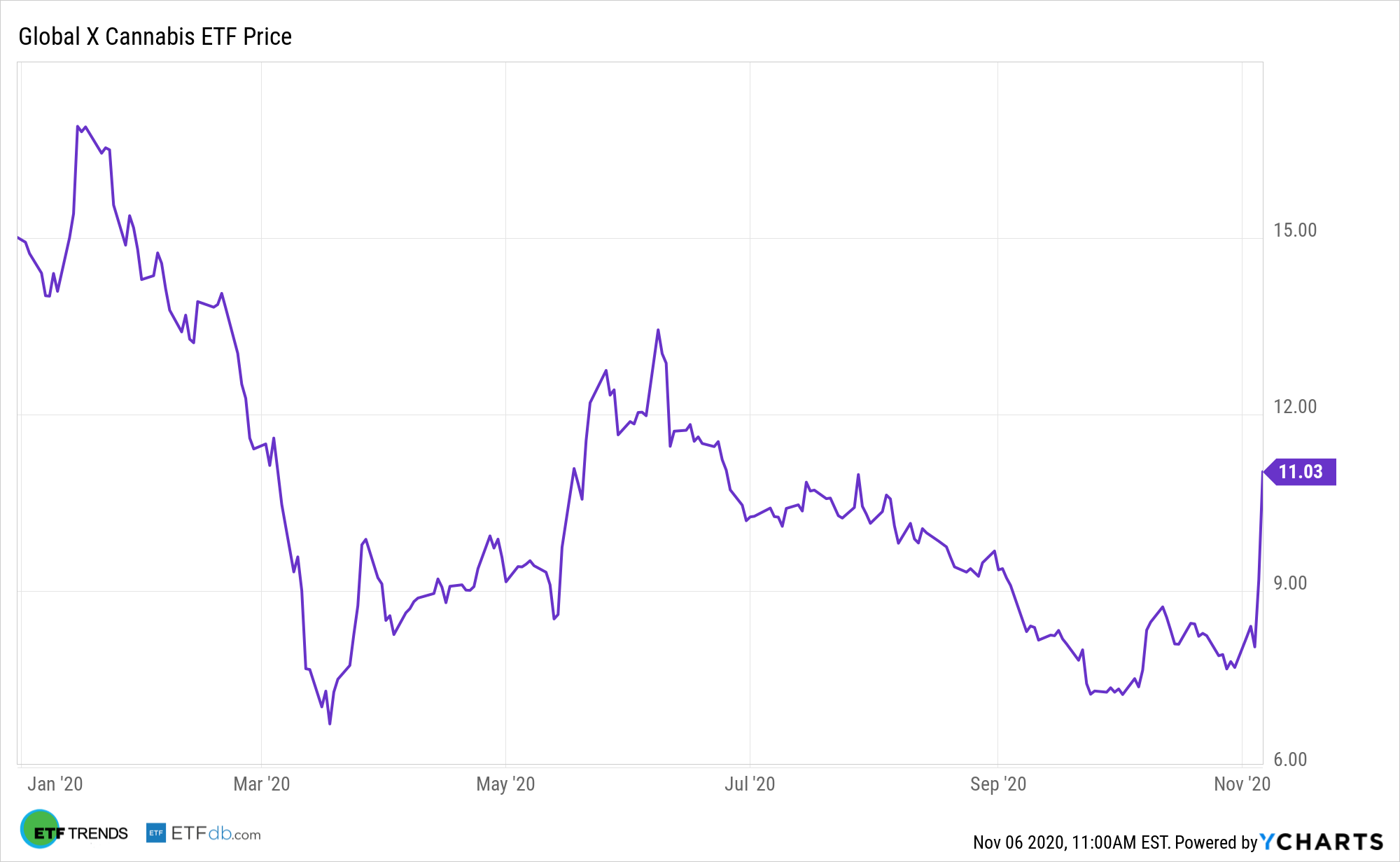

After soaring more than 14% on Thursday alone, the Global X Cannabis ETF (NASDAQ: POTX) is higher by nearly 18% over the past week. Marijuana-related ballot initiatives are the primary reason why.

POTX, the first cannabis fund from Global X follows a benchmark that holds “companies involved in the legal production, growth, and distribution of cannabis and industrial hemp, as well as those involved in providing financial services to the cannabis industry, pharmaceutical applications of cannabis, cannabidiol (i.e., CBD), or other related uses including but not limited to extracts, derivatives or synthetic versions,” according to Global X.

On Election Day, Arizona, Montana, and New Jersey expanded legalization to recreational cannabis while Mississippi approved medical marijuana and more conservative South Dakota signed off on both medicinal and recreational use.

“We view the success on all votes as evidence of still-growing acceptance for legalization among Americans. It also confirms our long-term view for nearly 25% average annual growth for the U.S. recreational market and nearly 15% for the medical market through 2030,” according to Morningstar.

Pot Politics

Some market observers that with states reeling from revenue shocks endured during a multi-month shutdown, legislators in those areas are looking for new ways to raise revenue and that could include permitting new vices in a bid to generate “sin taxes.”

“Amongst our coverage, 4-star Curaleaf (CURLF), 3-star Green Thumb (GTBIF), and 4-star Canopy Growth (CGC) immediately benefit from the election outcome. While Canopy only operates in Canada, its standing agreement to acquire U.S. multistate operator, Acreage Holdings, upon a change in federal law gives it economic exposure to Tuesday’s outcome,” notes Morningstar.

Canopy is the second-largest holding in POTX at a weight of 10.56%. Canopy previously stated it will only sell CBD products in states where it is permissible under U.S. law. It will also follow existing FDA regulations for manufacturing, labeling, and marketing dietary supplements.

Some other POTX holdings have modest U.S. exposure, which needs a boost in order to adequately capitalize on recent election results.

“Three-star Cronos (CRON), 3-star Tilray (TLRY), and 5-star Aurora (ACB) have some exposure to the U.S. but only through hemp-derived CBD. As a result, Tuesday’s outcome will have no direct impact. Despite its announcement the day after the election to acquire U.S. craft brewer Sweetwater, 5-star Aphria (APHA) will also see no direct impact,” notes Morningstar.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.