The universe of renewable energy exchange traded funds expanded rapidly in recent years as investors prioritized clean tech and climate-aware strategies.

With that expansion comes more choice, which is always a positive, but investors also need to recognize that not all renewable energy ETFs are cut from the same cloth. Another point worth remembering is that some of the seasoned funds in this category are still relevant.

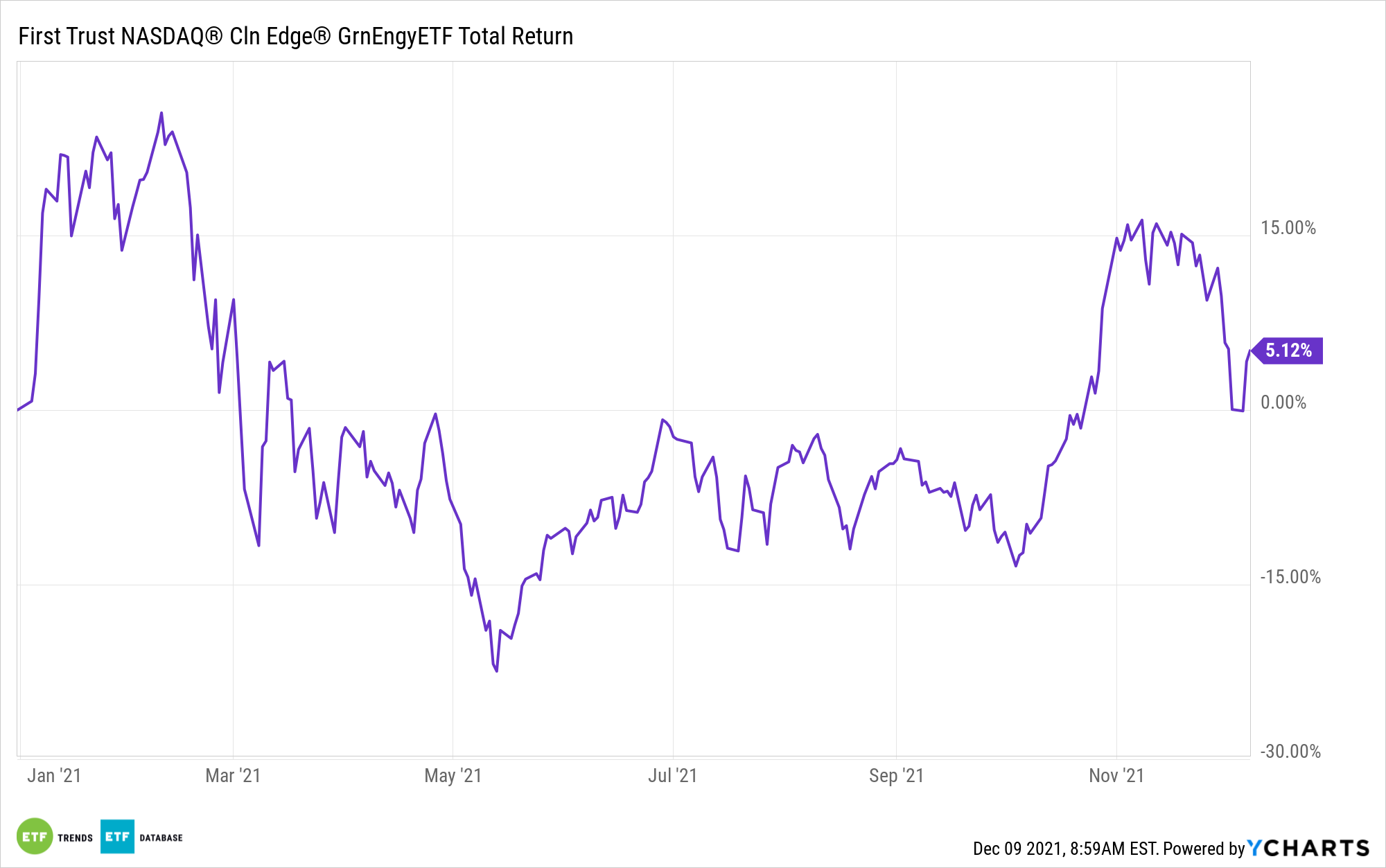

That group includes the First Trust NASDAQ Clean Edge Green Energy Index Fund (NasdaqGM: QCLN). QCLN follows the NASDAQ® Clean Edge® Green Energy Index and is one of this category’s largest constituents. It’s also one of the oldest, as it’s just two months shy of its 15th birthday. More importantly, it offers investors a pure approach to renewable energy and clean technology.

“There are many different definitions of clean energy. The definitions employed by clean energy indexes can vary widely. Some only include clean energy providers. Some get granular and focus on a single source of renewable energy, such as solar or wind. Others are more expansive and include ancillary businesses that indirectly profit from the clean energy transition,” says Morningstar analyst Lan Anh Tran.

QCLN holds 61 stocks, good for one of the broader lineups in the category. The Nasdaq Clean Edge Green Energy Index mandates that member firms derive at least half their sales from advanced materials, energy storage, energy intelligence, or renewable power generation. Bottom line: QCLN delivers on renewable exposure in a straightforward, pure way, helping investors avoid confusion and disappointment.

“There are many different definitions of clean energy. The definitions employed by clean energy indexes can vary widely. Some only include clean energy providers. Some get granular and focus on a single source of renewable energy, such as solar or wind. Others are more expansive and include ancillary businesses that indirectly profit from the clean energy transition,” adds Tran.

On that note, it’s worth acknowledging that among the largest renewable energy ETFs, QCLN features one of the largest carbon reduction footprints with one of the smallest exposures to fossil fuels. None of QCLN’s top 10 holdings are engaged in fossil fuels in any way, while seven of those 10 stocks generate at least half their revenue from carbon solutions. That keeps QCLN from behaving like a traditional energy ETF.

“Unsurprisingly, these funds’ performance does not track closely with a broad energy benchmark. Their correlation to the Morningstar Global Energy and Morningstar U.S. Energy indexes ranged between 0.50 and 0.60 over the trailing three years ending October 2021,” concludes Tran.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.