The Biden Administration is preparing a massive $3 trillion infrastructure package. Assuming it sees the light of day, expect plenty of renewable energy spending in that legislation, including much needed cash for electrical grid improvements.

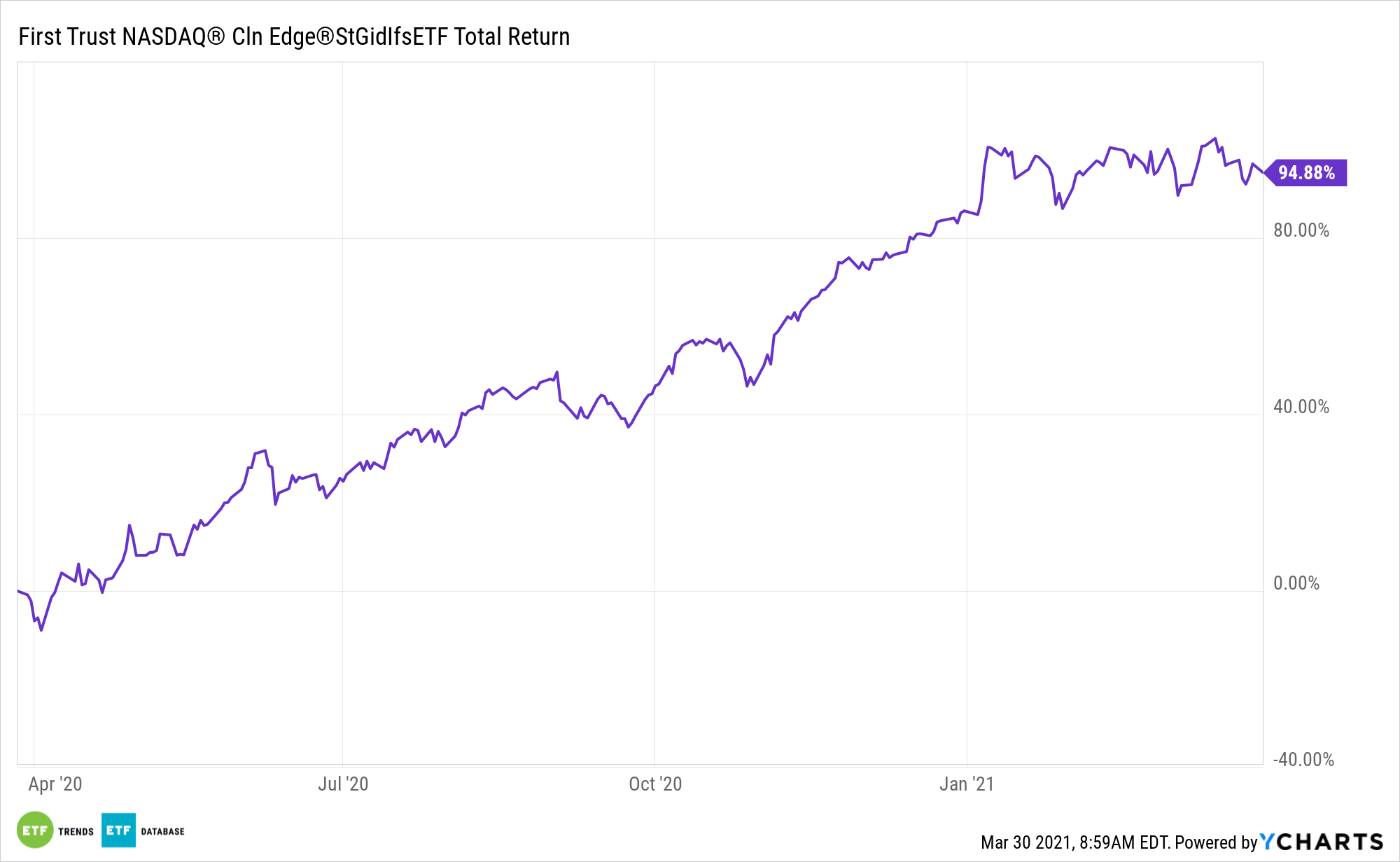

That could be a boon for the First Trust/Clean Edge Smart Grid ETF (NasdaqGM: GRID).

GRID seeks to reflect the NASDAQ OMX Clean Edge Smart Grid Infrastructure Index, which includes companies engaged in all components of the smart grid.

See also: An ETF Opportunity for Biden’s Smart Grid Dreams

Smart grid technologies will play pivotal roles in the electric vehicle and energy storage equations, putting GRID investors at the epicenter of disruptive booms.

GRID “includes domestic and international stocks and allocates 80% of its portfolio to ‘pure plays’ (companies that derive the majority of their revenue from smart grid, electric infrastructure, and/or other grid-related activities), and 20% to more diversified contributors to the grid modernization and smart grid market,” according to First Trust research.

‘GRID’ Can Grind Higher

The technologies and companies GRID provides exposure to are cutting-edge in the energy space, and are leaving traditional fossil fuel producers behind.

What makes GRID increasingly relevant at a time smart grid demand is booming is that it’s one of the purest plays among ETFs addressing this fast-growing industry.

“In our view, a paradigm shift in electrical power generation and distribution may be under way due to the advent of affordable wind and solar power, new energy storage technology, and the proliferation of microgrids, among other trends,” says First Trust. “For this transition to occur, massive capital investments to upgrade electrical infrastructure around the world will be needed. According to Bloomberg New Energy Finance, global spending on the power grid could reach $14 trillion from 2020-2050 in this scenario.”

GRID is poised to benefit from the seismic changes coming for electrical grids across the U.S.

“In our view, many of GRID’s holdings are well positioned to benefit from these trends. As of 2/28/21, GRID’s portfolio was allocated primarily to stocks domiciled in the US (66.3%) and European Union (29.7%). From a sector standpoint, GRID favors stocks in the industrials (51.0%) and information technology (27.1%) sectors. GRID tends to have more exposure to larger stocks, with a weighted average market capitalization of $61.8 billion, as of 2/28/21,” concludes First Trust.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.