Financial services stocks are among the best-performing groups in the U.S. this year. The tricky part of that is their relatively low yields.

Investors can enhance the financial services income proposition with the Invesco KBW High Dividend Yield Financial Portfolio (NASDAQ: KBWD). KBWD tracks the KBW Nasdaq Financial Sector Dividend Yield Index.

“The Fund generally will invest at least 90% of its total assets in the securities of publicly listed financial companies with competitive dividend yields, in the United States and that comprise the Underlying Index,” according to Invesco.

KBWD’s dividend yield of 8.21% is obviously eye-catching, but the fund offers other benefits. That yield is high because KBWD’s lineup is diverse relative to traditional, lower yielding financial services ETFs. Rather than relying solely on banks and brokers, KBWD also features insurance providers, asset managers, mortgage real estate investment trusts (mREITs), and business development companies (BDCs).

KBWD Perks

BDCs are comprised of companies that fund small- to mid-sized private companies, which are usually rated below investment grade or not rated at all – these companies would find it harder to acquire traditional means of loans, so they turn to outside sources of capital. Since the financial crisis, regulators have clamped down on traditional lenders, making it harder for many businesses to access public capital.

Mortgage REITs have exhibited a negative correlation to interest rates changes, especially if the yield curve flattens. Many agencies use leverage to capitalize on the arbitrage spread between short- and long-term interest rates, so companies can still make money in a rising rate environment, as long as long-term rates rise faster than the short-term rate or the yield curve steepens.

In the current low-yield environment, KBWD is the perfect opportunity for fixed income investors to diversify their portfolios and chase higher yields

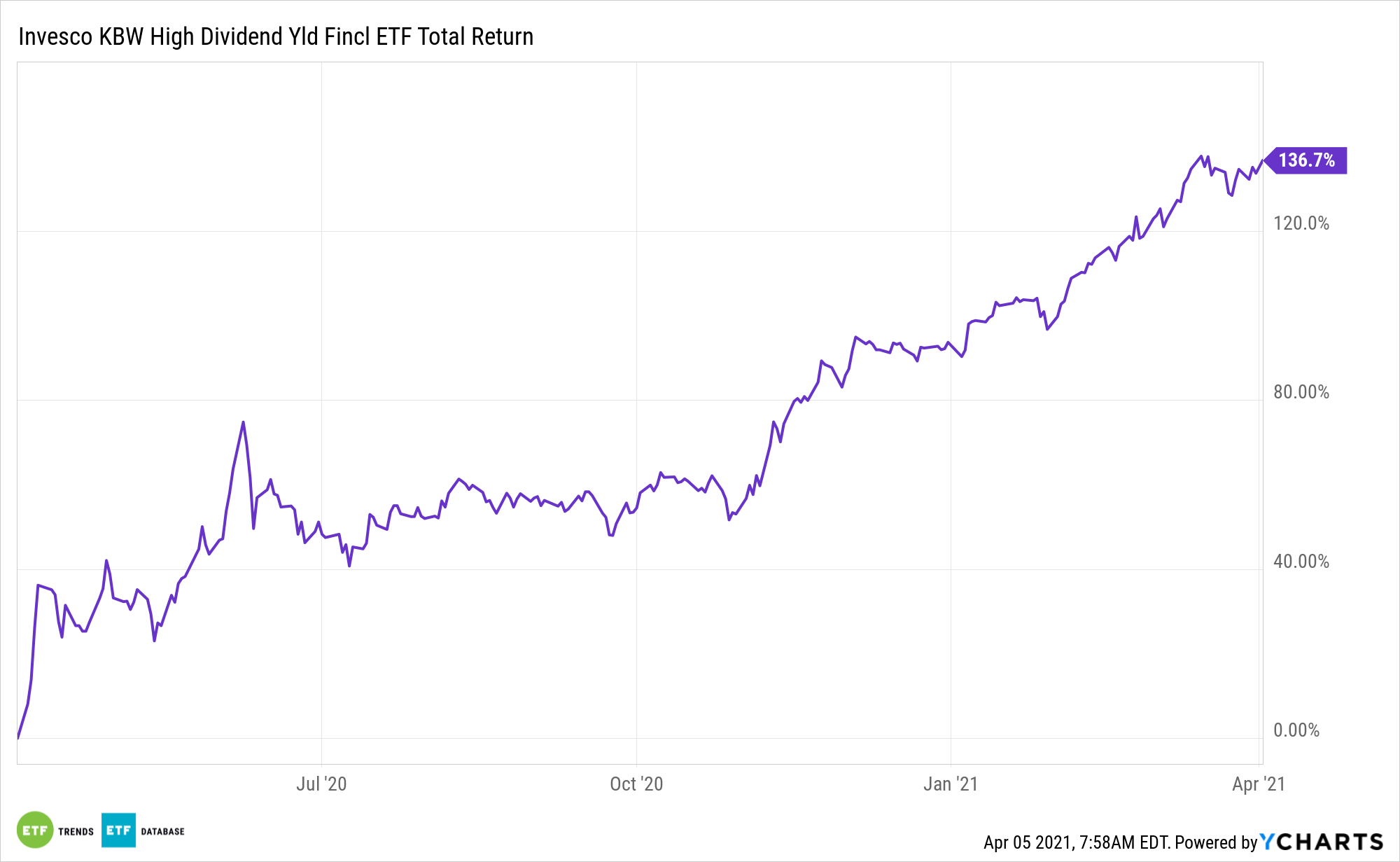

Another important benefit offered by KBWD is that because the fund isn’t reliant on, say, traditional bank stocks, to drive income and performance, it can reduce correlations within a portfolio because many of its holdings are classified as alternative asset or fixed income instruments. Reducing correlations is usually a long-term positive for investors and it doesn’t mean leaving returns on the table, as highlighted by KBWD’s 22.23% year-to-date gain.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.