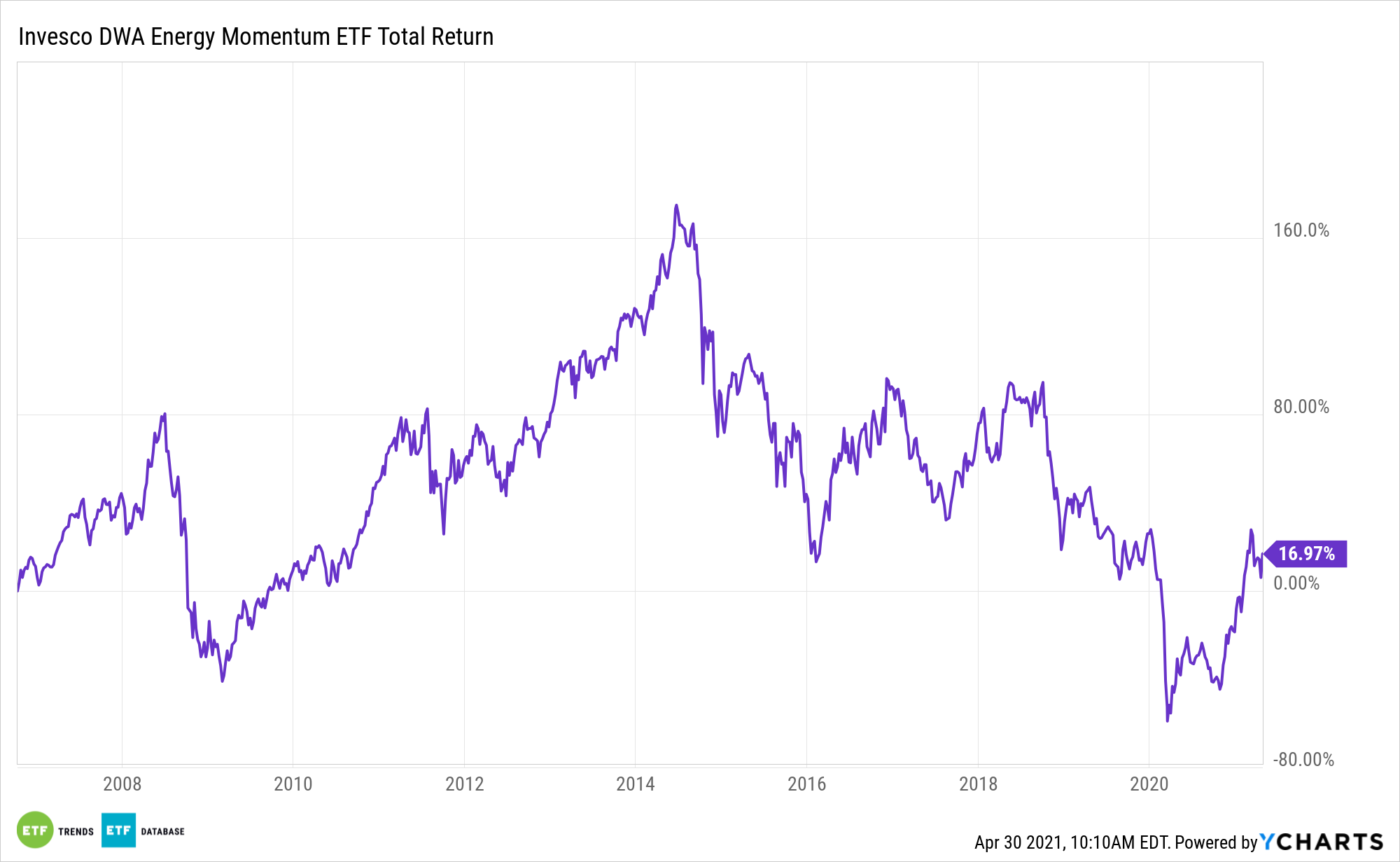

Some market observers say oil demand is poised to soar in epic fashion. Should that scenario come to pass, high beta assets like the Invesco DWA Energy Momentum ETF (PXI) are ready to benefit.

PXI seeks to track the investment results of the Dorsey Wright® Energy Technical Leaders Index. The underlying index is composed of at least 30 securities of companies in the energy sector that have powerful relative strength or “momentum” characteristics.

Investors considering PXI should note what Goldman Sachs said about oil demand earlier last week.

“The magnitude of the coming change in the volume of demand — a change which supply cannot match — must not be understated,” said the bank.

Power Up with ‘PXI’

In a sign that producers agree with that outlook, drilling activity is ramping up in U.S. shale locations, and more rigs are coming back online following the 2020 nadir.

“Jeff Currie, Goldman’s global head of commodities research, said he expects oil demand to increase by 5.2 million barrels per day over the next six months. This translates to Brent crude futures, the international oil benchmark, hitting $80 per barrel by the third quarter, he said,” reports Pippa Stevens for CNBC.

Within the energy sector, exploration and production stocks and oil services names are usually most correlated to crude prices. PXI taps into that theme, but there’s more favoring the ETF in the current environment.

“Goldman noted that U.S. gasoline demand is now near 2019 levels and jet demand has jumped 20% since March. With more people expected to hit the road once summer comes, the firm believes demand will reach 99 million barrels per day by the third quarter,” according to CNBC.

PXI is up almost 45% year-to-date.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.