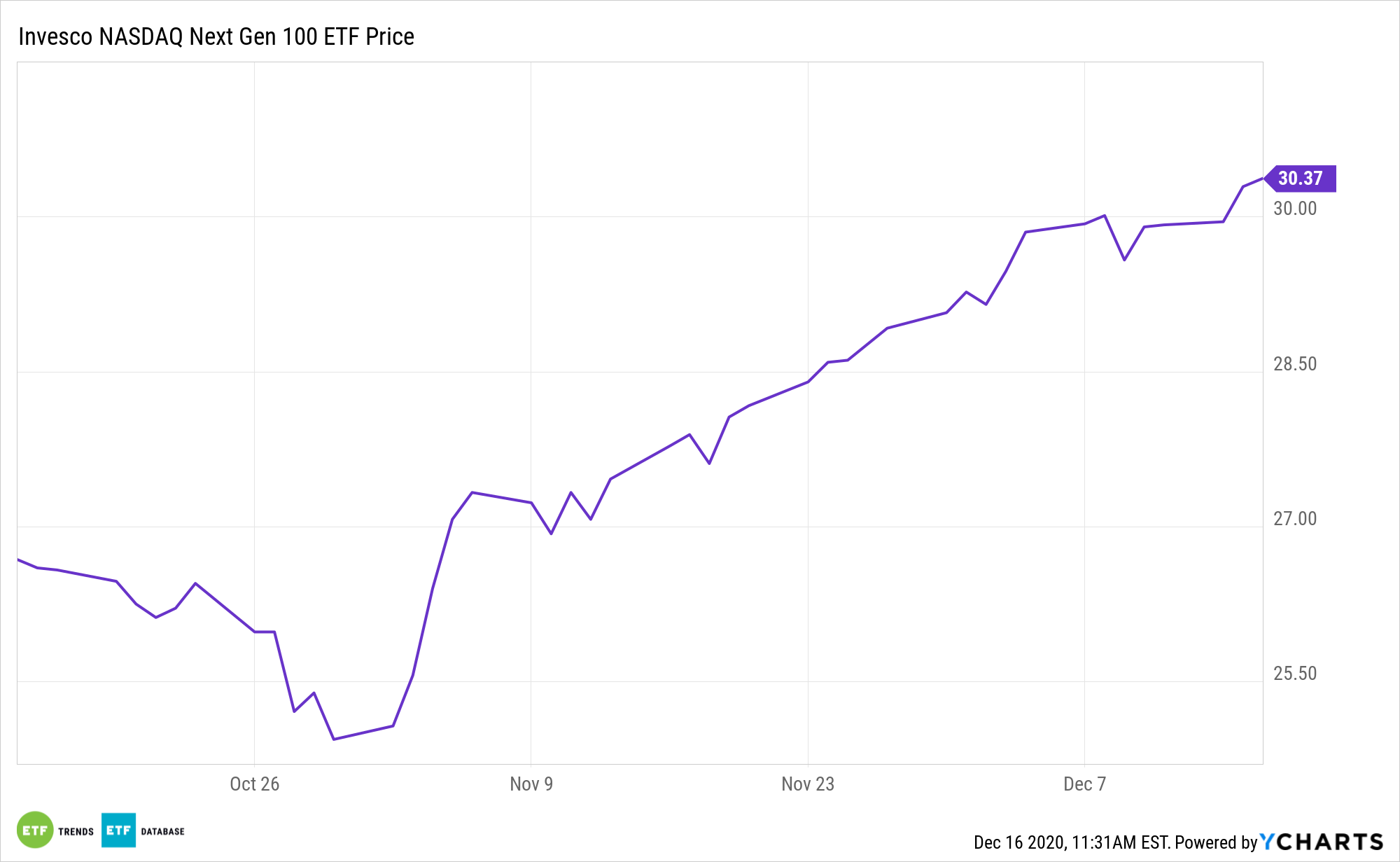

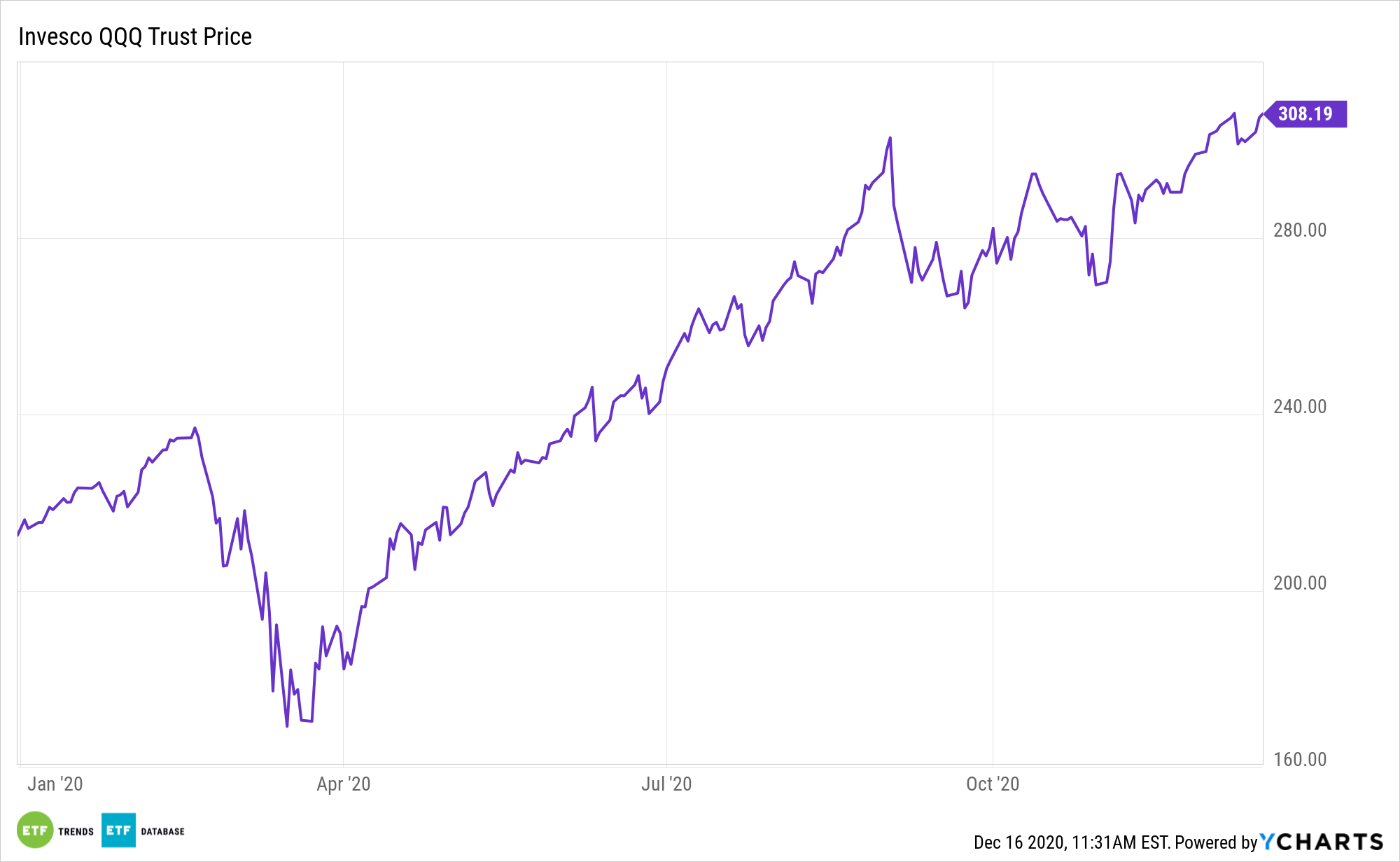

The Invesco NASDAQ Next Gen 100 ETF (QQQJ) is part of this year’s bumper crop of new exchange traded funds. As a relative of the famed Invesco QQQ Trust (NASDAQ: QQQ), the rookie ETF has a big legacy to live up to.

QQQJ, which is almost two months old, extends the QQQ ETF further by offering access to the “next 100” non-financial companies listed on the Nasdaq, outside of the NASDAQ-100 Index, offering a mid-cap alternative to the NASDAQ-100. In other words, QQQJ is a proving ground for companies that could eventually be added to the popular QQQ.

Data confirm that investors are responding to what QQQJ has to offer. The new ETF already has $410.5 million in assets under management, making it one of this year’s most successful rookie ETFs of any stripe.

Investors who are looking for growth opportunities should consider what it means to invest in innovation, and how those investments will be impacted by changes in policy. QQQJ can provide an innovative, mid-cap approach that thrives in any political climate.

The QQQJ ETF Is Not Just A Mirror Image Of QQQ

Importantly, QQQJ isn’t a carbon copy of QQQ. The differences between the two can work in favor of investors looking to augment QQQ’s mega-cap exposure with smaller names found in the new ETF.

“Yes, both indexes are overweight Technology but the Nasdaq-100 tends to average more than half its weight in Technology, with approximately 56% as of September 30, 2020. On the other hand, the Nasdaq Next Generation 100 allocated roughly 36% to Technology,” according to Nasdaq Global Indexes research.

QQQJ gives ETF investors tech exposure, but with a mid-cap twist. While large-cap companies in tech like Apple or Microsoft are solid plays, there are also opportunities to be had in mid-cap companies that investors may not know about due to a lack of media exposure.

“Another difference is the exposure to Industrials, with the Nasdaq Next Generation 100 at a 17% allocation compared to only 5% in the Nasdaq-100. Health Care is another major differentiator, as the Nasdaq Next Generation 100 recently had nearly triple the exposure to this industry, 20% versus only 7% for the Nasdaq-100,” notes Nasdaq.

QQQJ can capitalize on mid-cap market trends that can power through the pandemic. With more government scrutiny aimed at more tech heavyweights, QQQJ may help investors sidestep any negative exposure.

QQQJ’s underlying index is also overweight tech and consumer services stocks relative to old guard mid-cap benchmarks, giving the new ETF more of a growth feel than many traditional mid-cap strategies.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.