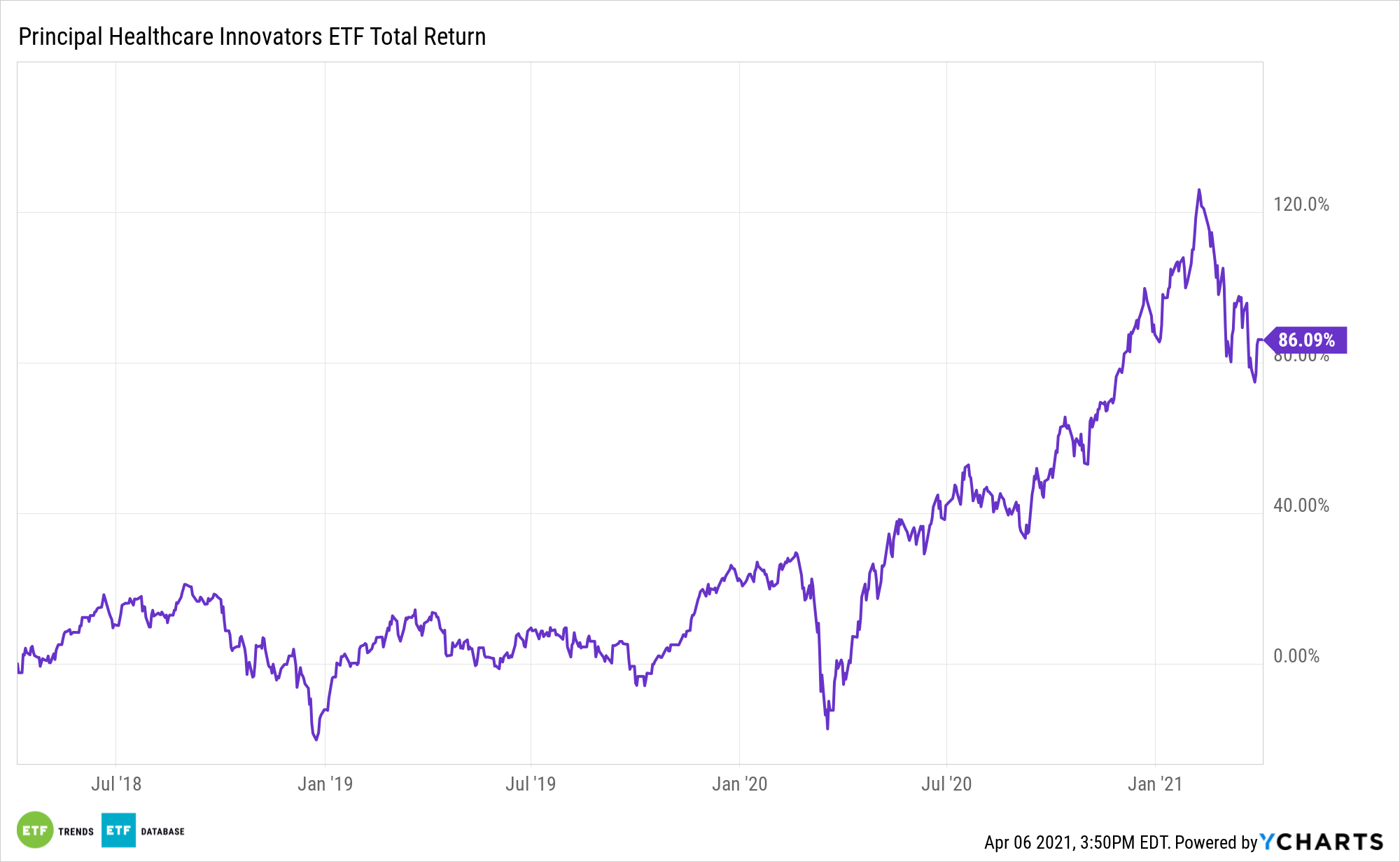

The coronavirus pandemic altered the healthcare landscape and how and where people work. The Principal Healthcare Innovators Index ETF (BTEC) is an exchange traded fund at the epicenter of those themes.

BTEC seeks to provide investment results that closely correspond, before expenses, to the performance of the Nasdaq Healthcare Innovators Index.

Under normal circumstances, the fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities of companies that compose the index at the time of purchase. The index uses a quantitative model designed to identify equity securities in the Nasdaq US Benchmark Index (including growth and value stock) that are small- and medium-capitalization U.S. healthcare companies.

Health tech will be integral in getting workers back to their offices safely.

“The coronavirus pandemic has thrown the US economy into a state of flux, forcing businesses into uncharted territory as they decide when and how to reopen. Before the pandemic, 39% of US office employees worked remotely—which nearly doubled to 77% during the pandemic, per a June PwC survey,” reports Business Insider.

BTEC Bringing Innovation to Healthcare

BTEC’s healthcare innovation sleeve offers investors another growth outlet – one ripe with long-term potential.

“We see the healthcare sector potentially benefitting from structural trends such as demographic shifts, emerging market healthcare spending growth and innovation across the board,” writes BlackRock. “For example, telemedicine has gained popularity during the pandemic, and could become a long-term solution for some care needs due to its cost and operational efficiency. We also see the relatively low valuation of the healthcare sector as appealing, and the risk of major policy change in the U.S. appears low given Democrats’ slim majority in the Senate.”

BTEC has some exposure to the telemedicine and digital health themes. As far as its underlying indexing criteria, the fund connects physicians and patients digitally, facilitating a range of medical activities that includes diagnosis, treatment, and medication management, as well as online pharmaceutical services and/or internet healthcare platforms.

Those exposures are pivotal as the new healthcare and work environment normals set in.

“The pandemic could hike up employer medical spending—creating an even greater sense of urgency for products that help ensure workers are in good health. The pandemic could increase self-insured employers’ medical spending by as much as 10% in 2021, per PwC’s estimates,” adds Business Insider.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.