The VictoryShares Dividend Accelerator ETF (VSDA) is a strong option for seasoned dividend investors.

The fund debuted in April 2017 and follows the Nasdaq Victory Dividend Accelerator Index (NQVDIV), which Victory Capital developed in partnership with Nasdaq. What makes VSDA unique is that it focuses on more than a company’s previous dividend track record.

VSDA offers some value exposure without subjecting investors to elevated volatility, potentially taking some of the risks out of paying up for low volatility stocks.

Dividend “growers typically don’t boast burly yields like yielders do, though they have their advantages. Notably, companies that regularly boost their dividends are usually profitable and financially healthy,” writes Morningstar analyst Susan Dziubinski.

VSDA: A Compelling Strategy for Income

Dividend growth as a means of trumping inflation could and arguably should serve to highlight the advantages of the ETFs that focus on dividend growth stocks. That group is comprised of well-established ETFs that emphasize dividend increase streaks as well as a new breed of funds that look for sectors chock-full of stocks that have the potential to be future sources of dividend growth.

VSDA features companies with “not only a history of increasing dividends, but which also possess the highest probability of future dividend growth. It seeks to provide exposure to dividend growth, rather than yielding, offering a potential diversification benefit to high dividend yielding alternatives,” according to VictoryShares.

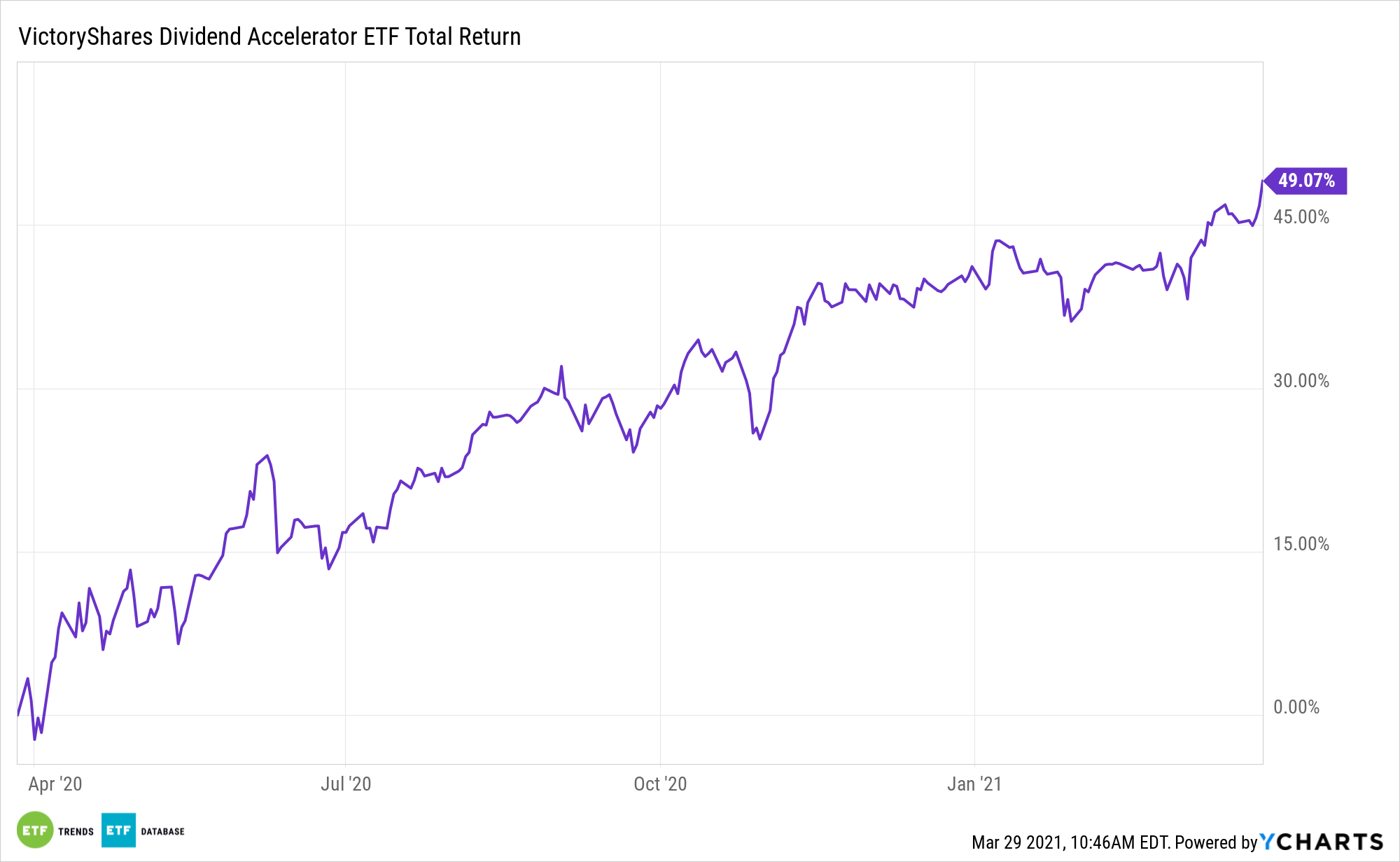

Moreover, VSDA could be a meaningful near-term consideration.

High “yielders in economically sensitive sectors may be vulnerable during an economic slowdown. Moreover, yielders face some interest-rate risk: When rates trend up, investors may swap high-income-producing stocks, especially in sectors like REITs and utilities, for bonds,” adds Dziubinski.

VSDA’s emphasis on dividend growers is particularly relevant in today’s market environment. Dividend-growing companies are also high quality names. Steady dividend payouts have also helped produce improved risked-adjusted returns over time. The high-quality focus may also help dividend growers outperform or do less poorly than the broader markets during weaker periods.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.