Intellia Therapeutics (NTLA) CEO John Leonard believes that gene-editing therapy could come to market “very, very soon,” according to an interview on CNBC’s Closing Bell, after news broke that CRISPR-based medicine was recently applied in a systemic delivery to a human in a breakthrough trial.

The trial, sponsored by Intellia and Regeneron, a biotech company, involved treating a rare disease via an IV infusion. Previously, CRISPR technology had been able to be used by removing cells from the body, genetically manipulating them, and then reintroducing them.

CRISPR is a gene editing technique that involves slicing targeted DNA and genes to treat diseases. A benefit to CRISPR treatment is that because it is designed to target one specific gene, the risks of side effects and adverse reactions is much smaller.

As with any treatment, it is “subjected to the standard sorts of clinical trials that any drug or gene therapy would be studied under, so we’re in the early stages of that,” explained Leonard.

“CRISPR itself can be broadly applied, the challenge is getting it to the particular genes that cause disease,” he added.

The technology could be ground-breaking for treating diseases that are based off of a singular gene. Diseases based on multiple genes will be more difficult, and will take more time.

Still, this is “a major advance in the gene editing space,” said Leonard.

Intellia Stock Soars

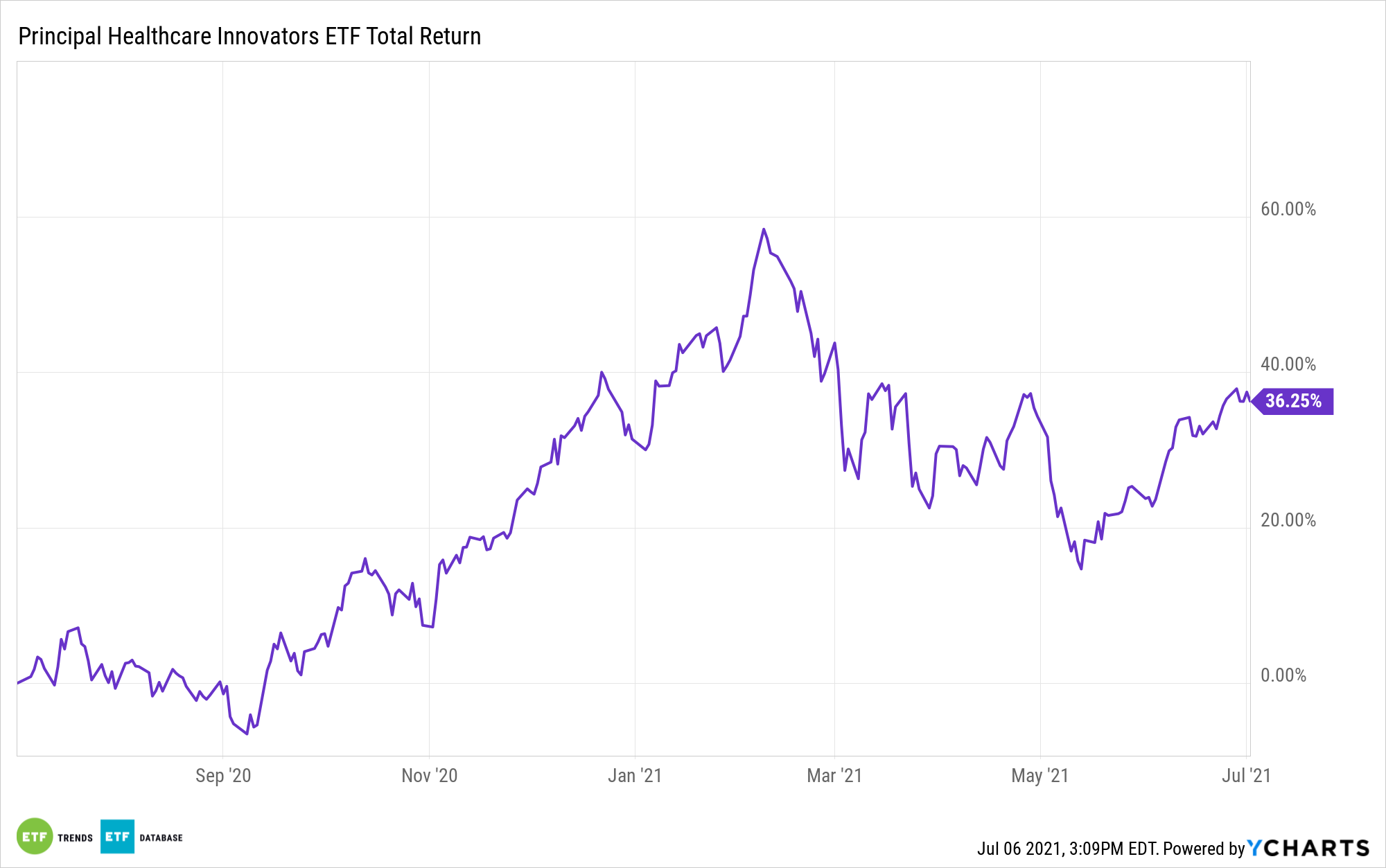

With the announcement of the successful trial with Regeneron, Intellia the stock price has risen 90% in the past week. ETFs holding the stock have also jumped.

The Principal Healthcare Innovators Index ETF (BTEC), which tracks the Nasdaq Healthcare Innovators Index, holds small- and mid-cap U.S. healthcare companies.

The fund has 1.53% of its portfolio weighted to Intellia.

BTEC ranks the top 150-200 companies by earnings analysis and score, then weights each by market cap, up to a cap of 3%.

Other companies held by the ETF include Teledoc Health Inc (TDOC), a telemedicine and virtual healthcare company, at 2.61%, and Exact Sciences Corp (EXAS), a molecular sciences company that targets early stage cancers, at 2.71%.

BTEC has net assets of $178 million and carries an expense ratio of 0.42%.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.