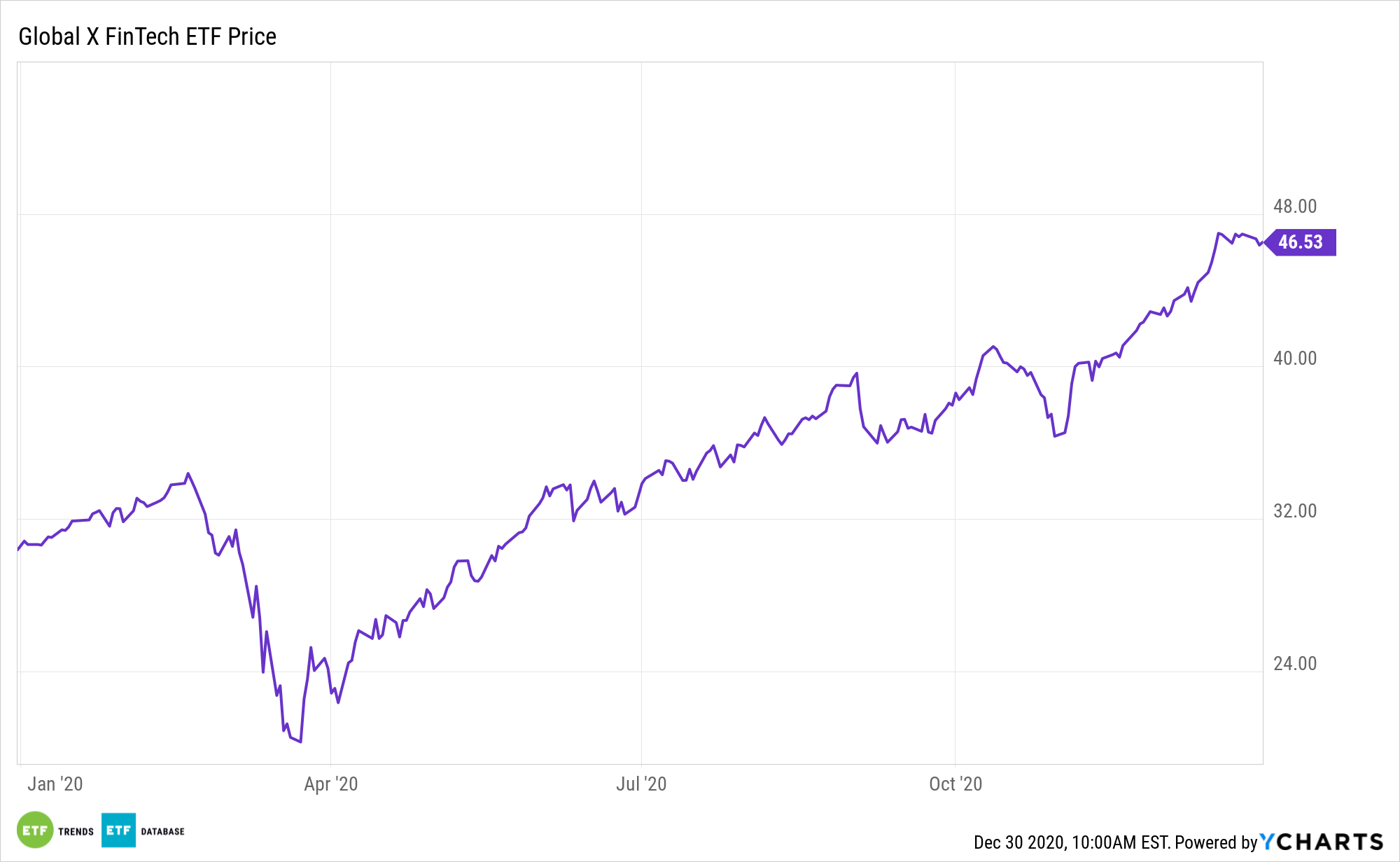

The move to digital payments is increasing in speed, providing significant upside for exchange traded funds like the Global X FinTech ETF (NasdaqGM: FINX).

FINX seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Global Fintech Thematic Index. The underlying index is designed to provide exposure to exchange-listed companies in developed markets that provide financial technology products and services, including companies involved in mobile payments, peer-to-peer (P2P) and marketplace lending, financial analytics software, and alternative currencies, as defined by the index provider.

Cash is on the way out and digital payments are here to stay.

“According to Statista, the total transaction value in digital payments is projected to grow at 23.7% in 2020 to reach $4.93 trillion. The number of digital payment users is forecast to increase by 10.1% YoY to reach 3.47 billion in 2020,” notes Sijoitusrahastot.

A Fine Time for FINX

With COVID-19 flaring up in many regions, contactless payments and the FINX components with exposure to that theme stand to benefit once more. At the industry level, contactless is viewed as a futuristic concept, but integral to the FINX thesis, that future is now. Contactless payments could see their share of all payments rise 10% to 15% because of the coronavirus. And digital payments aren’t just confined to younger, more tech-savvy generations.

The cashless/digital trend is a boon for FINX components, with stocks such as Square (NYSE:SQ) and PayPal (NASDAQ:PYPL) enjoying massive years.

“In the period between 2020 and 2024, it is (digital payments) set to grow at a 13.4% compound annual growth rate (CAGR) to reach $8.17 trillion by 2024,” adds Sijoitusrahastot. “Digital commerce is the market’s top segment, estimated to reach a total transaction value of $2.93 trillion in 2020. It will mark a growth rate of 4.8% YoY. In the period up to 2024, it is projected to grow at an 8.9% CAGR to reach $4.11 trillion. On average, the transaction value per user in digital commerce is estimated to total $843.0 in 2020.”

The move to cashless and contactless payments isn’t going to abate when the coronavirus is defeated. Demographic tailwinds could see to this being a move with major long-term implications.

Cards and digital payments are slowly but surely usurping cash as primary forms of payment, providing a compelling, long-term runway for growth for FINX investors.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.