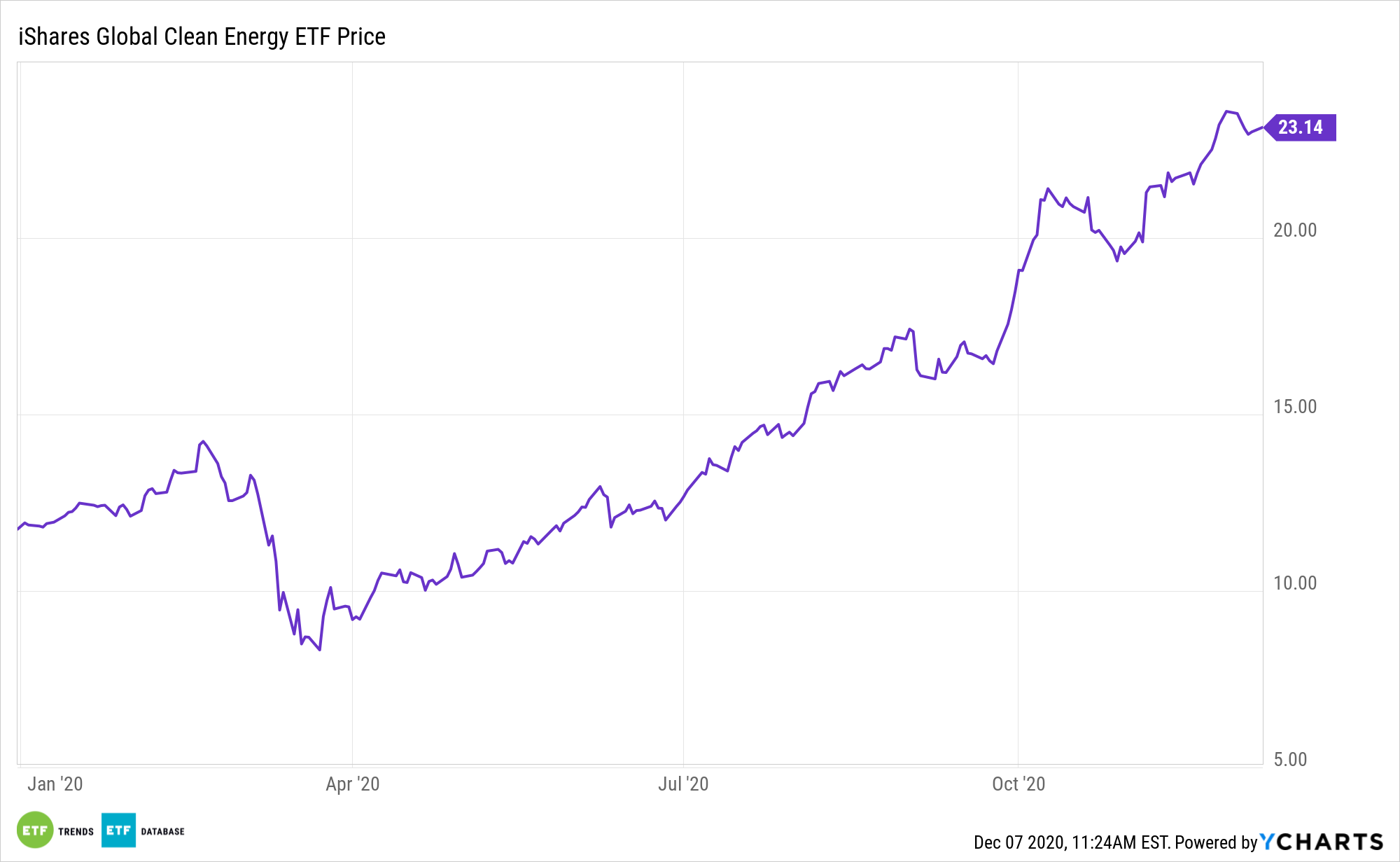

The iShares Global Clean Energy ETF (ICLN) has more than doubled this year as clean energy equities have come into the spotlight. Some market observers believe the asset class will continue shining in 2021.

ICLN seeks to track the S&P Global Clean Energy IndexTM. The fund generally invests at least 90% of its assets in the component securities of the index and in investments that have economic characteristics that are substantially identical to the component securities and may invest up to 10% of its assets in certain futures, options and swap contracts, cash and cash equivalents, as well as in securities not included in the index.

“Clean energy stocks, including those focused on solar power, have been on a tear this year as costs continue to fall and the regulatory outlook for these companies improves. First Solar, for example, is up 59.5% in 2020, outpacing the S&P 500 by 45 percentage points year to date,” reports Fred Imbert for CNBC.

Bank of America pointed out that solar and other clean energy stocks have been rallying as Inauguration Day nears, ushering the Biden Administration into office. The former Vice President previously laid out a $2 trillion sustainable infrastructure plan to pave the way for the U.S. power sector to be carbon free by 2035 and for the country to be carbon neutral by 2050.

For Clean Energy, an Encouraging Political Environment

“Pat Tschosik, senior portfolio strategist at Ned Davis Research, thinks investors should be mindful of three themes heading into the new year to maximize their returns. These themes are a ‘green wave,’ which encompasses clean energy and electric vehicles; a recovery from the coronavirus pandemic; and President-elect Joe Biden’s agenda,” according to CNBC.

Boosting the long-term cases for ICLN are data confirming solar and wind installation prices will continue declining in the coming decade.

Another reasons ICLN is relevant for strategic investors today is the sheer number of tailwinds at the back of the alternative energy industry, many of which are international in nature. Wind power is one just one example of that trend.

“A move this strong could also be an indication of a momentous shift away from fossil fuels and toward renewable energy,” notes Tschosik. “Clean energy momentum could continue for decades given the backing from both governments and private industry.”

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.