Many investors may think of direct sector participation as the antithesis of diversification. After all, a dedicated sector exchange traded fund, such as the Invesco DWA Utilities Momentum Portfolio (NASDAQ: PUI) only features stocks from the underlying sector.

However, at a time when elevated correlations are increasingly prominent, sector exposure in concert with broad market exposure can be advantageous to investors. There are a surprising diversification benefits in utilities.

“While no U.S. market sector offered true protection from the brief but severe market downturn in the first quarter of 2020, utilities have experienced the lowest performance correlation of any sector with the broad U.S. stock market in recent years,” writes Morningstar’s Christine Benz. “Nearly every other single sector has become more closely correlated with the U.S. stock market, and with other market sectors as well.”

The Correlations Matter

To be sure, PUI and utilities stocks weren’t perfect last year. The sector showed some vulnerability as power demand plunged due to office and store closures and shelter-in-place directives forced by the coronavirus pandemic.

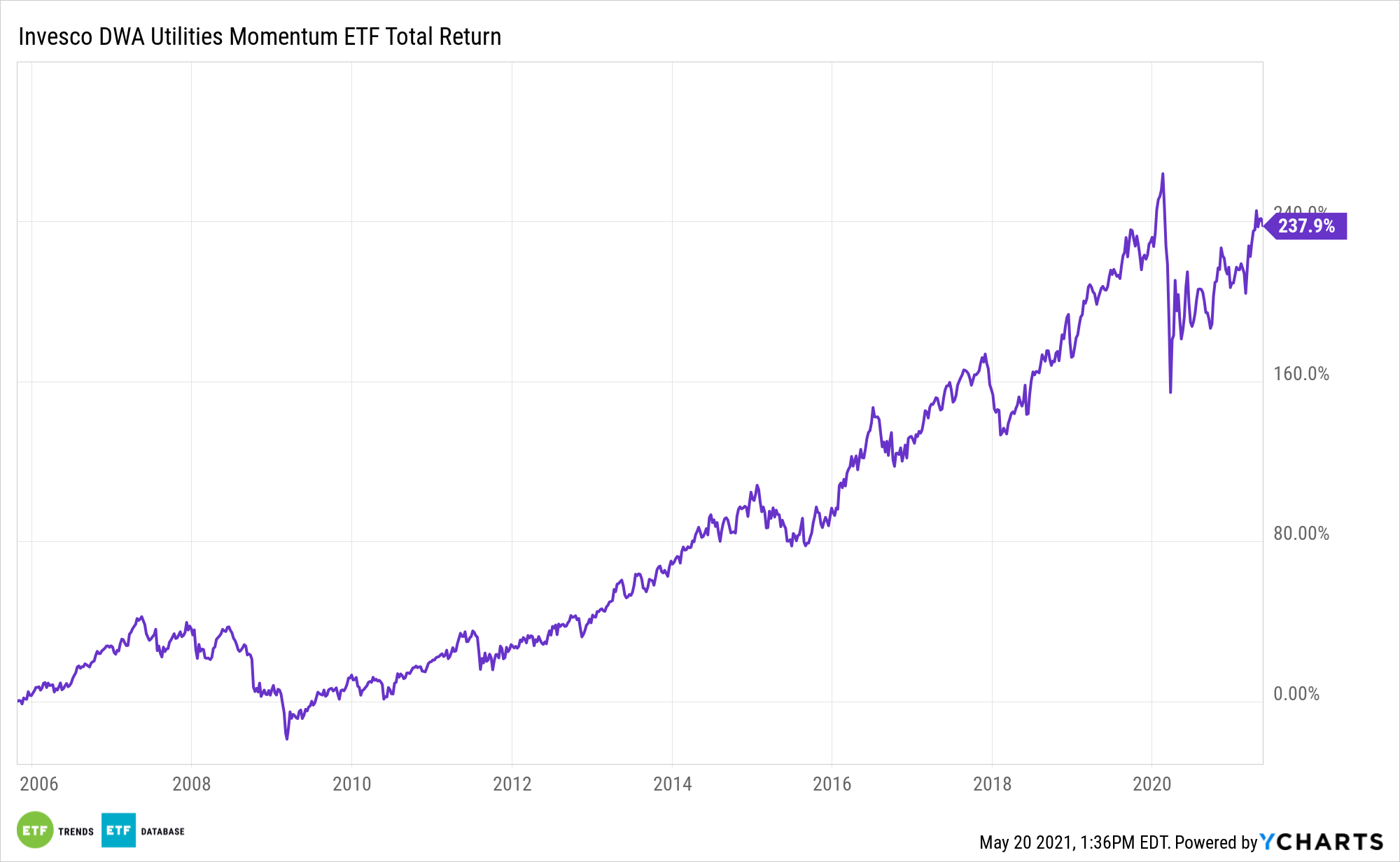

After bottoming in March 2020, stocks subsequently rebounded in epic fashion, but that rally favored higher beta fare and growth sectors, leaving defensive utilities behind. PUI dipped 5% last year, though it’s finding some strength in 2021 as it’s higher by 7.6% as of May 18. The primary benefit of utilities exposure in 2020, in addition to above-average dividend yield, was below-average correlation.

Last year, “utilities performed more differently from the broad U.S. market than any other single sector. The sector’s correlation with the broad market, while still positive, was 0.60, by far the lowest of all of the sectors,” adds Benz.

A viable consideration with PUI and utilities in general is that the sector accounts for just 2.61% of the S&P 500 – the index’s second-smallest sector weight ahead of only real estate. However, historical data indicate the other GICS sectors are usually highly correlated to the broader market.

“Utilities have exhibited the most different performance pattern of any of the sectors,” according to Benz. “That, combined with utilities’ above-market yields and the fact that broad-market indexes typically allocate just a tiny slice to them, suggest that investors seeking diversification and income could reasonably add a small additional allocation to the sector.”

Beyond diversification, PUI offers another benefit – one not found with rival cap-weighted strategies. The Invesco ETF tracks the DWA Utilities Technical Leaders Index, which is rooted in a relative strength methodology. That could position investors for more upside than is available with traditional utilities funds.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.