Investors are putting money where their mouths are by flooding into renewable energy exchange traded funds.

The First Trust NASDAQ Clean Edge Green Energy Index Fund (NasdaqGM: QCLN) is benefiting from that trend, wracking up inflows at a prodigious pace to start 2021.

“The five funds attracting the most flows in the first quarter of 2021 were all passive equity funds,” according to Morningstar research.

QCLN saw inflows of $1 billion in the first quarter after ranking as one of the top five asset-gathering renewable energy ETFs last year. As Morningstar points out, the First Trust ETF was the only non-iShares fund among the top five asset adders for sustainable funds in the first three months of 2021.

A Clean Edge for ‘QCLN’

QCLN seeks investment results that correspond generally to an equity index called the NASDAQ® Clean Edge® Green Energy Index. The index is designed to track the performance of small-, mid-, and large-capitalization clean energy companies that are publicly traded in the United States.

The First Trust ETF is benefiting from a groundswell of support for equity-based sustainable funds.

“Equity funds made up the lion’s share of flows, as they typically do. In the first quarter of 2021, equity funds attracted $18.7 billion, or 87% of all sustainable fund flows. On average over the three years that ended in March 2021, equity funds have attracted 74% of U.S. sustainable fund flows, peaking at 93% of flows in the first quarter of 2020,” according to Morningstar.

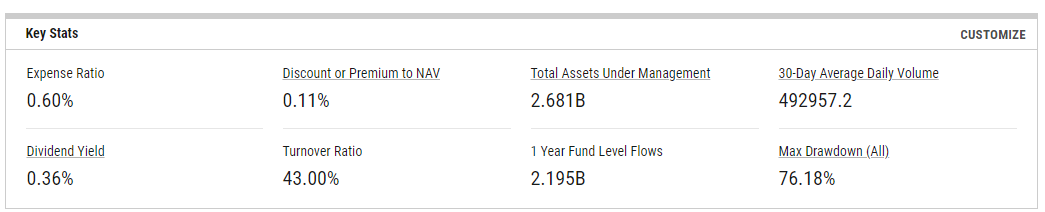

More importantly, QCLN is meriting that adulation, returning nearly 165% over the past 12 months. At the end of the first quarter, the fund had $2.8 billion in assets under management, a tally that’s poised to grow as more advisors and investors embrace passive sustainable funds.

“Assets in U.S. sustainable funds have stayed on a steady growth trajectory. As of March 2021, assets totaled nearly $266 billion. That’s a 12% increase over the previous quarter and a 123% increase year over year. Active funds retained the majority (60%) of assets, but their market share is shrinking. Three years ago, active funds held 82% of all U.S. sustainable assets,” concludes Morningstar.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.