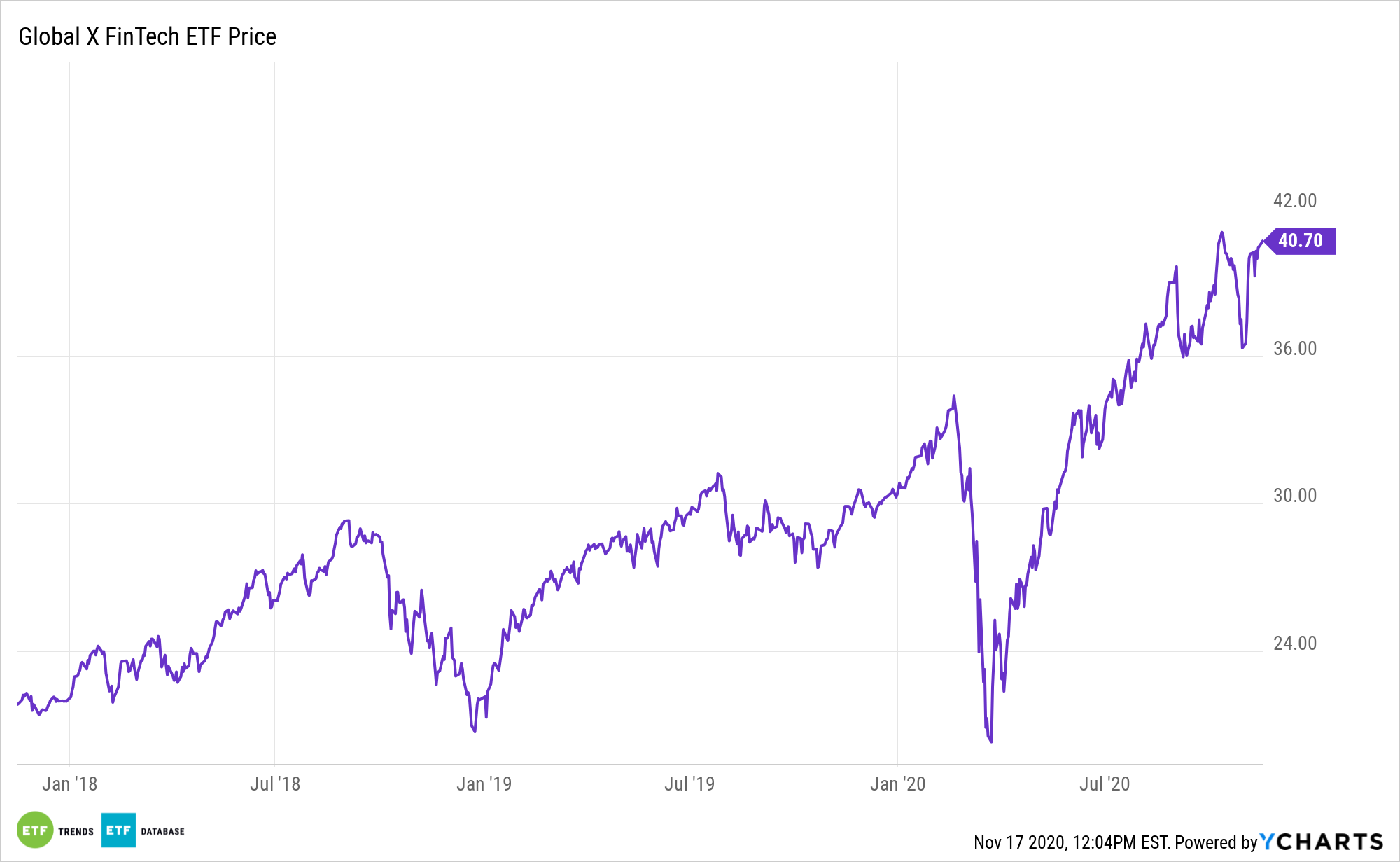

Up more than 33% year-to-date, the Global X FinTech ETF (NasdaqGM: FINX) reminds investors that fintech is one of the more viable disruptive themes with compelling long-term implications.

FINX seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Global Fintech Thematic Index. The underlying index is designed to provide exposure to exchange-listed companies in developed markets that provide financial technology products and services, including companies involved in mobile payments, peer-to-peer (P2P) and marketplace lending, financial analytics software, and alternative currencies, as defined by the index provider.

FINX member firms are already encroaching upon territory previously dominated by traditional banks, including smaller business loans, payment processing, and business payroll. Plus, there are advantages for fintech companies in pursuing bank charters even if it doesn’t mean those companies will open brick-and-mortar branches.

Social distancing may have kept customers away from brick-and-mortar banks, giving financial technology time to shine. As consumers forge on following the pandemic, the ease of use provided by fintech could be a major disruptor for banks.

FINX Fantastic for Crypto

Another catalyst for FINX is the moves of big-name fintech companies, such as PayPal (NASDAQ: PYPL) and Square (NYSE: SQ), into the cryptocurrency arena.

“PayPal, a pioneer in the digital payments industry, now offers users the ability to transact with Bitcoin and other cryptocurrencies. The platform’s expanded cryptocurrency functionality also allows users to buy, hold, and sell Bitcoin, Bitcoin Cash, Ethereum, and Litecoin,” according to Global X research.

FINX components are shifting financial services and economic transactions to technology infrastructure platforms, creating simplicity and accessibility while driving down costs. Square, the largest holding in FINX, has an impressive bitcoin footprint of its own.

“Square and Robinhood are two examples of companies that increased revenue after implementing cryptocurrency services. Square reported that revenue from Bitcoin reached $875 million in Q2 2020, a 600% year-over-year increase,” notes Global X.

Square and PayPal combine for almost 14% of the FINX roster.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.