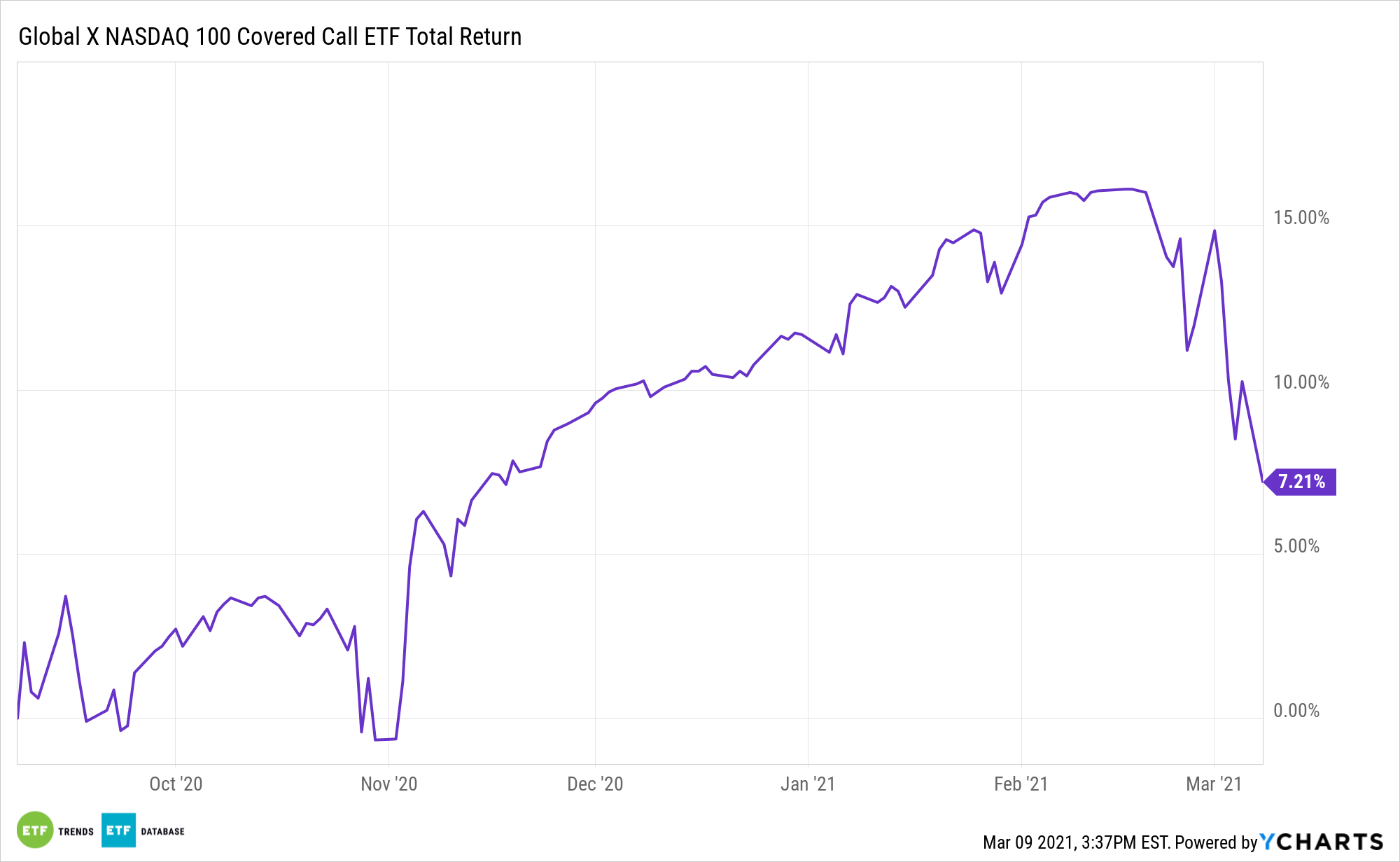

Covered calls offer investors several advantages, including higher income streams, reduced downside, and lower correlations to other asset classes. Enter the Global X Nasdaq 100 Covered Call ETF (QYLD).

QYLD is an income-generating spin on the Nasdaq-100 Index (NDX), an index lightly allocated to dividend-offending sectors, such as energy and real estate, while heavily allocated to leaders with strong balance sheets, such as the technology and communication services sectors. QYLD’s income is derived from writing covered calls on the NDX.

In today’s volatile fixed income environment, QYLD is particularly appealing for income-starved investors.

“BlackRock believes that by using an equity covered call strategy, investors can reduce portfolio volatility by capturing option premiums, without having to sacrifice long-term performance,” according to BlackRock research. “In a covered call strategy, investors sell call options against their equity holdings and receive an upfront “option premium” in exchange for forgoing potential capital appreciation if the underlying stock appreciates above the option strike price. These option premiums generate cash flow which help to mitigate some of the downside risk to owning the stock.”

Capture More Income, Less Downside

A covered call refers to an options strategy where an investor writes or sells a call option on an asset that they already own or bought on a share-for-share basis in order to generate income via premiums derived from the sale of the call options. Investors have long capitalized on covered call options strategies for income generation.

These funds enable “collaboration with portfolio management teams to optimize overwriting strategy on a stock by stock, product by product basis by customizing the portfolio overwrite percentage, strike prices and duration of options,” adds BlackRock.

The covered-call options strategy allows an investor to hold a long position in an asset while simultaneously writing, or selling, call options on the same asset. Traders typically employ a covered-call strategy when they have a neutral view of the markets over the short-term.

While these buy-write ETFs may not produce any phenomenal returns compared to the broader equities markets, their underlying options strategy helps them generate outsized yields.

QYLD yields a stout 11.79%.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.