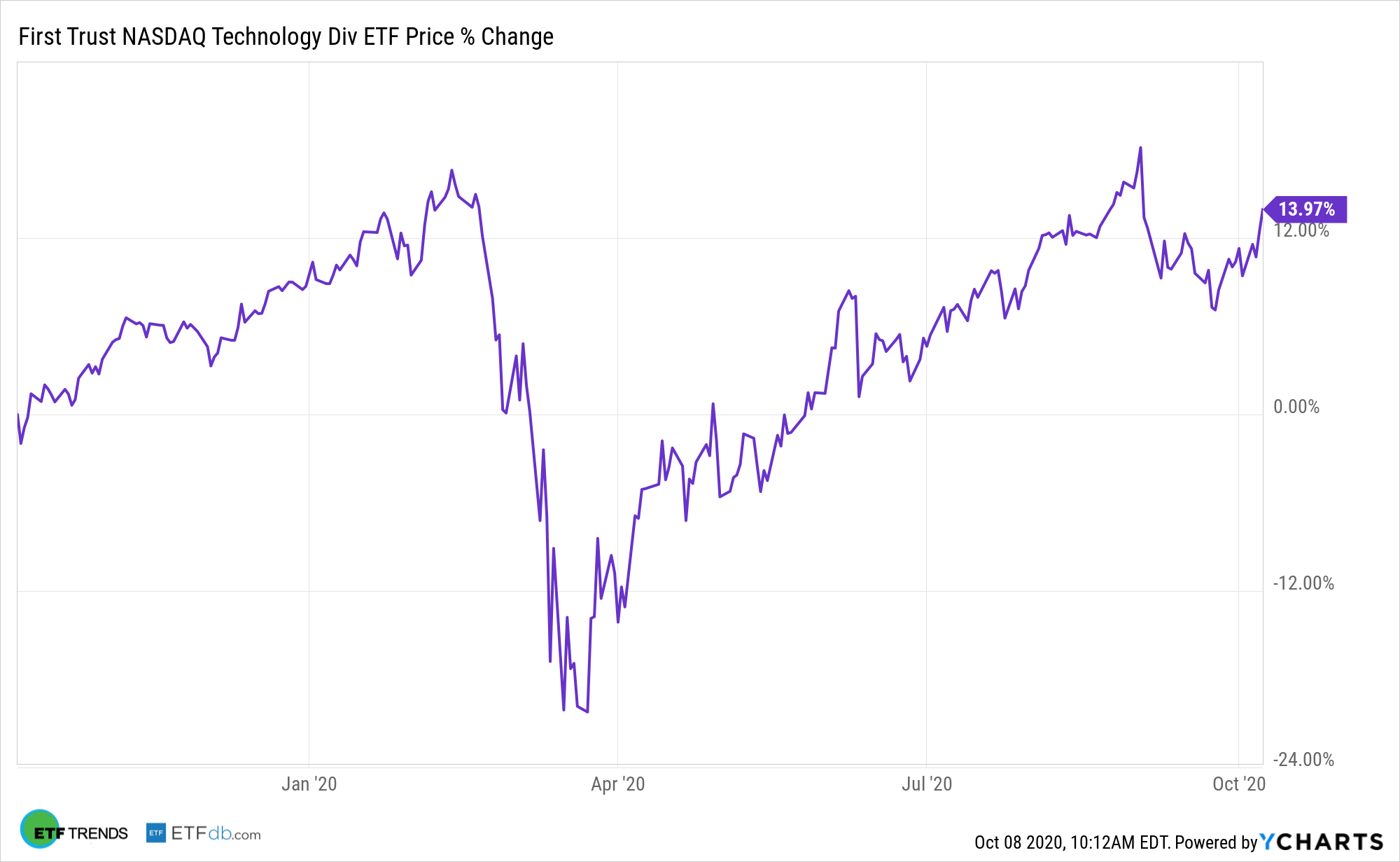

Broadly speaking, technology is still a low-yield sector. Its members in the S&P 500 yield just 1% on average, but the group is home to reliable dividend growth, which is accessible with some exchange traded funds, including the First Trust NASDAQ Technology Dividend Index Fund (NasdaqGS: TDIV).

TDIV tracks the NASDAQ Technology Dividend Index and allocates nearly 20% of its combined weight to tech behemoths Apple Inc. (AAPL) and Microsoft Corp. (MSFT). Those are two of the most well-known, steady dividend growers in the tech sector, but other TDIV components are helping the cause, too.

That includes “Texas Instruments (TXN), which in mid-September said it would boost its quarterly payout by 13%, to $1.02 a share from 90 cents. The chip maker’s stock yields 2.9%. It’s up about 12% year to date, dividends included,” reports Lawrence Strauss for Barron’s.

TDIV Offers Dependability

For years, technology was the not first sector investors thought of when they thought of dividends. The largest sector weight in the S&P 500 is changing that and that change has been a boon for an array of ETFs. In fact, in dollar terms, technology is now the largest dividend-paying sector in the U.S.

Dow component International Business Machines (NYSE: IBM) is one of the higher yielding names in the TDIV portfolio at 5.4%.

“The company earned $2.18 a share in the second quarter, nine cents better than the consensus, according to FactSet. However, as Barron’s pointed out, while the cloud computing business was strong, other businesses weakened, including IBM’s consulting operation,” according to Barron’s.

TDIV screens for technology names that have paid a regular or common dividend within the past 12 months, have a yield of at least 0.5% and have not had a decrease in common dividends per share paid within the past 12 months.

“The two best year-to-date performers among these six tech companies are Qualcomm (QCOM) and Broadcom (AVGO). The shares of these two chip companies are up about 34% and 17%, respectively, including dividends,” according to Barron’s.

Those two semiconductor names combine for about 8.5% of TDIV’s roster. The First Trust ETF, which has $1.23 billion in assets under management, has a 12-month distribution north of 2%.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.