The Nasdaq and the S&P 500 opened at record highs on Monday, lifted up by Tesla and energy stocks, reported Reuters.

The Nasdaq Composite rose 42.87 points (0.28%) to 15,541.26, the S&P 500 was up 5.24 points (0.11%) to 4,610.62, and the Dow Jones Industrial gained 14.09 points (0.04%) to 35,833.65 at opening, starting a big week that includes the Federal Reserve monetary meetings.

The Federal Reserve will have the Federal Open Market Committee meeting this Tuesday and Wednesday, during which it may finally formally announce tapering of the stimulus bond purchases it began last year to buoy the economy through pandemic shutdowns, reported Yahoo Finance.

Many analysts believe, and the Fed has recently signaled, that it is time for the $120 billion monthly purchases of mortgage-backed securities and Treasuries to taper off. Once started, Federal Reserve Chair Jerome Powell has indicated that the pullback would be completed by the middle of next year, and rate hikes would most likely follow shortly after.

“The upcoming FOMC meeting will be important for three reasons: 1) the announcement of tapering; 2) guidance around what tapering means for the path of hikes; and 3) nuanced changes in views around inflation risks given recent data,” wrote Bank of America economist Michelle Meyer.

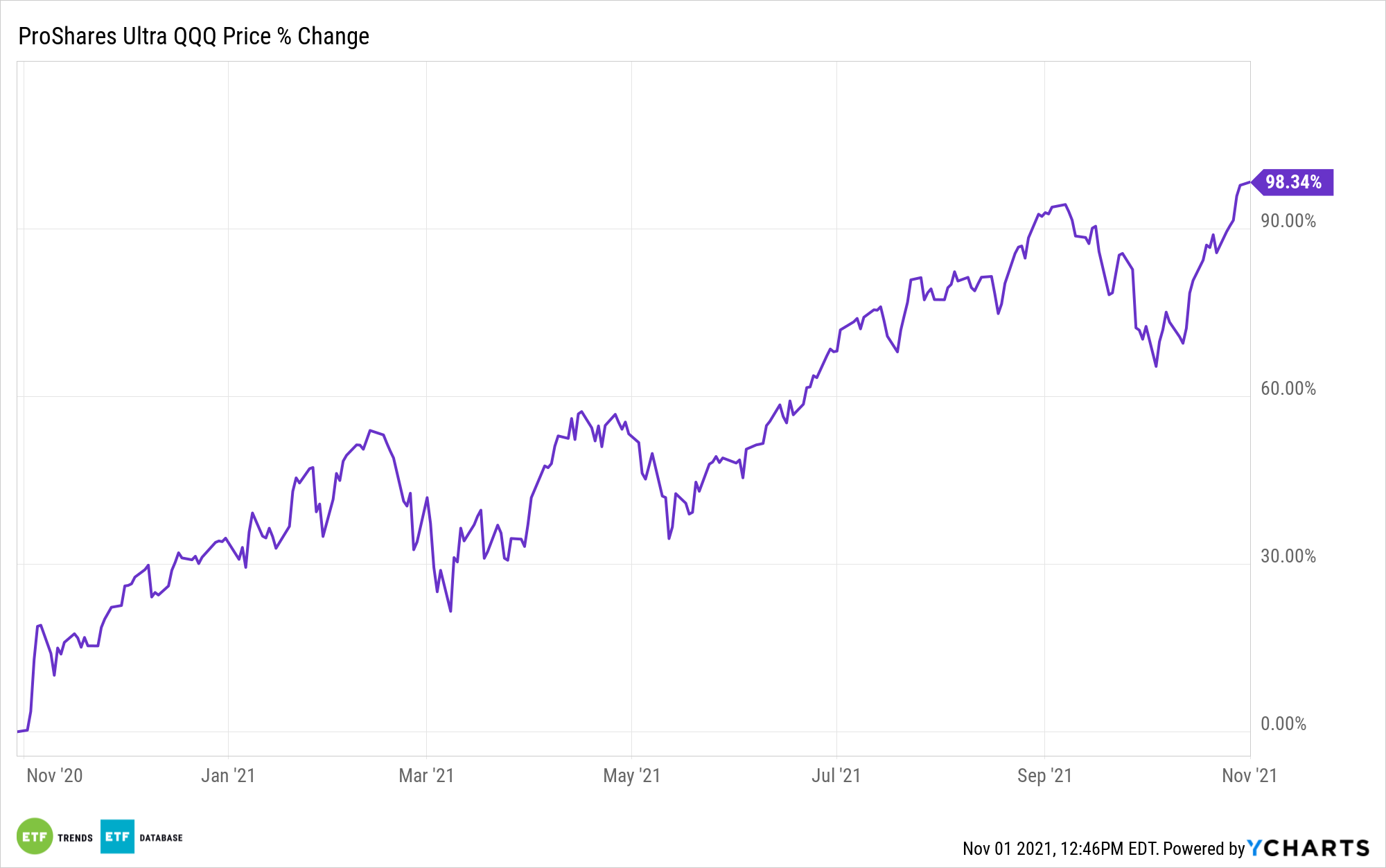

Leveraging Gains on QQQ with ProShares

For investors seeking to capitalize on the Nasdaq rise, the ProShares Ultra QQQ (QLD) offers a leveraged take on the popular index.

The fund captures twice the daily return of the underlying Nasdaq-100 index, before fees and taxes. The exposure resets daily, and as such does not provide a simple 2x multiplier on the return of the underlying index.

Therefore, QLD should be monitored at least daily by investors.

As a leveraged fund, QLD carries greater risks than non-leveraged benchmarked funds.

If the fund is held over a period of time longer than a single day, and the underlying Nasdaq-100 index remains trendless and oscillating without establishing a clear upward or downward trend, QLD can lose money.

However, in times of a clear upward trend, QLD has the potential to outperform the index due to compounding.

QLD carries an expense ratio of 0.95%, with a contractual waiver that ends on September 30, 2022.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.