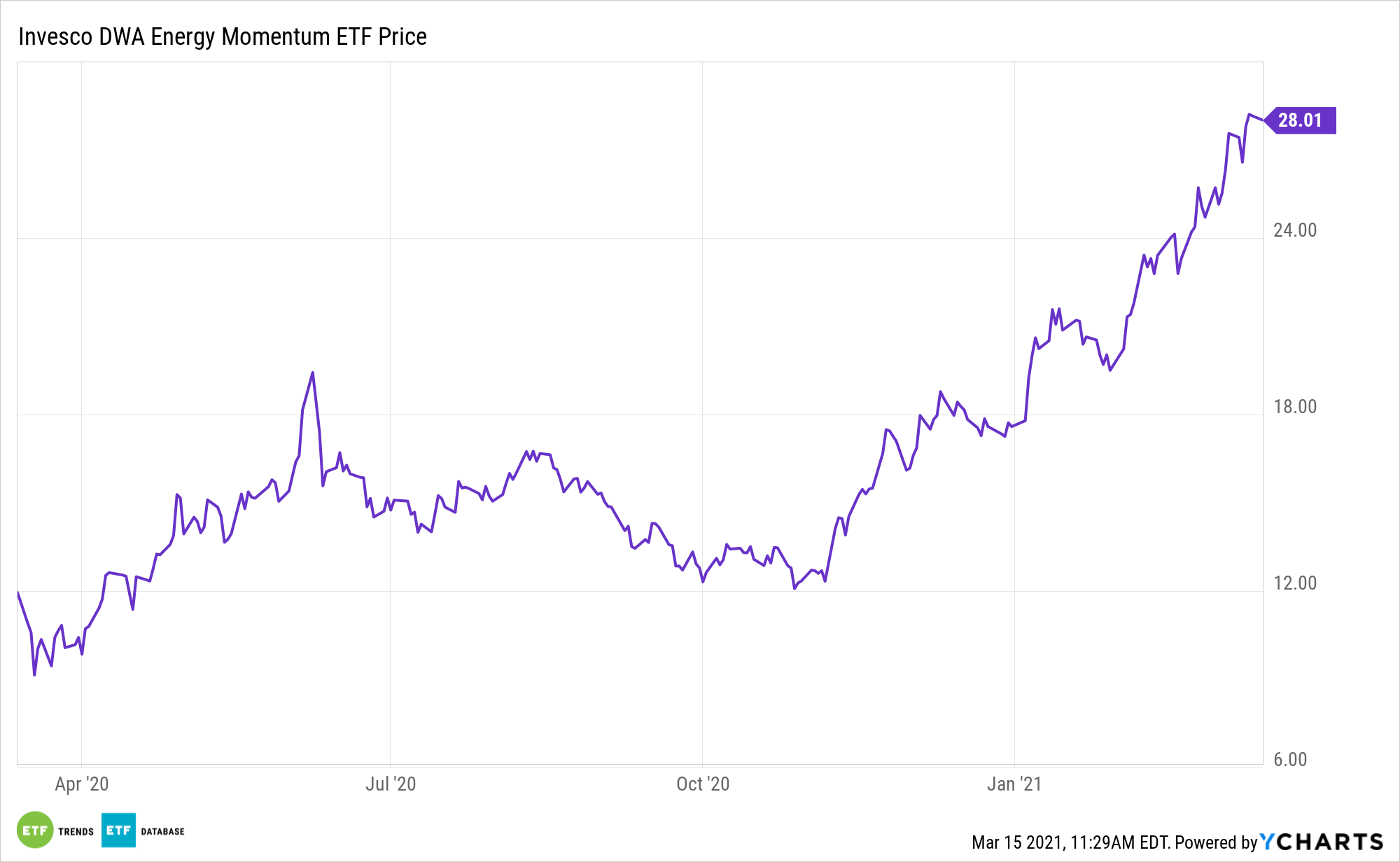

With energy ranking as the best-performing sector to start 2021, some investors are considering momentum as a way of accessing the high-flying group. The Invesco DWA Energy Momentum ETF (PXI) is one stellar option.

PXI seeks to track the investment results of the Dorsey Wright® Energy Technical Leaders Index. The underlying index is composed of at least 30 securities of companies in the energy sector that have powerful relative strength or ‘momentum’ characteristics.

Using the relative strength index, investors can identify areas with positive forward momentum. Relative strength measures a stock’s performance in relation to its peers.

A rosier outlook for economic growth and oil demand could fuel gains in energy sector-related exchange traded funds this year.

According to the Organization of Petroleum Exporting Countries’ recent monthly report, the global oil demand forecast was upwardly revised by as much as 200,000 barrels a day, the Wall Street Journal reports.

The oil cartel pointed to the newest $1.9 trillion fiscal stimulus bill in the United States and “the continuing recovery in Asian economies” for its improved outlook on the economy and oil markets.

More Catalysts for ‘PXI’

“Sustained higher oil prices likely will encourage U.S. producers to increase production this year, which could eventually weigh on prices, J.P. Morgan analysts say, now forecasting U.S. crude output to exit 2021 averaging 11.78M bbl/day, 710K bbl/day more than a year earlier,” reports Seeking Alpha.

PXI has plenty of other tailwinds for investors to consider.

“At current prices, most U.S. onshore operators are economic, leaving a vast group of operators, from large public companies to private players, in good position to ramp up activity in H2 and build solid momentum for higher volumes in 2022,” according to JPMorgan.

PXI has another feather in its cap: clean energy exposure. Looking at PXI’s top holdings, two of the top five operate in the clean energy space, which is only seeing more strength under newly installed U.S. President Joe Biden. Biden’s push for clean energy initiatives is expected to grow the clean energy sector even more during his administration.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.