Markets continue to be choppy as they are pushed up by increasingly hopeful news regarding the severity of Omicron and then back down again as the job market continues to tighten and put greater inflationary pressures on the economy. It can be difficult to find fixed-income opportunities, but Strategy Shares has a unique, targeted ETF that aims to provide a 7% distribution annually.

Advisors and investors seeking fixed income with a targeted annualized distribution rate distributed monthly should consider the Strategy Shares Nasdaq 7HANDL Index ETF (HNDL). The fund is the first-of-its-kind within the ETF space to seek the yield performance and price of the Nasdaq 7HANDL Index.

The underlying index is broadly diversified and divided evenly between fixed income and equity ETFs that make up 50% and a “Dorsey Wright Explore Portfolio” that makes up the other 50%.

The first half of the fund is subdivided into a 70% allocation to U.S. fixed-income ETFs (the core fixed income sleeve) and 30% to U.S. large cap equities (the core equity sleeve). The core fixed-income sleeve is made up of an equal weight of the three U.S. aggregate bond ETFs that have the lowest expense ratios after waivers. The core equity sleeve is split further, with half containing the three U.S. large cap ETFs that have the lowest expense ratios after waiver and equal weights them; the other half is made up of the largest ETF that tracks the Nasdaq-100 Index.

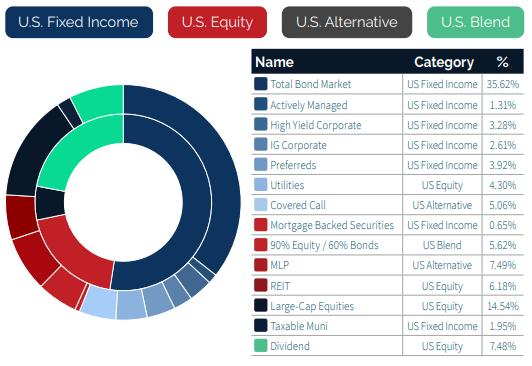

The second half of the fund, known as the Explore Portfolio portion, is comprised of allocations within U.S. specific equity, blend, fixed-income and alternative assets, or else categories that have a history of providing high-income levels. This portion of the fund utilizes a “100% rules-based, proprietary, momentum-tilted, optimized allocation methodology” per the prospectus. It is comprised of 12 different categories, with a single ETF representing each that is typically the largest ETF within that asset category.

Image Source: Strategy Shares as of September 30, 2021

The index seeks to offer stability within its net asset value and offers leverage that equates to 23% of the portfolio, but the fund itself will be subject to market movements and conditions. To achieve leveraged returns, HNDL purchases a total return swap on a securities-only version of the index, known as the Nasdaq HANDL Base Index. This index is made up solely of ETFs and has no leverage itself.

The fund is unique in its approach in that within an index of 19 ETFs, over 20,000 individual securities are represented within the underlying holdings.

HNDL has a monthly distribution policy on fund shares that equate to a 7.0% annualized payout on the fund’s per-share net asset value. Some or all of the distribution can be a return of capital from the original investment, and distributions can be modified at any time.

HNDL carries a contractually agreed expense ratio of 0.80% that ends on August 31, 2022.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.