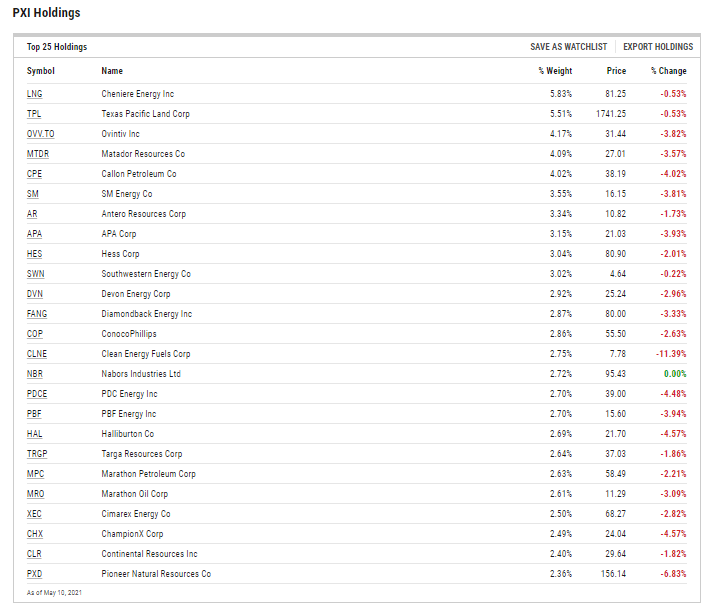

The energy sector’s redemption story is reaching epic proportions this year. Up nearly 55% year-to-date, the Invesco DWA Energy Momentum ETF (PXI) is a big part of it.

As the global economy emerges from the dark clouds of the coronavirus pandemic, oil demand is improving. That’s a boon for PXI, an exchange traded fund heavy on exploration and production and oil services – industries that are more sensitive to oil price fluctuations than integrated oil companies.

Providing a foundation for PXI’s rally, both the Organization of the Petroleum Exporting Countries (OPEC) and the International Energy Agency (IEA) recently upped global oil demand forecasts.

“Both the IEA and OPEC monthly oil reports came with huge drops in commercial oil inventories in OECD countries for the seventh consecutive month in February. They reported a massive drop in global oil inventories that built up during last year’s COVID-19 demand shock for the data gathered for February. This entailed a further drop in global oil inventories in the coming months,” according to Hellenic Shipping News.

Valuations Supporting an Energy Rally

Adding to the near-term case for PXI is that despite the energy sector’s ascent this year, it’s not overvalued. In fact, it’s still a credible value destination with market observers pointing the S&P 500 Energy Index being cheap relative to the broader market.

PXI is levered to the value theme because three-quarters of its components are classified as value stocks. While market participants see momentum in the value resurgence, some are starting to lean toward smaller value stocks. That’s another theme that could benefit PXI because 94.50% of its holdings are either mid- or small-cap names, according to issuer data.

Other signs point to more oil upside. Those signals include professional traders upping bullish bets on crude.

Last week, “was the fourth week in a row in which portfolio managers have added long positions in oil futures,” reports OilPrice.com. “In the week to April 27, hedge funds added the equivalent of 30 million barrels in the six most important petroleum futures and options contracts. At the time, this was the most bullish position in the oil complex in more than two and a half months, with the net long in crude oil futures jumping to the highest in six weeks.”

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.