The rise of e-commerce and internet activity isn’t a strictly American theme. China and other developing markets prove as much, accessible to investors with ETFS like the Global X Emerging Markets Internet & E-Commerce ETF (NASDAQ: EWEB).

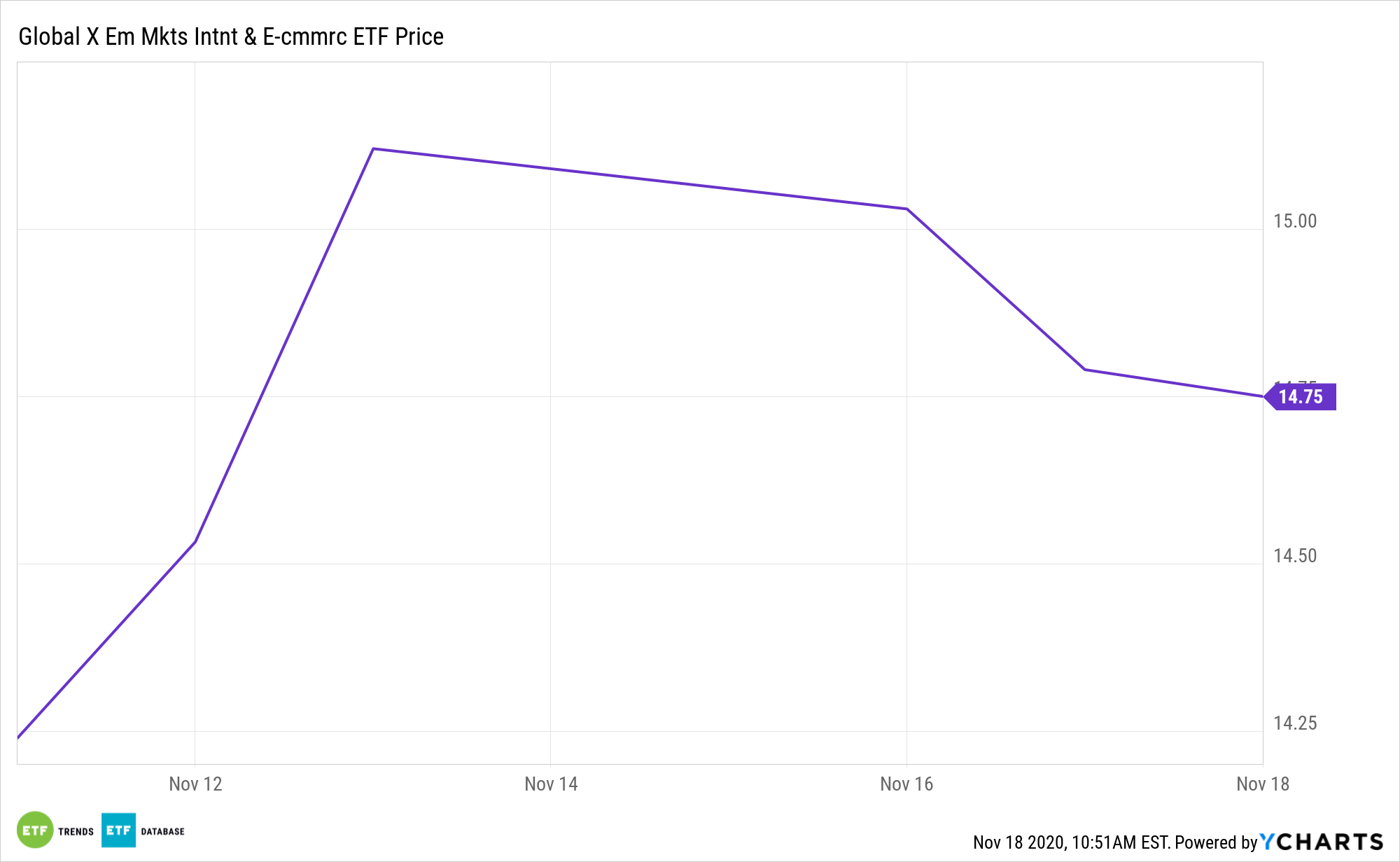

EWEB, which debuted last week, tracks the Nasdaq CTA Emerging Markets Internet & E-commerce Net Total Return Index and holds nearly 50 stocks. For a variety of reasons, EWEB could prove to be one of 2020’s more well-timed ETF launches.

Emerging markets offer investors favorable demographics that continue to support consumption-based growth. Specifically, 85% of the global population resides in developing economies, accounting for over 50% of global GDP.

“With the long term slowing of economic growth in developed markets, emerging markets are driving the majority of global economic growth,” writes Global X analyst Chelsea Rodstrom. “Much of this growth is attributable to EM’s expanding middle class; a powerful generation of consumers whose new spending habits and internet connectivity are giving rise to quickly growing industries. Nowhere is this more evident than within the internet and e-commerce industry, where EM companies are becoming global innovators in markets ripe for disruption and long term growth.”

EWEB Weightings Banking on Growing Middle Class

As a split internet/retail ETF, EWEB devotes over 93% of its weight to the consumer cyclical and communication services sectors. EWEB has eight geographic exposures with China looming large at an allocation of 74%. There are strong fundamentals backstopping this new ETF.

Looking ahead, middle-income consumers will likely take on a greater role in the emerging economies. According to McKinsey & Co. projections, there will be an expected 4.2 billion people among the consuming class by 2025, with emerging markets making up $30 trillion in consumption to developed markets’ $34 trillion.

GDP data are also supportive of the EWEB thesis.

“EMs are not only growing faster than developed economies but are becoming major global economies in their own right,” notes Rodstrom. “In the mid-1990s, EMs began outpacing Developed Markets (DMs) in terms of real GDP growth, and with the exception of 1998, have continued growing faster than DMs since. Likewise, China and India are now among the top 5 largest economies globally by GDP, while Brazil is the 9th and Russia is the 11th largest economy in the world.”

EWEB charges 0.65% per year, or $65 on a $10,000 investment.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.