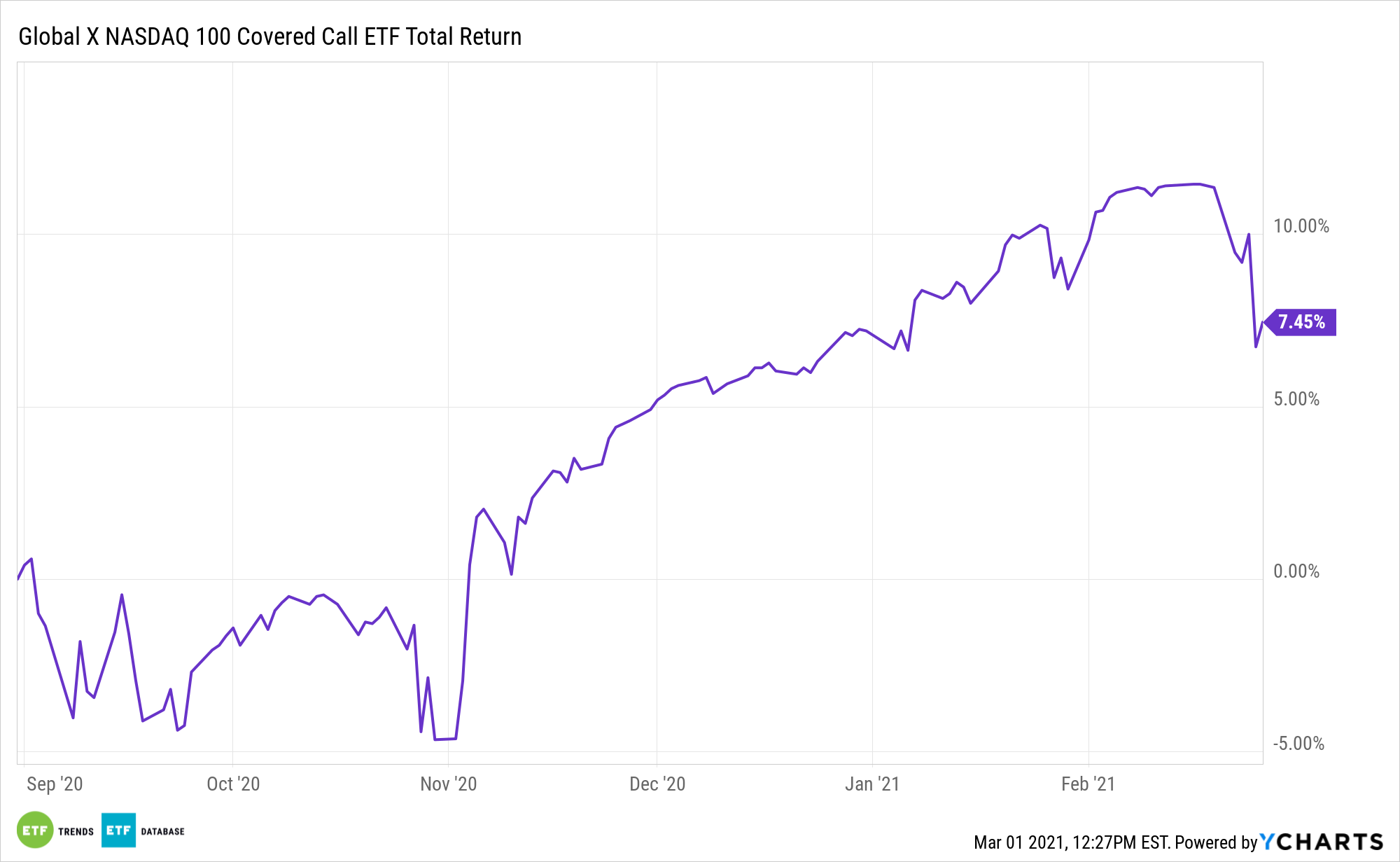

Fixed income investors understand how difficult it is trying to squeeze out as much income as possible from safe haven options like government debt. Fortunately, some ETFs offer exposure to other income-generating sources, like covered calls. Enter the Global X Nasdaq 100 Covered Call ETF (QYLD).

QYLD is an income-generating spin on the Nasdaq-100 Index (NDX), an index lightly allocated to dividend-offending sectors, such as energy and real estate, while heavily allocated to leaders with strong balance sheets, such as the technology and communication services sectors. QYLD’s income is derived from writing covered calls on the NDX.

Covered call strategies can potentially augment a portfolio during periods of heightened volatility. The covered call options allow an investor to hold a long position in an asset while simultaneously writing, or selling, call options on the same asset.

Covered Calls, Explained

The recent market swings show that the aging bull market rally is susceptible to sudden extreme bouts of volatility. Investors worried about further risks may turn to alternative strategies that exhibit lower correlations to traditional assets. This includes ETFs that track buy-write or covered call strategies to generate attractive yields if markets continue to slow down in the year ahead.

A covered call refers to an options strategy where an investor writes or sells a call option on an asset that they already own or bought on a share-for-share basis to generate income via premiums derived from the sale of the call options. The covered call strategy caps upside potential and provides limited downside protection, so it is ideal for investors with a neutral-to-bullish outlook.

Conversely, an at-the-money call can result in the stock being called away, a risk investors don’t have to worry about with QYLD.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.