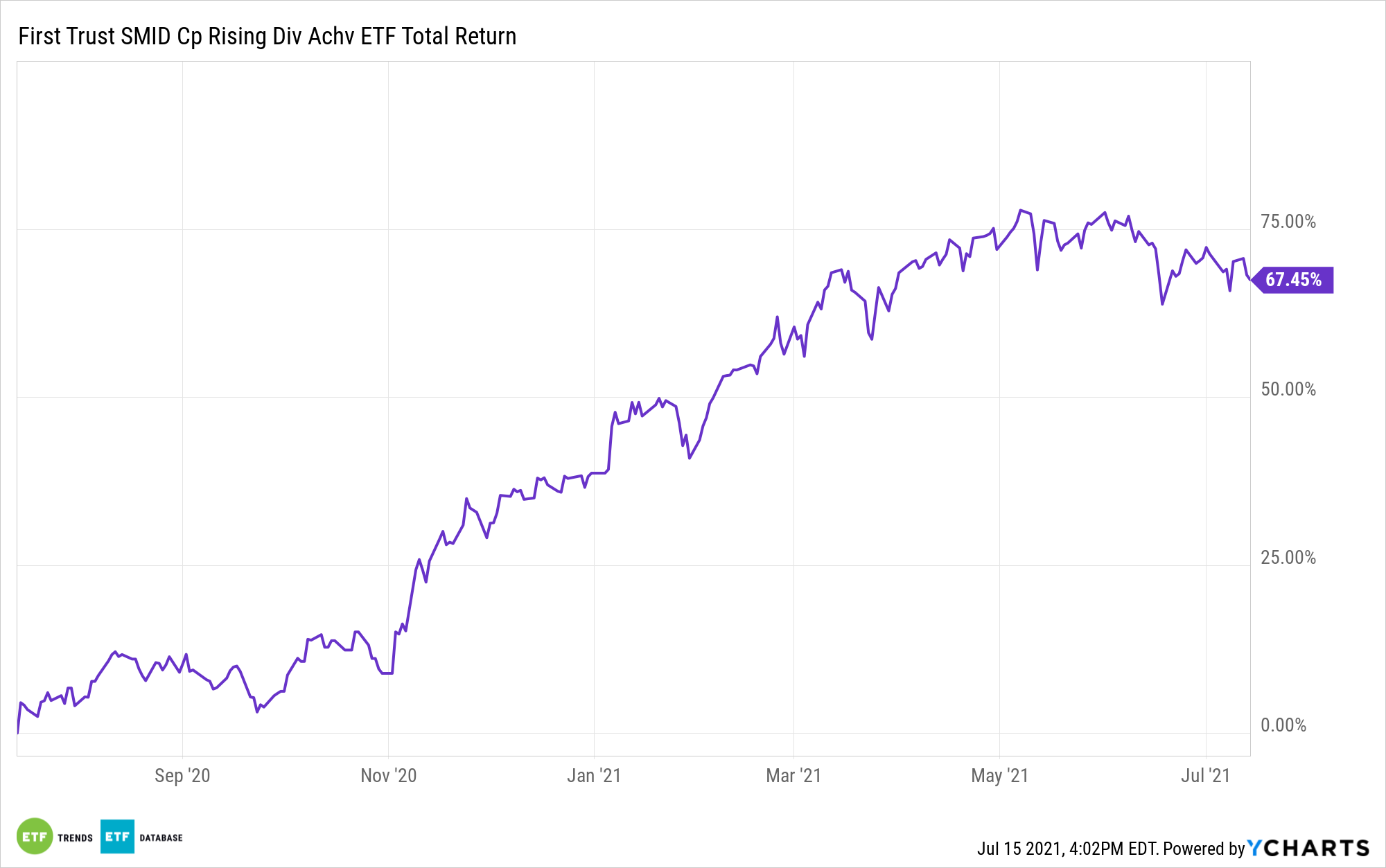

Investors looking to diversify their dividend portfolios, which tend to be heavy on large cap equities, may find improving opportunity amongst smaller stocks. The First Trust SMID Cap Rising Dividend Achievers ETF (NASDAQ: SDVY) is an efficient avenue for tapping into that trend.

SDVY, which turns four years old in November, tracks the NASDAQ US Small Mid Cap Rising Dividend Achievers Index. A straight forward explanation of SDVY is that it’s the small- and mid-cap counterpart to the popular First Trust Rising Dividend Achievers ETF (NasdaqGS: RDVY). Both funds employ similar screening metrics that serve to elevate their quality profiles.

SDVY is a relevant near-term consideration because after some rough spots for smaller dividend payers last year, these companies are joining their large cap counterparts to the dividend growth upside in 2021.

As of the end of the second quarter “63.3% of S&P MidCap 400® issues now pay a dividend, up from 62.5% for Q1 2021 and up from 58.8% in Q2 2020,” according to S&P Dow Jones Indices. “50.4% of S&P SmallCap 600® issues pay a dividend, up from 49.4% in Q1 2021 and up from 45.8% in Q2 2020.”

SDVY: Room for More Payout Growth

SDVY’s trailing 12-month distribution as of June 30 is just 1.08%, implying ample room for upside. It’s also a symptom of rising equity prices in the second quarter.

“Large-cap yields decreased to 1.38% (1.47% for Q1 2021 and 1.84% for Q2 2020), mid-caps to 1.20% (1.23% for Q1 2021 and 1.62% for Q2 2020), and small-caps increased to 1.12% (1.11% for Q1 2021 and 1.44% for Q2 2020),” according to S&P Dow Jones.

Beyond pure yield, there are more signs that SDVY can deliver payout growth while exposing investors to a basket of quality stocks. For example, the NASDAQ US Small Mid Cap Rising Dividend Achievers Index not only requires member firms to have a trailing 12-month payout that exceeds the payouts of the previous three and five years, it also mandates that member firms have cash-to-debt ratios of above 25% and payout ratios below 65%.

The benchmark’s positive earnings requirement is also supportive of dividend growth because money-losing companies with dividend obligations may cut or suspend those payouts to conserve cash.

The $140.39 million SDVY allocates 30% of its weight to financial services stocks, levering the fund to renewed dividend growth from that sector. A 14% weight to tech, one of the fastest-growing dividend growth sectors, further enhances the fund’s quality tilt.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.