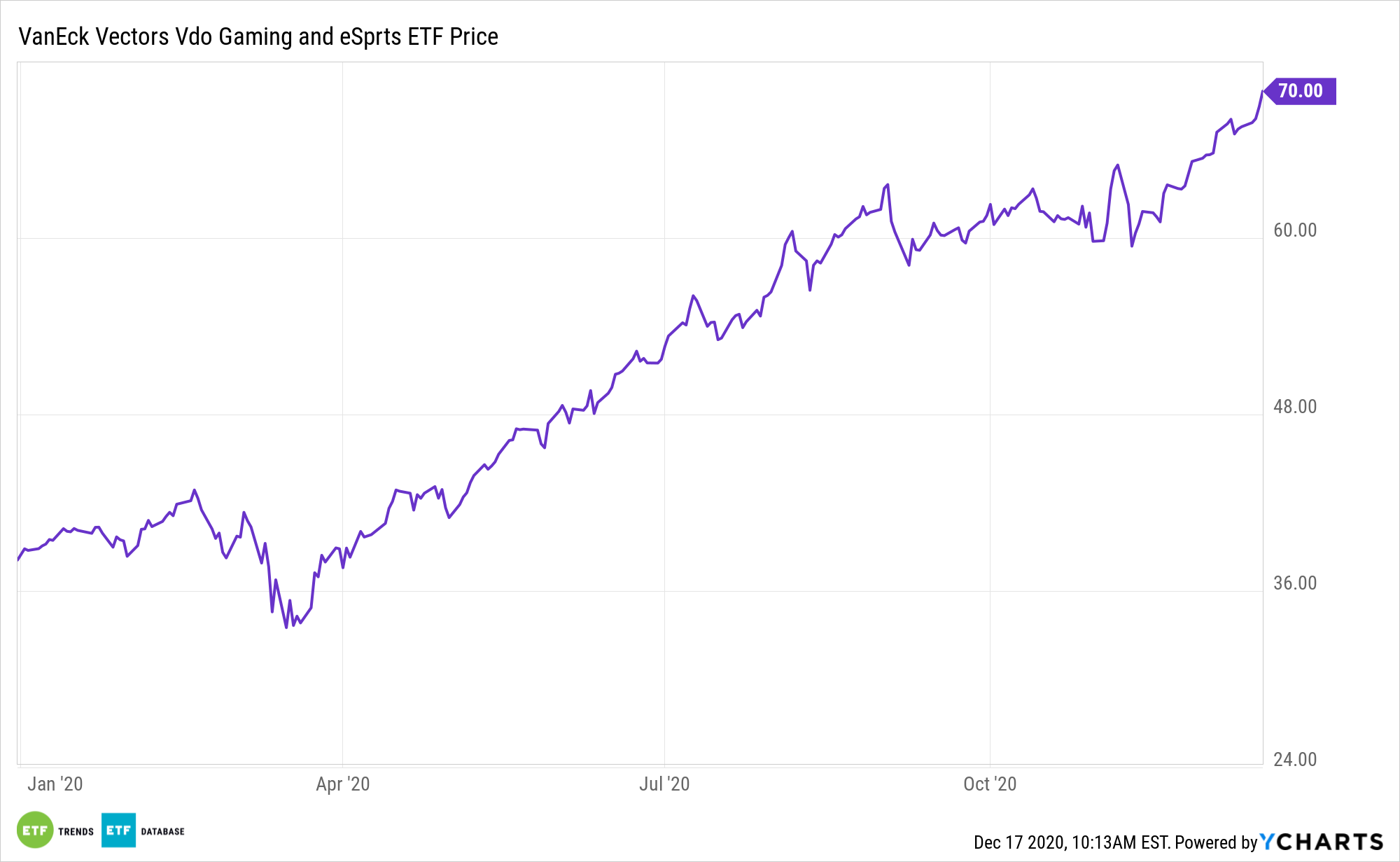

With the holiday shopping season in full swing, investors evaluating video game stocks and exchange traded funds such as the VanEck Vectors Video Gaming and eSports ETF (NASDAQ: ESPO) are largely focusing on new titles and consoles.

However, there are longer-ranging factors to consider, including the expansion of cloud gaming.

It’s no longer a secret that videogaming and Esports are big business. That said, investors should keep gaming-focused ETFs on their watch lists for the new year. Video game equities have a reputation for performing well after shutdown events similar to Covid-19.

“Streaming games on the cloud is similar to streaming a movie on Netflix, but with cloud gaming, the user is in control. For example, when streaming a movie on Netflix, the user has zero influence on what happens in a scene, but with cloud gaming, the user’s inputs guide every stage of the game,” according to IHS Markit research.

The Cloud Beckons for Gamers

While cloud computing is often seen through a corporate lens, it has significant implications for gaming and associated assets like ESPO.

“Over the last year, cloud gaming has picked up the pace, with cloud computing giants like Microsoft, Amazon, and Google investing millions of dollars in it,” according PiplSay research. “By ridding consumers of expensive gaming rigs and letting them stream high-end games over the internet across multiple devices, this latest technology is all set to change the face of gaming as we know it. Already, the cloud gaming market in America is valued at USD 1.15 billion in 2019 and is expected to reach USD 2.70 billion by 2025. Given the scope, how excited are Americans about it, and which game streaming services are they most interested in?”

ESPO has another feather in its cap: significant exposure to high-flying semiconductor name NVIDIA (NVDA). That’s important given the company’s exposure to the booming cloud gaming market.

There are demographic implications to the cloud gaming boom, too.

“53% of Millennials took an interest in cloud gaming amid the pandemic as compared to 47% of Gen Zers,” notes PiplSay. “39% of Millennials have subscribed to a cloud gaming platform as compared to 31% of Gen Zers and 29% of Gen Xers.”

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.