November jobs reports and unemployment figures reflect an economy not just recovering but growing. Private payroll numbers came in higher than anticipated, and adjusted unemployment numbers were at their lowest since 1969, reports CNBC.

ADP, a payroll processing firm, reports that private companies added 534,000 new jobs in October when estimates were only anticipating close to 506,000. One of the biggest areas of growth was the leisure and hospitality industry, which gained 136,000 jobs, a direct reflection of economic recovery amidst the pandemic.

Overall, large companies were the drivers of the job growth, with companies that employed more than 500 people adding 277,000 jobs in November, while companies that employed more than 1,000 added 234,000 new jobs.

Image source: CNBC

“The labor market recovery continued to power through its challenges last month,” said Nela Richardson, chief economist for ADP. “Service providers, which are more vulnerable to the pandemic, have dominated job gains this year. It’s too early to tell if the Omicron variant could potentially slow the jobs recovery in coming months.”

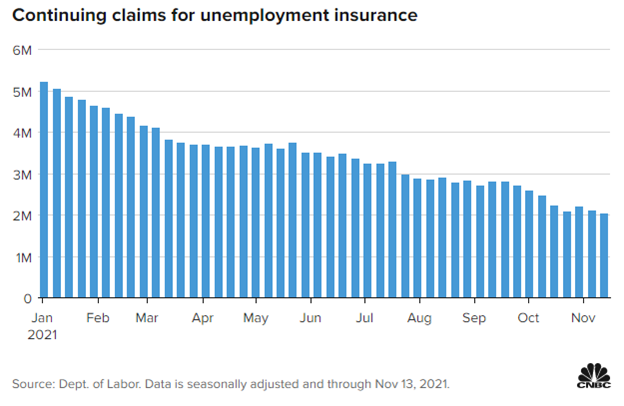

The report comes in tandem with the report of record low unemployment levels, with workers filing 199,000 initial claims in the week that ended November 20, the lowest weekly reported number since November, 1969. It’s important to bear in mind that the number is adjusted for seasonality, a control that is applied during times of anticipated layoffs established from previous annual patterns.

Regardless, unemployment numbers are still trending in a direction of reduction and show a tremendous improvement from the height of the pandemic, which saw around 6 million new claims weekly.

Investing With Volatility in Mind

For cautious investors looking for a fund that manages risk by reducing exposure during significant drawdowns, the VictoryShares US 500 Enhanced Volatility Wtd ETF (CFO) is one solid option. The fund allows investors to gain balanced exposure to large-cap U.S. equities that are driving the recovery between variants, and has a unique volatility-weighted approach, while reducing its exposure to equity markets during significant decline.

CFO tracks the Nasdaq Victory US Large Cap 500 Long/Cash Volatility Weighted Index. The benchmark screens all publicly traded U.S. stocks and only includes those with positive earnings in the most recent four quarters.

From there, the benchmark takes the top 500 stocks by market cap and weights them based on the volatility of their price changes over the previous 180 days. Those with lowest volatility get the highest weighting, while those with the highest volatility have the lowest weighting.

During times of decline of 10% or more in daily closing value of the Nasdaq Victory US Large Cap 500 Volatility Weighted Index (the same as the benchmark but without cash allocations) compared to the most recent monthly closing value, the fund withdraws 75% from stocks and reallocates to cash. The cash is invested in 30-day U.S. Treasury bills or money market mutual funds that invest in short-term U.S. Treasury obligations.

The fund will reinvest in stocks when the decline becomes less than 10%; if the index declines 20%, then the fund allocates 25% back into stocks; if the index declines 30%, it allocates an additional 25% back into stocks; if the index declines 40%, the remaining 25% will be reallocated back to stocks.

The index limits exposure to any particular sector to 25%. CFO’s sector breakdown as of end of October includes a 16.68% allocation to industrials, 16.19% to financials, a 15.09% allocation to information technology, 13.80% to healthcare, 10.06% to consumer discretionary, and various smaller allocations.

The fund has an expense ratio of 0.38%.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.