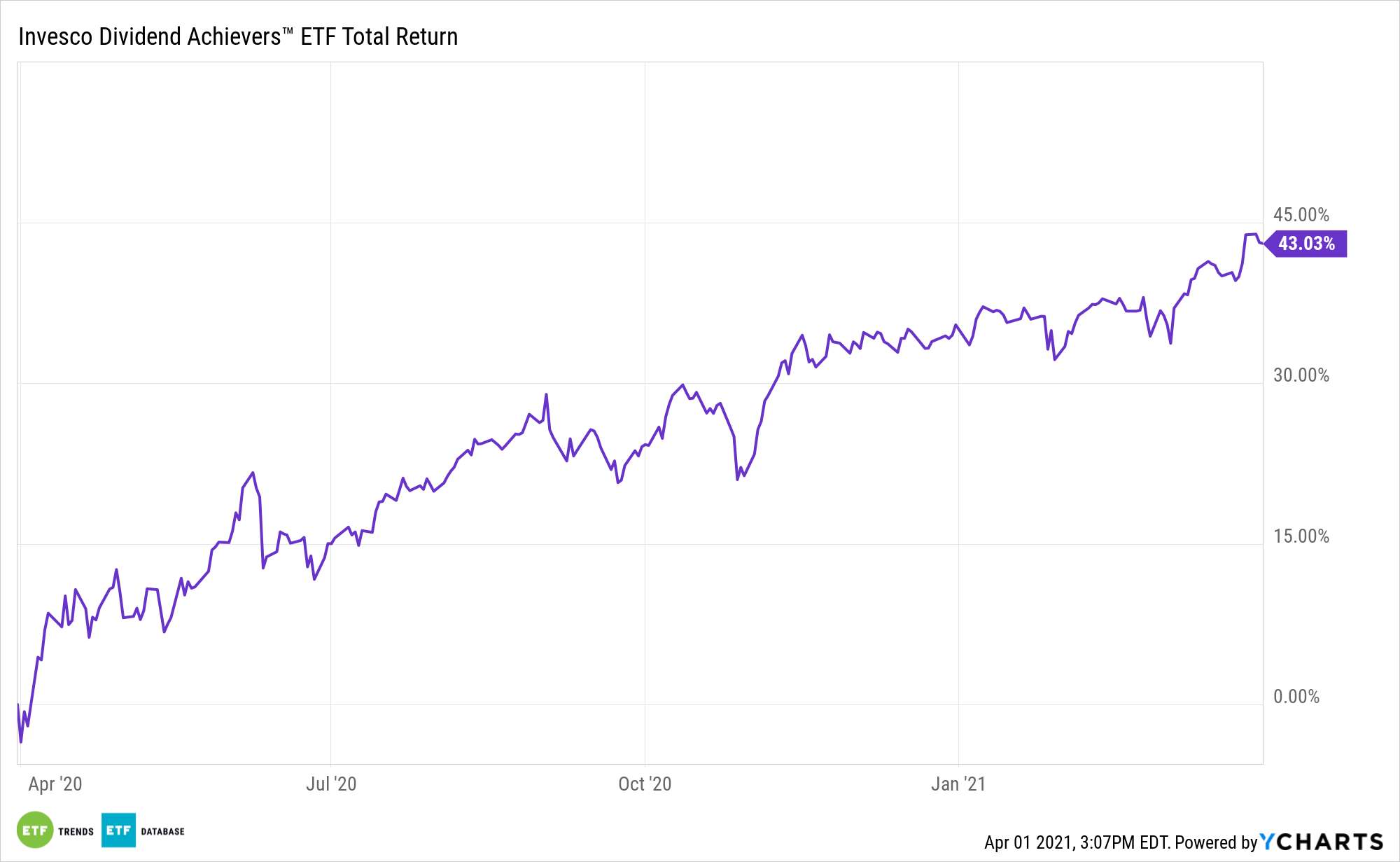

Dividend stocks are coming back into style, highlighting the benefits of exchange traded funds like the Invesco Dividend Achievers ETF (NASDAQ: PFM).

PFM tracks the NASDAQ US Broad Dividend Achievers. That benchmark requires member firms to have dividend increase streaks of at least 10 years. In other words, PFM is very much a quality strategy, and one that’s durable over the long haul.

Dividend stocks are always relevant, but some of their luster was lost last year with a wave of cuts and suspensions amid the onset of the coronavirus pandemic. With interest rates low and dividend growth improving, payouts are taking on renewed importance for income-starved clients.

Due to its emphasis on payout growth rather than high yields, PFM is a safe idea for investors looking to revisit dividend stocks over the near-term.

PFM: The Right Call for Consistency, Quality

The ETF’s emphasis on dividend growers is particularly relevant in today’s market environment. Dividend-growing companies are also high quality names. Steady dividend payouts have also helped produce improved risked-adjusted returns over time.

PFM emphasizes quality and dividend sustainability, traits that are meaningful in any climate. Investors should consider quality dividend growth stocks that typically exhibit stable earnings, solid fundamentals, strong histories of profit and growth, commitment to shareholders, and management team conviction in their businesses.

Dividend “growers typically don’t boast burly yields like yielders do, though they have their advantages. Notably, companies that regularly boost their dividends are usually profitable and financially healthy,” writes Morningstar analyst Susan Dziubinski.

PFM has another advantage: inflation-fighting potential. Dividend growth as a means of trumping inflation could and arguably should serve to highlight the advantages of the ETFs that focus on dividend growth stocks. That group is comprised of well-established ETFs that emphasize dividend increase streaks as well as a new breed of funds that look for sectors chock-full of stocks that have the potential to be future sources of dividend growth.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.